The offshore seismic data acquisition industry has seen significant changes over the past few years, most notably in the downsizing of the vessel fleet and the exit of many of its key players.

But, there may be some reason for optimism. As E&P companies’ cash flow has improved – driven by lower costs and recovering oil prices – the global market for seismic data has gradually improved since 2016.

However, E&P companies are maintaining a cautious approach to spending and although the seismic industry experienced a strong 3Q 2019, benefiting particularly from client M&A and asset transfers, the size of the market is still below the average level observed over the past 15 years.

The seismic data acquisition market was perhaps the hardest-hit segment in the offshore oil and gas industry over the past few years. A significant consolidation and restructuring of that market ensued. Most of the contractors in the market are now either pure vessel providers or pure multi-client companies, while the integrated model has been mostly abandoned.

Moreover, there has been substantial M&A activity resulting in a more consolidated industry. The acquisition capacity has been significantly reduced, with the number of available vessels currently at less than half of the 2014 level.

However, it is this same restructuring that is expected to help create a healthier industry in the longer term, with better quality on deliveries and improved economics.

The seismic vessel contractors that remain are reporting improvement in the market. Polarcus recently said that the level of tender activity from E&P companies has been improving. The company says that three of its core vessels are fully booked to 2Q 2020, and that its level of backlog is expected to build through 4Q 2020.

The number of vessel owners continues to shrink, this “re-shaping” of the seismic industry should give Polarcus an expanded client base of more multi-client companies that do not own vessels. The company recently reported that it has started acquisition of the latest phase of the Cygnus regional multi-client 3D survey in the Vulcan sub-basin, offshore northwest Australia.

The Polarcus Naila started a 4D seismic survey over block G offshore Equatorial Guinea on Jan. 22, 2020, according to operator Trident Energy.

Located about 15 km (9.3 mi) offshore, block G contains the Ceiba and Okume fields in water depths ranging from 100 to 1,200 m (328 to 3,937 ft).

The survey is expected to last 45 days and cover and area of 340 sq km (131 sq mi). The results are expected to be available in 4Q 2020.

This is the third 4D seismic monitor survey over the fields and the first by Trident Energy, who has been operating the assets in partnership with Kosmos Energy, Tullow Oil and GEPetrol since acquiring them in 2017.

Since the last monitor survey in 2014 there has been continued production, new producer wells and improvements to the water injection pattern, all of which have altered the fluid flow patterns within the reservoir.

PGS also sees an improving market. “The seismic market continued to strengthen during 2019, resulting in better vessel utilization and higher contract prices,” said Rune Pedersen, president and CEO. In a note to analysts, Pedersen said that the company’s “strong position” in the 4D market and integrated product offerings enabled PGS to accelerate its contract revenues, and achieve close to 40% higher pricing in 2019 compared to 2018. “Our order book nearly doubled during 2019, compared to year-end 2018, improving visibility going into 2020. We expect seismic acquisition activity to continue to increase, supporting a further pricing increase for our services but not at the same pace as in 2019.”

PGS recently reported that the Republic of Congo has started an ongoing promotion of all open blocks. On offer are five blocks in the interior Cuvette basin and 10 blocks in the Coastal basin, seven of which are offshore and extensively covered by PGS data.

Last year, state-owned SNPC and PGS reprocessed a large volume of seismic data over the Congo Coastal basin offshore area, using modern reprocessing techniques to deliver a single merged dataset – Congo MegaSurveyPlus. According to PGS, the results have led to an improved and consistent regional geological perspective.

SNPC and PGS now plan to acquire a new regional MC3D survey over the shallow-water Congo shelf area, “Peu Profund,” which should enhance presalt imaging and improve knowledge of the post-salt opportunities.

In addition, PGS said that it expected to start the Painimaut 3D multi-client program offshore Papua New Guinea in February. The Ramform Hyperion will acquire the survey. During the two-month program, the vessel will be towing a 12 x 8 km x 150 m streamer configuration with a triple-source. The survey will provide 3D data over held and vacant acreage in the frontier Papuan basin. Fasttrack 3D data over Phase 1 is expected to be available at the end of April 2020. According to PGS, this is the first time a Ramform Titan-class vessel has visited Papua New Guinea.

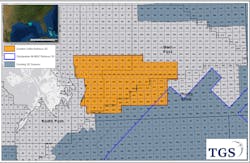

TGS says it has been pursuing a counter-cyclical investment strategy, and during the downturn added substantial amounts of data to its multi-client library. TGS also completed the acquisition of Spectrum, a move that was designed to enhance its position as a global multi-client seismic company. This, in combination with an efficient cost base, strong balance sheet and flexible business model, should put the company in a unique position to benefit from improving market conditions in the future, company officials said.

In December, TGS reported that it had started the Declaration Refocus next generation M-WAZ imaging program in the Mississippi Canyon area of the US Gulf of Mexico. This new, reimaging workflow is designed to provide enhanced imaging and greater illumination of prospectivity in the area.

The program comprises data covering more than 380 outer continental shelf blocks (~8,860 sq km/3,421 sq mi) from orthogonal 3D WAZ programs previously acquired by TGS using WesternGeco Q-Marine and CGG StagSeis seismic systems between 2010 and 2015.

Full product delivery of Declaration Refocus is expected at the end of 2020.

The new imaging project will process data from the prolific Mississippi Canyon, Viosca Knoll, and De Soto Canyon areas. Particular attention will be given to increasing frequency content and resolution throughout the entire data section with additional focus on the Norphlet formations, the company said. The imaging process is also expected to provide enhanced velocity and salt models. This project is supported by industry funding.

Meanwhile, CGG has been transforming itself from a seismic vessel survey contractor to a seismic data acquisition technology provider. Sophie Zurquiyah, CGG CEO, said: “In the current market environment, with E&P companies continuing to prioritize spending around quicker returns, and generating free cash flow, we remain focused on bringing new technology to our clients for their near field exploration, field development and reservoir optimization needs.”

One key example of that new technology, Zurquiyah noted, was CGG’s launch of GPR, Sercel’s new ocean bottom node. GPR is designed to leverage the performance of Sercel’s QuietSeis broadband digital sensor technology to collect better data for accurate seismic imaging, as compared to data collected by conventional sensors.

CGG officials said that the launch of GPR coincides with the continuing growth and maturity of the global node market and will help reduce the risks and increase the success of its clients’ reservoir exploration and development efforts. CGG said the new node has successfully completed sea trials with input from BGP.

In February, Total renewed CGG’s contract to operate the oil major’s Dedicated Processing Center (DPC) in Pau, southwest France, for five years from January 2020.

According to CGG, the two companies have collaborated at the DPC since 2006 on innovative technologies and tailored workflows for a variety of environments worldwide. Some of the major advances that followed have been in 4D processing.

Meanwhile, the restructuring of the seismic vessel market is ongoing. After completing its acquisition of the marine seismic assets of WesternGeco two years ago, Shearwater GeoServices now reports the completion of a transaction with CGG.

The deal with CGG includes the takeover of five high-end seismic vessels and two legacy vessels, previously owned by CGG Marine Resources Norge and Eidesvik Offshore; five complete streamer sets previously owned by CGG; and a long-term capacity agreement granting Shearwater a guaranteed cash flow and activity level for a period of five years.

The capacity agreement includes a minimum commitment of two vessel-years annually over the agreed five-year period. It provides cash flow and sustained activity to Shearwater, at the same time guaranteeing CGG access to strategic capacity for its future multi-client projects through Shearwater’s global fleet of 3D vessels.

Shearwater has assumed the net liabilities associated with the vessels it has taken over, and now has a fleet of 23 vessels, including three ocean bottom seismic multi-purpose vessels and two dedicated source vessels. Preparations continue for the joint creation of a new streamer technology company, and these are set to complete in the first half of 2020, assuming regulatory approvals.

Digitalization

Neptune Energy is looking to digital subsurface investments to speed the process of discovering hydrocarbons and advancing them into production.

During a presentation at DigEx 2020, the company revealed how it is working with various partners and vendors to develop new tools to process and interpret seismic data.

Its goals are to reduce administrative/preparation times for the company’s geoscientists, providing them with data-informed insights to help them identify hydrocarbons more efficiently and with greater certainty, in turn lessening the risk of a dry hole well.

In addition, the company is testing new digital workstations supplied by hybrid cloud solutions provider Cegal. These workstations would be hosted on Microsoft Azure’s cloud infrastructure and would use technology from Bluware that is said to allow artificial intelligence and machine learning to interpret large volumes of data.

The resultant global data hub and a platform would permit Neptune’s teams at various locations share and analyze geological data, thereby pooling their resources and experience.

Gro Haatvedt, Neptune’s vice president Exploration & Development, said: “Exploration and drilling is an important part of our strategy to grow our business in key geographies, yet it is expensive and time-consuming.

“Vast amounts of data, often stuck in multiple silos around the world, must be reviewed and interpreted before a single well can be drilled. At the same time, we employ incredibly intelligent geoscientists and exploration teams who have to spend much of their time on administrative work.

“Our digital subsurface approach will provide tools and platforms for our teams to access data quickly, allowing them to focus their time on delivering insights and results.”

Neptune’s chief information officer, Kaveh Pourteymour, added: “Our goal is to make use of digital technologies to find and produce oil and gas faster, with more certainty and safely.

“If we can provide better intelligence and insights on where hydrocarbons reside, we can accelerate their discovery and production and reduce the cost of exploration.”

Offshore Colombia

Offshore Colombia is an area of increased seismic and exploration activity. Fugro says that it has completed a seep hunting study in the Caribbean Sea with the Colombian Maritime Authority (DIMAR). This involved taking cores of shallow-water seabed sediment, geochemical analysis, and seabed heat flow measurements.

In addition, Fugro provided classroom and vessel-based training to DIMAR personnel.

The program was conducted in two phases onboard ARC Roncador, the authority’s new multi-purpose hydrographic vessel. Fugro mobilized equipment that included two self-contained laboratories and a heat flow probe.

Performing preliminary geochemical analysis at sea is a unique capability, Fugro claimed, allowing it to rapidly identify high-potential cores, thereby shortening project delivery schedules – in this case, by around two months.

ION Geophysical says that it has entered into a multi-client agreement with Colombia’s National Hydrocarbon Agency, the ANH, granting rights to reprocess existing data and acquire new 2D and 3D multi-client programs offshore the country’s Caribbean coast.

In February 2019, the ANH announced a series of reforms to encourage investment in exploration and production, such as a permanent license round and a more attractive tax regime, to boost declining production and increase reserves. The data is intended to enable better understanding of hydrocarbon potential and investment opportunities of underexplored shallow and deepwater offshore blocks on offer.

Joe Gagliardi, senior vice president of ION’s Ventures group, said: “We are continuing to extract maximum value from existing datasets by seamlessly reimaging them into a single volume, tying all available well data and then supplementing with new data where necessary.

“The combination of Colombia’s new permanent license round and improved legislative terms are causing E&P companies to take a second look at Colombia’s offshore frontier. Analysis to date suggests several established petroleum systems offshore that we believe are worth better understanding.” •