Santiago Ferro, Natalia Blánquez, Bruno Conti, ANCAP

Uruguay has political, democratic and social stability, and macroeconomic soundness, which creates the right environment for successful investment. It is also a stable and predictable country, features that are taken as a differential by investors. The important growth of the country over the last decade is clearly linked to the significant increase in foreign direct investment (FDI), which has reached record levels, and has positioned the country among the main recipients of FDI, in terms of gross domestic product (GDP) in South America. Uruguay is the best country to live in Latin America, according to the 2017 Legatum Prosperity Index and the Mercer Index (2017).

Yet despite these positive social and economic metrics, a lack of exploration and development offshore Uruguay means that its basins are considered frontier, with consequent high exploratory and geological risks. This frontier situation is due to the fact that even though oil and gas shows have occurred in some exploratory wells drilled in Uruguay, there has never been a commercial discovery yet. Therefore, there is currently no hydrocarbons production in the country.

To reduce the country’s dependence on imported oil and promote domestic production, ANCAP, the national oil company of Uruguay, in accordance with the policy set by the Ministry of Industry, Energy and Mining (MIEM), began to encourage investment in the upstream industry in 2007. The main tools ANCAP selected for this purpose were a) the offshore bidding rounds, which were designed to attract risk capital from international oil companies (IOCs); and b) multi-client agreements, which were designed to promote exploration investment from service companies.

E&P contracts

The first Uruguay Round was held in 2009; Uruguay Round II in 2012; and Uruguay Round 3 in 2018. As a result of these bidding rounds, there was a maximum of 10 contracts in force in 2013 with several world-leading oil companies, which participated directly in the different bidding processes or entered afterwards via farm-ins. These companies included: BG, BP, Equinor, ExxonMobil, GALP, INPEX, Petrobras, Shell, Total, Tullow Oil, and YPF.

The response to Uruguay Round II was remarkable, with 11 top tier IOCs qualified and 19 offers submitted for eight blocks. The exploratory work commitment surpassed $1.5 billion. This round was considered a major success by industry analysts, and they attributed the success of the process to several factors: a great desire on part of the industry to engage in frontier exploration, attractive fiscal terms, and a favorable regulatory environment in a stable country.

Multi-client contracts

Service companies have acquired several geophysical multi-client surveys in Uruguay, at their own cost and risk. ANCAP has been using this type of agreements with many of the most important contractor companies in the oil industry. This approach has allowed an important increment in the available database and resulted in significant revenues for ANCAP, with constant promotion of exploration opportunities in Uruguay by the service companies as they promote their data as a relevant by-product.

The main multi-client agreements that ANCAP has signed are, among others: with ION-GXT for acquisition of 2D seismic, reprocessing of 2D and 3D seismic; with Spectrum (which is now TGS) for the acquisition of 2D seismic; with PGS for the acquisition of 3D seismic; with CGG-Robertson for the preparation of several geological reports; with EMGS for the acquisition and reprocessing of 3D controlled source electro magnetism (CSEM).

Available database

As a result of all these multi-client agreements and the production-sharing contracts signed with IOCs, exploratory operations in Uruguay peaked in 2013 and 2014. The main activities carried out offshore since 2007 include:

• 28,000 km (17,398 mi) of 2D seismic (which adds to the 13,000 km (8,078 mi) of 2D seismic offshore Uruguay available before 2007, mostly located in shallow waters, to reach 41,000 km (25,476 mi) covering with 2D seismic all the offshore).

• 43,500 sq km (17,375 sq mi) of 3D seismic (which was completely nonexistent in Uruguay before 2012).

• 13,500 sq km (5,212 sq mi) of CSEM.

• More than 200 piston core samples for geochemistry analysis.

Record water depth

After 40 years without any wells drilled offshore Uruguay the world record water depth well, Raya X-1, was drilled in the Pelotas basin in 2016. This well touched the seabed at 3,404 m (11,168 ft) of water depth, reaching the targeted Oligocene turbidite but without any shows of hydrocarbons. The Raya X-1 well was drilled by Total as operator, with ExxonMobil and Equinor as partners, in 100 days of operation, without any health, safety or environmental incidents, on time and on budget. ANCAP played an important role in the facilitation of the activities, coordinating with the port authorities and customs for the success of the project.

Therefore, nowadays, Uruguayan offshore basins are still underexplored because there is scarce direct information through wells (only three wells have been drilled offshore Uruguay); however, there is a very significant amount of seismic data coverage, which helps to reduce the exploratory risk.

Open Uruguay round

Given the renewed interest of the upstream industry to explore in the frontier areas of the Southern Atlantic margin, ANCAP and MIEM understood it was convenient to review the system for awarding areas for the exploration of hydrocarbons, in order to make it more competitive with regards to the fiscal regimes offered in other frontier-exploration destinations. Therefore, by Decree 111/019, a new regime for the selection of oil operating companies for the exploration and exploitation of hydrocarbons was established: the Open Uruguay Round.

The Open Uruguay Round system accomplishes the most valued factors by oil companies at the moment of participating in a bidding round: transparency in the process of decision making, a clear and predictable schedule, and making available a significant amount of data to the exploration companies.

In this continuously open process, companies can qualify and submit offers at any time. However, the system does not imply a direct negotiation; instead, it works as two bidding rounds per year, with opening of offers at two instances per year.

Oil companies’ qualification is based on their technical, economic, and legal background. With the purpose of promoting the participation of independent oil companies focused on exploratory operations, the terms include the possibility of qualification exclusively for the exploration period, with or without exploratory well, as well as for the exploration and exploitation periods, with technical and economic requirements significantly differentiated in each case.

Similarly as in the first three bidding rounds, in case there are two or more offers for the same area on the same instance, the offers would be compared based on three biddable criteria: the committed work program for the first exploratory period, the percentage of increase of profit oil for the Uruguayan state, and the maximum percentage of association of ANCAP, and the area would be awarded to the highest score offer. In order to mitigate the exploratory risk, ANCAP is offering large areas offshore, from shallow (50 m) to ultra-deepwaters (more than 4,000 m bathymetry), with an average size of 14,360 sq km (5,544 sq mi) .

The contract model approved in the Open Uruguay Round regime is similar to typical production-sharing contracts (PSC) widely used in the industry, for which the contractor assumes all risks, costs, and responsibilities of the activity. No royalties or bonuses of any kind are applied. The exploration period, which has a term of up to 11 years, is divided in three exploration phases and companies could have an area for six years before committing to drill exploratory wells. The term of the complete contract including the exploitation period is 30 years, which could be extended for 10 additional years if requested by the contractor for justified reasons and approved by the executive branch.

Regarding the contract economy, the production income is divided in three portions: cost oil, profit oil for the contractor, and profit oil for the Uruguayan state. The contractor is allowed to recover the cost oil (operating and capital costs) from gross income before sharing the production profit. The cost recovery is limited to 60% of gross income in case of oil production and 80% in case of natural gas production. For any given quarter, if cost oil is more than the allowed limit, the remaining unrecovered amount is carried forward and recovered in the following quarter until it is fully recovered.

The profit oil is the portion of production remaining after the cost oil has been deducted. It is split by the state and the contractor on the basis of a sliding scale by which the state’s share increases as the relationship between gross income and total costs increases.

ANCAP has a back in option, which means that, after the commerciality of a discovery is declared, it has the right to take up a working interest in the project development. ANCAP’s participation ranges from 20% up to a maximum that is also biddable and used for comparison of offers, as mentioned before. After ANCAP has associated to the IOC, it would have the same role as any partner in a typical joint operating agreement.

Therefore, the Open Uruguay Round Contract has been designed in such a way that the oil company controls the risk and reward terms of the exploration equation, because all terms that define it are part of the offer: the economy of the contract, strongly influenced by the profit oil sharing and ANCAP’s association percentage, and the committed exploratory program for the first exploration phase, are both offered by the oil company in the bid.

Offshore hydrocarbon potential

Three basins can be recognized offshore Uruguay: Punta del Este basin located in the southwest segment near the border with Argentina; Pelotas basin that develops in the northeast and continues in southern offshore Brazil; and Oriental del Plata basin which develops in deepwaters over continental crust.

The genesis of these basins is related to the breakup of the Gondwana supercontinent and later opening of the South Atlantic Ocean in Late Jurassic-Early Cretaceous times. They have a total extent of more than 125,000 sq km (48,263 sq mi), considering the outer boundary of 200 nautical miles, and a sedimentary infill that in some areas exceeds 7,000 m (22,966 ft).

Three main tectonic-stratigraphic stages are recognized in the evolution of the Uruguayan offshore basins: prerift (Devonian–Permian), synrift (Late Jurassic–Early Cretaceous) and postrift (Aptian–Present). The prerift mega-sequence is represented by preserved remnants of a Paleozoic basin that developed in the area before the breakup, which also outcrops in the onshore (Paraná basin). The synrift sequence is represented by the continental infill of halfgraben structures that in great part are constituted by thick lacustrine shales that could represent significant source rock intervals, as was proven in the conjugate margin by the AJ-1 well in Orange basin (offshore South Africa). The seismic interpretation of the postrift sequence allows identifying at least four important maximum flooding surfaces that are associated with significant marine transgressions (Aptian-Albian, Cenomanian-Turonian, Paleocene, and Miocene). The geological model shows that at least two of these transgressions are associated with the deposition of significant world-class source rocks intervals (Aptian and Cenomanian-Turonian). The Paleocene transgression, also recorded in Argentinian and Brazilian basins, is represented by a thick layer of shales that represents the main regional seal of the basin.

Proven high-quality reservoir rocks have been encountered in the sedimentary record of the Uruguayan offshore basins with porosity values between 18 and 25%. The most important ones are related to the alluvial-fluvial systems of the synrift sequence, the fluvial-deltaic sandstones of the early postrift sequence, and the lowstand deposits of the early and late postrift sequences.

Although oil and gas accumulations have yet to be identified, the offshore basins of Uruguay are still underexplored. Despite the fact that significant 2D and 3D seismic data have been acquired recently, only three exploratory wells were drilled in the area. Two of them (Lobo X-1 and Gaviotín X-1) were drilled in 1976 by Chevron, and are located in shallow waters (40-50 m) of the Punta del Este basin. The third well (Raya X-1), described above, was drilled in the Pelotas basin.

The Gaviotín X-1 had a total depth of 3,631 m while Lobo X-1 had a total depth of 2,713 m (8,901 ft). Both targeted antlicline structures in the synrift sequences. They were declared dry wells and did not found significant source rock levels because they were placed in basement highs, and close to the basin depositional and erosional limit. However, it is important to notice that fluid inclusions of oil and gas were found in both wells, especially in the Cretaceous sequence, proving the presence of an active petroleum system and the effectiveness of the marine Paleocene shales as a regional seal.

On the other hand, the target of Raya X-1 was an Oligocene turbidite that developed 2,400 m (7,874 ft) below seabed, composed by a sand body of high porosity and thickness of 135 m (443 ft). The lack of large faults in the area of the well that could act as migration pathways, connecting the Oligocene reservoir with the Aptian source rock, is the main reason to explain the water-bearing nature of this turbidite.

Thus, taking into consideration the distribution of the main source rocks of the basins, the presence of migration pathways, the development of significant reservoir rocks and the presence of a regional seal (Paleocene), the Cretaceous appear to be the most prospective sequences.

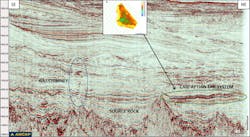

The seismic interpretation allows the identification of different structural, combined and stratigraphic prospects, in variable water depths. The latter are the most widespread prospects, and are represented by channels, turbidite systems, pinch outs and carbonate buildups.

There are several direct and indirect evidences of the occurrence of hydrocarbons, which confirm hydrocarbon generation and the presence of an active petroleum system. Some of these include fluid inclusions of oil and gas in wells and gas chimneys, brightspots and AVO anomalies in seismic.

Conclusion

Uruguay is a reliable and stable country with above-ground risks minimized, which counterbalances the high exploratory risk. The success in the previous bidding rounds and the multi-client agreements allowed a significant increase in the available database offshore Uruguay, reducing exploratory risks.

ANCAP and other Uruguayan institutions were able to deliver in complex projects such as 3D seismic acquisitions (with four 3D seismic vessels working simultaneously) or the abovementioned world-record water depth Raya X-1 well. Although Raya X-1 well was dry, it did not reach the Cretaceous sequences, which appear to be the most prospective.

The Open Uruguay Round has been approved by Decree 111/019 in April 2019, and two offers have been submitted by a top E&P operator of the Atlantic Margin in the first instance of 2019; therefore, the new regime is starting to show a positive response from the upstream industry.

ANCAP is offering data rooms to oil companies continuously (in its offices in Montevideo or to be arranged in Houston and London), and is making available a massive amount of information at the ANCAP-E&P web page, which can be found at https://exploracionyproduccion.ancap.com.uy/.

In summary, the Open Uruguay Round represents a unique opportunity to acquire a frontier asset with extremely low exploratory program requirements (up to six years without well commitment), good bidding round terms, and a sound and fair contract model. •