Technology, innovation keep Kerr-McGee leading GoM exploration, development

Jennifer Pallanich Hull

Gulf of Mexico Editor

Kerr-McGee doesn't focus on its image as a development leader in the Gulf of Mexico. The Oklahoma City-based company just goes about its business, and the reputation follows.

The Gunnison and Red Hawk developments in the deepwater GoM are just two recent examples of the independent's willingness to embrace new technology, a characteristic that has followed the company from its origins in 1929, to its first spar in the Gulf in 1996, to the tubes now under fabrication at Gulf Marine Fabricators yard in Ingleside, Texas, for the Red Hawk cell spar. GMF is temporarily storing the Gunnison hull, a truss spar development in Garden Banks block 668, and constructing Red Hawk, a cell spar development in Garden Banks block 877.

Kerr-McGee has dealt with a variety of technologies in its efforts in the Gulf.

"We get a taste of everything," said Frank Patterson, vice president of GoM exploration.

Kerr-McGee plans to apply its GoM experience to select deepwater basins around the world, said David Hager, senior vice president of oil and gas. At year-end 2002, the company had reserves of 1.03 Bboe and had bought into acreage across the globe, including the purchase this summer of some properties off the Bahamas.

"We're still in the early phases of analyzing the Bahamas portfolio," Hager said.

Kerr-McGee is confident that it will have discoveries to which it can apply knowledge gained in the deepwater Gulf since its entry there in the 1980s, he said. "We always are out there looking for new prospects."

This year, Kerr-McGee has acquired interests in 82 blocks in the GoM, nine licenses off the Bahamas, three blocks in the North Sea, and additional acreage in Bohai Bay, China.

With growing interests outside the Gulf, Hager said, the company is moving "in a measured way so we don't stretch our skill set too thin."

Before the independent will commit itself to an area, Patterson said, the company weighs a number of factors: resource potential, fiscal terms, whether the company can operate there safely, safety of the personnel, and whether the area has a potential for meaningful growth.

"We have some exciting potential all around the world," said Don Vardeman, director of worldwide facilities engineering.

GoM strategy

Kerr-McGee's overall E&P strategy is to grow primarily through exploration, with supplemental growth from acquisitions, Hager said, and the GoM is a large component of that strategy.

He said the company has shifted its exploration program to deeper depths and subsalt plays, which require more geoscience work to find resources and reduce risk.

"Some of these play types will work and will work very well, and some may not," Hager said.

The sediment column and salt issues make the deepwater GoM complicated to image, Patterson said.

"We're moving into areas where imaging is the key," he said, adding that most of the easily imaged areas have been shot and drilled.

Kerr-McGee, like many other oil companies, is working up imaging algorithms with vendors, high-grading blocks that are around salt, Patterson said.

Hager said the company's deepwater activity gives Kerr-McGee an advantage.

"We understand that it's more complex than just taking the geologic data from the shelf and covering it with more water," he said.

In its youth, Kerr-McGee tackled the shelf, where it still has a legacy position, including a few development wells. The company is contemplating the deep shelf play.

null

"We see this as a play that we may pursue in the future," Hager said.

It's becoming tougher to find the quality projects in the Gulf, Hager said, so the company focuses on improving the economics of the areas being explored.

One reason Patterson believes Kerr-McGee succeeds in the GoM is the company's strategy of covering potential play types.

"We've grown in understanding in the dynamics of the Gulf of Mexico, and we believe that's going to be the key to the future as far as getting into new plays and continuing the success that we've seen," he said.

The GoM is a unique basin, he said, noting that in most other places, operators can't drill so deep and still have a viable deepwater program. The focus must be on dropping costs to decrease risk-dollar exposure, Patterson added. To get there, he said, operators and contractors must work together to bring incremental breakthroughs.

"We need to continue the evolution of the drilling and facilities side of our industry," Patterson said.

Gunnison to go onstream

Sanctioned in October 2001, the Gunnison truss spar will take 2.4 million hours to complete. The field, in 3,150 ft of water at Garden Banks block 668, will go onstream in 1Q 2004.

"It took us nine well bores to appraise Gunnison," said Gary Mitchell, project manager for deepwater facilities. "Gunnison turned out to be a really optimal development with its combination of dry tree oil and gas wells and gas subsea tiebacks."

The nine-slot dry tree spar was installed Aug. 21 over seven pre-drilled wells, leaving spots for two more wells. The spar has workover capabilities but no drilling ability. Mitchell said the spar will be able to shift 300-400 ft off center to allow a semi on site for new drilling. Three subsea trees have been installed, and the wells are completed.

Gas from the Durango satellite field in Garden Banks block 667 and the Gunnison East field in Garden Banks block 669 will both be tied into the spar before heading through a 16-in. pipeline to the Garden Banks block 191 platform in 456 ft of water to flow into the Stingray Gas Pipeline to the Louisiana shore. Oil will head through an 18-in. pipeline to a platform at Galveston block A-244 in 361 ft of water before entering the Exxon Hoops line to the Texas shore. The spar will process up to 40,000 b/d and 200 MMcf/d.

Mitchell said Gunnison will accommodate future tiebacks. Gunnison itself has 10 pay sands between 12,000 and 18,000 ft. Partners in Gunnison are operator Kerr-McGee with 50%, Nexen with 30%, and Cal Dive with 20%.

Some companies are not comfortable with the spar as a development option, Mitchell said, because of the flex of the riser at the keel tank. But Kerr-McGee and Technip have solved that, he said. The keel joint is a key part of the spar design and can take the deflections of the spar motions due to current and environment.

"The risers are still a challenge," Mitchell said, noting there is always a concern the riser will bend in its position through the keel joint. It could also be difficult to inspect and repair the risers, he said. Knowing these concerns upfront, he added, led Kerr-McGee to design the spar for 20 years and the risers for 200 years.

In another departure from past spars, the air can system is redesigned to provide a more efficient and fabrication-friendly solution. The air can system is fundamentally the same as before in that it provides buoyancy to float the production riser.

The Mustang Engineering-designed Gunnison topsides include four decks: a helideck, a work-over deck, a production deck, and a cellar deck. Topsides fabrication is nearing completion at Gulf Island Fabricators, and installation will follow in 4Q 2003.

Gunnison, which has a 98-ft-wide and 549-ft-tall hull, is 8 ft wider than the Boomvang and Nansen spars to deal with the deeper wells and higher pressure.

"We've got a lot of flexibility built into the design," Mitchell said, noting redundancy was also specified. "We always think in terms of secondaries. What if your primary system doesn't work? You go to your secondary system."

The Technip-designed Gunnison spar is equipped with strakes to deal with vortex-induced vibrations and is designed to 1/2-ft heave in a 10-year winter storm, Mitchell said.

"We can really tune the system for heave," he said.

In March, Heerema pre-installed the driven piles to meet the required 180-day waiting period for applying load to the piles. Mitchell said Kerr-McGee opted for driven piles because of loop currents and to lower development costs over the suction pile concept. The nine 220-ft pilings self-penetrated to 60 ft, and Cal Dive's Q4000 pounded the 84-in. diameter pilings so only 15 ft remain above the mudline.

"The hammer worked flawlessly," Mitchell said.

Cal Dive will also install the subsea system designed by JP Kenny including Aker-Kværner umbilicals, Wellstream flexibles, Delta pipeline end manifolds, jumpers, and leads to join the FMC subsea trees to the spar. Dockwise's Mighty Servant I brought the Gunnison spar to the Gulf Marine Fabricators yard in Ingleside, Texas, in mid-June from Technip's Mäntyluoto Works yard Pori, Finland.

A technology play

In the Gulf, the industry has found a way to develop fields in deeper water than before and to develop smaller fields more efficiently, Hager said. Innovations in technology have allowed the GoM play to continue, he said.

"The Gulf of Mexico is really a technology play, to a large degree," he said. "It's stayed alive because companies have continued to innovate."

Patterson said Kerr-McGee's challenge is how to move discoveries into production under a plan that conforms to the independent's understanding of the area.

"We have a regional understanding that we work hard to develop," he said.

This focus begins with geoscience and geophysical work leading up to developmental engineering, he said.

Kerr-McGee's hub-and-spoke approach in the GoM allows the company to enhance the economics of the Nansen, Boomvang, Gunnison, and Red Hawk developments by using the facilities as hubs. The company holds 25 blocks in the Nansen/Boomvang area, about 40 in the Gunni-son area, and 25 in the Red Hawk area.

Once a project is sanctioned, Vardeman said, the company strives to quickly bring it to first production while maintaining a safe work environment and keeping it on budget.

From the start of a project, Hager said, the company has a preliminary development plan and is ready to implement it if successful.

"We went in with a final product in mind before we ever drilled," he said, citing the Nansen development as an example.

The company's development programs include two staples: subsea elements and technology.

"One thing that's consistent about all of our deepwater developments is there's always a subsea component," Vardeman said.

The wells, Mitchell said, sometimes use smart well technology, or a series of sleeves that open and close via remote control to allow the operator to move from one pay zone to another without intermittently requiring a drilling rig. Kerr-McGee used the smart well technology on the Boomvang and Nansen fields and will use the technology at Gunnison as well.

The company positions itself as a rapid applier of new technology, whether it's drilling, exploration, or facilities and development, Hager said, pointing to spars as one example. While the company does not participate in R&D work, the independent evaluates these advances and rapidly applies them as well, he added.

Kerr-McGee's exploration arm gives the company a competitive edge, Hager said. The company has a small internal technology group charged with identifying technology and applying it where the technology can help, he said.

"We're not looking for technology for the sake of technology," Vardeman said. "We see technology as the solution to an economic problem."

Hager said the company's methods are not focused simply around one specific technology but a team approach. Some pure drilling technologies have helped, but the difference has been involving the geoscientists early in the process to analyze the entire geological section of the well, he said.

Patterson called this integration one of Kerr-McGee's strengths.

"There's a lot to be said for success," Hager said. "We know what success looks like. We've had a lot of success out there. We have the people with the knowledge and confidence to know where to go next."

Red Hawk landing soon in Gulf

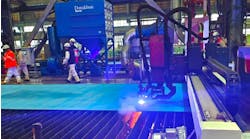

Red Hawk's cell spar design is easier to fabricate than previous spar designs, according to Don Vardeman, director of worldwide facilities engineering. The Gulf Marine Fabricators yard in Ingleside, Texas, is constructing the Red Hawk spar.

"It's not hydrodynamics as much as different ways of doing things," said Ed Horton, spar designer, about the difference between the cell and truss spars.

As "father of the spar," Horton patented spar design in the 1980s, and he expects the next design innovations will be in associated systems, like risers and mooring, and reduced fabrication time.

The cell spar tubes are 20 ft in diameter, and the yard is manufacturing the tubes in 10-ft sections by rolling the metal into a tube and rolling in the T-beams. Three of the shafts will be 560-ft long, and the other four will be 280-ft long. The keel tank will be the lower 50 ft of the long cylinders, and Vardeman said heavy fixed ballast will be installed while the spar is at quayside.

null

The tubes, being repetitive creations, are easier and quicker to fabricate.

"It's working out," Horton said of the design. "It's the first spar we've built in the US."

The cell spar will also be one of the first in the GoM to use polyester mooring in a permanent installation. Each side will use 7,000 ft of mooring.

Devon Energy and operator Kerr-McGee each hold 50% interest in Red Hawk.

Located in Garden Banks block 877 in 5,300 ft of water, Red Hawk reserves are estimated at 250 bcf. The cell spar will have initial capacity to process up to 120 MMcf/d of gas, with ultimate capacity of 300 MMcf/d. First production from the natural gas field is set for 2Q 2004. The facility will initially handle two subsea systems.