Top 5 offshore development projects to watch in 2024

Editor's note: This cover story first appeared in the March-April 2024 issue of Offshore magazine. Click here to view the full issue.

By Bruce Beaubouef, Managing Editor

Buoyed by high prices and rising energy demand, offshore operators and international oil companies are advancing plans for several field development projects, and 2024 looks to be a busy year for offshore construction activities.

With that in mind, the editors of Offshore have compiled the following Top 5 field development projects to keep an eye on this year.

The projects were selected primarily on the basis of an expected or upcoming FID, but other parameters included notable aspects such as size of reserves; infrastructure scale and scope; unique milestones such as first deepwater production; or inclusion of emissions reductions technologies.

Kaskida

BP’s Kaskida prospect was originally discovered in 2006 in Keathley Canyon block 292 in a water depth of 5,860 feet (1,790 m). The field, which holds an estimated four billion barrels of oil, was the heart of a large BP project to develop technology to drill in high pressure and high temperature offshore reservoirs.

The company’s Project 20K aimed to design and develop drilling rigs, subsea production systems and blowout prevention equipment to produce oil and gas in reservoirs with extreme conditions of pressure of up to 20,000 pounds per square inch and temperatures as high as 350°F (175°C). The project was however put on hold in 2013 due to its high costs and technical challenges.

But with favorable market conditions, improvements in geological analytics and drilling technology, BP revived the project last year. Speaking to investors last May, CEO Murray Auchincloss (then CFO) said that a concept selection process was underway for Kaskida, and that BP aimed for a final investment decision in 2H 2024, with a price tag ranging from $15 to $20 billion.

BP has reportedly invited South Korean shipyards Samsung Heavy Industries, Hanwha Ocean, and HD Hyundai Heavy Industries, along with Singapore’s Seatrium, to bid on the construction of floating oil and gas production platforms (FPUs) for the development of the Kaskida and Tiber oilfields. Reports also indicate the BP has specified a semisubmersible production platform that can handle about 80,000 barrels per day of oil and 25 million cubic feet per day of gas. BP is reportedly targeting a 2028 first oil production date for Kaskida. Reports indicate that lessons from Kaskida will enable BP to unlock other, similar geological reservoirs in the Gulf of Mexico.

Whiptail

ExxonMobil Corp. is on track to begin its sixth oil project in Guyana, the Whiptail offshore field development project, with an FID expected within 1Q 2024. Along with partners Hess Corp. and China’s CNOOC, ExxonMobil unveiled its $12.9-billion proposal for the Whiptail project last August and formally submitted the plan to the government of Guyana in October. The project will feature a new FPSO which will be spread moored in a water depth of about 1,630 m (5,300 ft) in the Starbroek block offshore Guyana. First oil is targeted for late 2027. The Whiptail project is expected to increase the ExxonMobil-led consortium’s oil output in Guyana to more than 1.2 million barrels per day.

Last October, ExxonMobil commissioned SBM Offshore to perform FEED activities and studies for the Whiptail FPSO. Subject to government approvals of the development plan and project sanction including FID by the partners, SBM Offshore will construct and install the FPSO, which will feature the company’s seventh newbuild, multipurpose Fast4Ward hull combined with standardized topsides modules. Ownership of the FPSO will likely transfer to the client at the end of the construction period and prior to the start of operations offshore Guyana.

SBM says that it plans to operate the platform using its integrated operations and maintenance model. This involves combining its own and ExxonMobil’s experience, applying key learnings from other FPSOs currently deployed on the Stabroek Block.

Whiptail’s FPSO will be designed to produce 250,000 bbl/d of oil, with associated gas treatment capacity of 540 MMcf/d and water injection at up to 300,000 bbl/d. The vessel have an onboard storage capacity for about 2 MMbbl of crude oil.

Coral Norte

Eni’s second FLNG production project offshore Mozambique has “potential” for a final investment decision in 2024, according to Arnaud Pieton, CEO of Technip Energies. Back in November 2022, the 3.4 mtpa Coral Sul (Coral South) FLNG in Mozambique shipped its first cargo of LNG, adding Mozambique to the LNG producing countries. The TJS consortium, consisting of Technip Energies, JGC, and Samsung Heavy Industries, built the unit for Eni, the first FLNG facility ever to be deployed in the deep waters offshore Africa. Eni discovered the Coral field back in May 2012 and it operates Area 4 along with its partners ExxonMobil, CNPC, Galp, Kogas and ENH. The partners are now working on the second FLNG project offshore Mozambique, called Coral Norte (Coral North). Pieton reportedly told analysts during a recent earnings conference call that the Coral Norte unit would be a replica of the Coral South FLNG facility. He added that if Eni decides to take the FID in 2024, it would most likely be towards the end of the year. Pieton also said that: “the work for us is progressing in the sense of early engineering work and preparing the groundwork for being able to hit the ground running at the time of the FID.”

Cameia/Golfinho

Total Energies is advancing field development plans for its $6-billion Cameia/Golfinho project offshore Angola, and reports indicate the company will issue the FID this year. The Cameia and Golfinho fields are in blocks 20 and 21 in the Kwanza basin, in some 5,600 ft of water. The field development plan includes an FPSO (TotalEnergies’ seventh off Angola), connected to a network of at least five subsea wells and associated pipelines. Facilities on the platform would include a combined-cycle turbine for power generation and equipment to eliminate flaring.

TotalEnergies EP Angola operates both blocks with an 80% interest, with the remainder held by Sonangol Pesquisa & Produção. TotalEnergies, Sonangol and the Angolan National Agency for Petroleum, Gas and Biofuels (ANPG) signed a memorandum of understanding concerning development of two fields in May 2023, and the FID was initially expected last year. But more recent reports indicate that the FID will be issued in 2024. The project will launch the first production in the Kwanza basin and is expected to contribute significantly to Angola’s national production targets. Its potential could attract other operators to launch other developments in the Kwanza basin, according to ANPG officials.

Online reports indicate that TotalEnergies has selected Saipem to oversee the field development project, and that the Italian company is in the process of negotiating with a number of Chinese shipyards to design and build an FPSO capable of producing 70,000 barrels of oil per day. The reports say that Saipem will select the shipyard subcontractor in March and that construction work will start in July. First oil is being targeted for 2026.

Block 58

APA Corp. and TotalEnergies have announced the launching of development studies what they describe as a “large oil project” in Block 58, offshore Suriname. TotalEnergies is the operator of Block 58, with a 50% interest, alongside APA (50%). Successful appraisal of the two main oil discoveries, with the drilling and testing of two wells at Sapakara South and three wells at Krabdagu, confirmed combined recoverable resources of approximately 700 million barrels of oil for the two fields. These fields, located in water depths between 100 and 1,000 meters, will be produced through a system of subsea wells connected to a FPSO located 150 km off the Suriname coast, with an oil production capacity of 200,000 barrels per day. The detailed engineering studies (FEED) got underway late last year, and the FID is expected by year-end 2024. First oil is targeted for 2028.

FID trends

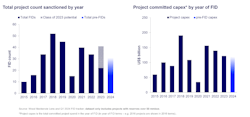

More upstream projects are expected to take the FID this year, says Wood Mackenzie. Up to 30 upstream projects developing resources of more than 50 MMboe could go forward for development this year, the consulting firm recently reported. The total number of FIDs could be eight more than the 22 signed off in 2023, with potential overall investments of $125 billion targeting 14 Bboe recoverable.

The projected increase follows a year in which numerous anticipated projects were delayed or postponed. Ross McGavin, principal analyst at Wood Mackenzie, said: “National oil companies in the Middle East will control the most projects, but the majors will be busy as well, particularly as they prioritize advantaged deepwater resources.”

In most cases, the payback periods could be less than eight years from FID, he added, with operators committed to swift execution, reducing unproductive capital and higher returns.

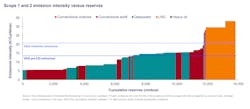

Average emissions intensity for the newly approved developments FID class of 2024 is 13.6 kgCO2e/boe. As estimated by Wood Mackenzie’s Emissions Benchmarking tool, this is below the global upstream average of 21 kgCO2e/boe (including liquefaction emissions).

“New projects are a lever to meet emission reduction goals, especially those focused on deepwater projects that continue to deliver on low emissions intensity and economic returns,” McGavin said.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.