Offshore energy capex to grow again in 2025 led by Asia, Middle East

By Matthew Hale, Rystad Energy

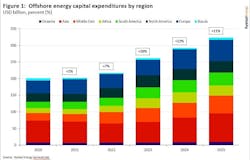

As suppliers to the energy industry enter a new year, offshore operators are poised to increase capital expenditures (capex) to over $300 billion, marking a new high for offshore oil and gas and power markets. After investment growth slowed from 20% in 2023 to 12% in 2024, Rystad Energy projects further moderation to 11% in 2025.

However, this remains below the record set in 2014, when offshore upstream capex reached an all-time high and offshore wind expenditures contributed less than 3% of the total. In 2025, offshore wind and floating solar are projected to make up nearly 19% of total expenditures as solar and wind installation continue to command a larger share of the power generation mix.

Regional trends

Regionally, Asia, led by China, will continue to be the largest market for offshore investments and the biggest source of growth. The Middle East, driven primarily by Saudi Arabia and Turkiye, will be the second largest contributor to 2025 gains. Meanwhile, Poland is expected to push growth in the European region, offsetting slower gains in the UK and Norway.

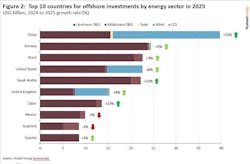

As in many domains, developers of China-based projects are the largest investors in offshore energy by a healthy margin, with over half of those capital expenditures directed toward wind generation capacity. Among the top 10 countries, only the UK nears having more power projects than oil and gas. With a forecasted growth rate of 15% in 2025, Chinese capital expenditures will expand the most in dollar terms, followed by Saudi Arabia and Poland. Saudi Arabia is set to achieve an exceptional growth rate of 22%, driven by expansions at the Marjan and Zuluf fields and the associated Tanajib gas plant, which will process 2.6 Bcf/d of natural gas.

In the US, following a contraction in offshore wind in 2023 as developers attempted to negotiate higher offtake electricity prices, wind capital expenditures rebounded substantially in 2024, partly offsetting a decline in upstream oil and gas investments. This trend is expected to continue in 2025 as several wind projects progress toward full-scale development while oil and gas spending shrinks.

Notably, the approval of Ocean Winds’ 2.4-gigawatt (GW) SouthCoast Wind project in December marked the 11th offshore wind project approved under the Biden administration, adding a cumulative 19 GW of capacity.

While US oil and gas leasing is expected to grow in 2025 under the Trump administration, the effects will not be felt in the same year. All of the top 10 countries are expected to expand, with the exception of Australia and Mexico. LNG-based capex declines are the main factor in Australia while Mexico faces foreign investment headwinds despite the development of Woodside Energy’s Trion project and Pemex’s plans to arrest production declines.

Top 10 countries

Looking at the top 10 countries for offshore investment in 2024, there were several large floating production, storage and offloading (FPSO) projects and two Saudi Arabian developments. This year’s list should be more diversified, as shown in the “Top 10 E&P projects” chart. African countries are featured more prominently, with Eni’s Coral Norte floating LNG project in Mozambique leading the group that also includes Eni’s Baleine Phase 3 FPSO in Cote d’Ivoire and Shell’s Nigerian Bonga North Phase 1 tieback.

Half of the top 10 projects are large, fixed platforms, including the third phase of North Field Compression in Qatar; the second phase of Absheron in Azerbaijan; and Pemex’s Zama development in Mexico. In the Gulf of Mexico, BP’s greenfield Tiber hub is expected to utilize the design of the Kaskida floating production unit, which was sanctioned in July 2024 in a design-one-build-many approach.

Meanwhile, South American FPSO sanctioning will take a slight breather this year following a long string of newbuilds in Brazil and Guyana, with the Marlim Revitalization (P-86) FPSO being the only South American project in the top 10 in 2025. These investment decisions will further stretch the offshore fabrication supply chain, which is still responding to substantial growth in 2023.

Offshore wind installation

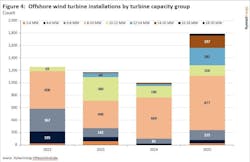

While the pace of offshore wind turbine installations slowed again in 2024, turbine counts are projected to grow substantially in 2025. Notably, 2024 was the first year to see a material volume of turbines installed that exceeded 12 megawatts (MW) in individual output capacity. Rystad Energy estimates that 282 turbines in the 12-14 MW range will be installed in 2025, up from 33 installations in 2024, with individual output capacities of 10-12 MW. As a result, this year will serve as a milestone and a test of the emerging trend toward larger wind turbines, which offer improved efficiency and higher output but also come with increased installation and maintenance costs. While the share of these larger models is set to grow, smaller 8-10 MW turbine installations still make up the bulk of installations, with 877 units in 2025 compared to 660 units in 2024.

Rig and vessel markets

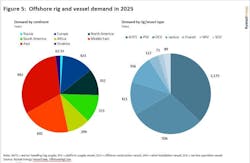

Shifting the focus to the offshore rig and vessel markets, the total demand for offshore units can be visualized by considering both the oil and gas and wind energy sectors. Asian countries, led by China, will account for over a quarter of vessel demand, accounting for 992 years of work, while the Middle East will rank as the second largest region, with 641 vessel years.

When examining different types of vessels, we see that anchor handling tug supply (AHTS) vessels will require the largest fleet to supply over 1,100 years of demand, followed by platform supply vessels (PSVs), offshore construction vessels (OCVs), and jackup rigs. While some vessels are able to work across both the upstream and wind sectors, jackup and floating rigs are confined to oil and gas or carbon capture and storage (CCS) activities; while wind installation vessels (WIVs) are tailored toward foundation and turbine installation. With limited newbuild rigs in the pipeline and a fast-growing wind sector, shipyards will be pushed to meet the demand for these specialized vessels in the coming years.

Capex trends

With crude oil prices remaining above $70 per barrel, oil and gas capital expenditures remain elevated and are expected to grow again in 2025 as the cycle grinds higher. Combined with the expansion of wind, solar and CCS projects, total offshore investments are projected to increase by 11% over 2024. China will lead the way, with both Saudi Arabia and Qatar contributing materially to this expansion.

Shallow-water, fixed platform projects in Qatar, Azerbaijan, Mexico, Kazakhstan and Malaysia will be complemented by deepwater developments in Mozambique, the US, Brazil, Cote d’Ivoire and Nigeria, which will target large volumes of gas in addition to liquids. A noteworthy milestone is expected in 2025 for 12+ MW wind turbines, and the combined demand for offshore vessels and rigs will push utilization rates higher, resulting in growing backlogs for many service providers.

About the Author

Matthew Hale

Matthew Hale is senior vice president—Drilling & Wells at Rystad Energy. He has extensive experience in oilfield services, spending most of his career with Baker Hughes and NOV supporting product development, marketing, and corporate strategy teams. He holds a bachelor's degree in mechanical engineering and an MBA, both from Rice University.