Confidence returning to floating production market

Nearly two years after the global pandemic and oil price collapse darkened industry sentiment, the global FPS market has rebounded, and rebounded more quickly as compared to the industry downturn seen in 2015.

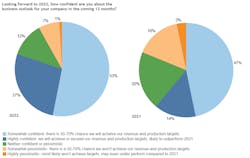

Recently, Energy Maritime Associates conducted its ninth annual Global Floating Production Industry Survey, which gauges current market sentiment and collects data on where the industry is headed in the future. Respondents come from all areas of the industry, and from all parts of the globe. The survey clearly indicated that positive industry sentiment has returned in the new year after experiencing a decline in 2021.

Confidence has returned to pre-pandemic levels. This year 80% of respondents expressed positive sentiment (somewhat confident to highly confident) compared to 79% in 2020 and 61% last year. The largest shift was in those expressing high confidence, increasing from 14% to 27%. At the same time those who were somewhat pessimistic dropped from 16% to 7%. The number of very pessimistic respondents also reduced from 3% to 1%.

For 2022, many commented that while activity is clearly on the rise, COVID-related issues continue to cause complications. In addition, some respondents commented that ESG issues may impact sanctioning and financing of new developments. Here are a couple of key quotes:

“The market is hot, but COVID headwinds are a risk to execution.”

“Investors are still very reluctant to go ahead with projects.”

Cost inflation

Higher prices are a certainty for 2022 according to 97% of respondents. Increased activity, higher commodity prices, reduced competition, and COVID measures are all driving this escalation. Almost two-thirds expected a 5-10% increase in capex costs, while over 25% believe that inflation will be more than 10%. The remaining 11% of respondents do not anticipate significant cost escalation. This is a dramatic shift from last year, when 45% expected no inflation, including 31% that anticipated cost reductions.

The main areas driving cost inflation are labor, logistics, and commodities. The cost of steel increased dramatically in 2021, but some respondents believed that steel prices may stabilize or even decline. However, other commodities, particularly oil, are expected to remain high, impacting transportation and manufacturing costs. Supply chain issues and COVID complications continue to drive logistics prices. Tight labor markets, driven by high activity and travel restrictions, are pushing up salaries in shipyards, manufacturing plants, and in project management.

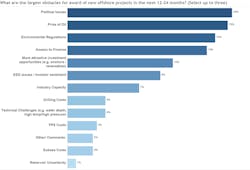

Obstacles to growth

For the first time, political issues were identified as the greatest obstacle to offshore project growth. There has been a dramatic shift in sentiment which is impacting new developments, as seen by Shell’s withdrawal from the UK’s Cambo project. In addition, progressive governments have declared that they will not normally provide international support for hydrocarbon developments, which could impact financing and negotiations with foreign governments. Last year, political issues ranked fourth.

Following this trend, environmental regulations jumped from sixth place to third. Of greatest concern here is the banning of new offshore developments or the cessation of new leasing rounds. There has been a shift in sentiments here, and some respondents expressed the fear of an existential threat to the industry.

The price of oil, which had been the main issue for the last seven years, fell to second place. Access to finance moved from second to fourth place, although we received many comments regarding difficulties in obtaining funding for new developments, due to ESG concerns and new guidelines for investments in the hydrocarbon sector.

Industry capacity is a growing concern, increasing to 7% of respondents, up from 5% last year. Costs remain low on the list of concerns with less than 4% worried about FPS, drilling or subsea-related costs in the next two years.

Potential bottlenecks

While costs are not a major concern currently, prices are expected to rise and could become a larger issue in the near future. For the last four years there has been little concern about industry capacity, with the top response being no capacity constraints expected. This has been changing over time, from 36% in 2017 to 15% in 2020. There are now significant concerns about supply chain bottlenecks, with less than 7% expressing no concerns. The primary concerns relate to fabrication yards, shipyards, project management, offshore installation, and power-generating equipment. With international travel and labor supply restricted by the global pandemic, it makes sense that the largest concerns are with fabrication yards and shipyards.

Power-generating equipment has become a greater issue, moving up from 12th place to 5th place since last year. Availability of offshore installation equipment has become a larger concern, jumping from 8th place to 4th place this year. Constraints in SURF and mooring equipment remained low, reflecting substantial availability in 2022-2023.

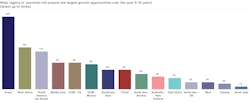

Growth regions

Brazil remains the top growth region again this year, as it has been since the beginning of the survey. Petrobras awarded five FPSOs in 2021 and has plans for many more on the giant pre-salt fields. Independent operators are redeveloping older fields, while larger players such as Equinor and Shell are progressing new developments. EMA is tracking 26 potential projects in Brazil, which could require up to 39 floating production units.

After a year in the third spot, West Africa returned to second place buoyed by the prospects of long-awaited awards offshore Angola and Nigeria.

South America (excluding Brazil) moved down from second place, perhaps due to some disappointing exploration drilling results. Nonetheless, ExxonMobil has placed orders for four FPSOs and has plans for a further six units in Guyana (10 in total). There could be potential for double this number to develop the entire basin, which extends to neighboring Suriname.

The Middle East jumped up from 8th place to 4th place this year, perhaps driven by prospects in Iran and Qatar. The US and Mexican sides of the GoM round out the top six.

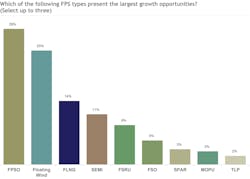

FPS growth potential

FPSOs remained the clear leader as the floating production system with the most promising growth potential, according to almost 30% of respondents. Floating wind held second position again, reflecting growing enthusiasm for renewables. The prospects for FLNG seem to be picking up, moving up from fourth place to third, perhaps due to prospects for monetizing stranded/flared gas. Production semisubmersibles moved up two spots to third place, with repeat orders of standardized designs driving down costs. EMA is tracking 22 developments that could require a production semi, mainly in the Gulf of Mexico (US and Mexican waters) and Australia. The outlook for FSRUs, which are used for LNG import, decreased from 13% to 8%.

Technology game changers

This year, when we asked which type of technology will have the largest impact on the offshore industry, floating wind was the winner by far, accounting for over one-third of the responses. While still in its infancy, there is a great deal of enthusiasm and hope for floating wind systems. Time will tell if it can live up to the expectations.

Long-distance subsea tiebacks moved up one spot to second place. This technology could increase the utilization of existing facilities and follows the trend of infrastructure-led investment. Tiebacks certainly will extend the life of currently installed production units, while the impact of future requirements is yet to be seen. Some stand-alone FPS developments could be replaced by tiebacks, while an FPS hub with tieback of multiple fields could also become economic.

Unmanned production facilities (UPFs) dropped to third place with just under 20% of the votes. Several reasons account for UPF’s popularity: the high cost of personnel as a portion of operating costs; application of digital solutions; and increasing comfort with remote work. While unmanned fixed facilities are common, the technology has not yet been transferred to floaters. Even if the concept of a completely unmanned floating facility is not realized, reductions in personnel offshore would still result in reduced operating costs.

Contracting strategy

The leading FPS contractors have received a slew of awards and are now executing multiple projects simultaneously. After canceling the tender for the Parque Das Baleis FPSO in 2021 for the second time, Petrobras reversed course and awarded the contract to Yinson, which was the sole bidder.

We asked respondents how this lack of competition will impact contracting strategy, particularly for the largest projects which can cost over $1.5 billion and produce 200+kboe/d. Almost 40% believed that there would be more direct negotiations rather than competitive tenders, such as the Buzios 6 FPSO award to SBM by Petrobras. Just over a quarter of respondents thought that field operators would turn to creative solutions such as redeployed units or taking on the project management responsibilities. Another 24% expected that a tight leasing market would drive use of alternative contracting models, such as EPC or BOT (build-operate-transfer).

Only 11% thought that companies would delay project sanctioning due to insufficient competition. This is a sharp drop compared to last year, when 27% expected delays in award. Rising costs and high oil prices are ratchetting up the pressure on producers to sanction developments as soon as possible.

Floating wind: threat or opportunity

There has been a great deal of excitement regarding floating wind, with many companies looking to diversify into the renewables space. We asked about the impact of floating wind on the existing floating production sector. Would it compete or be complementary, and over what time period?

Some 40% of respondents expected floating wind to be complementary and enable new floating oil and gas units. These units could then be powered by renewable sources, rather than from shore, and thus reduce their carbon footprint.

A slightly larger number (43%) believed that floating wind will represent competition, with most expecting it in the long term (2040+). However, 9% thought that floating wind could overtake hydrocarbon production units in terms of energy produced by 2040.

Just over 15% of respondents felt that electricity from floating wind would not have a significant impact on the floating production sector.

Conclusions

The floating production market remains one of the brightest spots in the offshore industry today, including growing excitement in the floating wind sector. Offshore development costs remain low, with break-evens under $35/bbl for the most robust projects. However, field operators are under increasing scrutiny from investors to balance capital investment, returns, and ESG issues. Activity levels are expected to continue to improve in 2022-23, but will be hindered by capacity constraints and access to finance.

The author

David Boggs is the Managing Director of Energy Maritime Associates, which publishes market-leading reports on the floating production industry and advisory services for developments requiring FPSOs, FLNGs, FSRUs, Semis, Spars, TLPs, MOPUs, and FSOs. Boggs has over 20 years’ experience in the offshore oil and gas industry including as General Manager–Commercial for fleet of leased FSOs and FPSOs. He has a BA cum laude from Harvard University and an MBA with honors from the University of Texas at Austin.

About the Author

David Boggs

Managing Director, Energy Maritime Associates

David Boggs is the Managing Director of Energy Maritime Associates, which publishes market-leading reports on the floating production industry and advisory services for developments requiring FPSOs, FLNGs, FSRUs, semis, spars, TLPs, MOPUs, and FSOs. Boggs has over 20 years’ experience in the offshore oil and gas industry including as General Manager–Commercial for fleet of leased FSOs and FPSOs. He has a BA cum laude from Harvard University and an MBA with honors from the University of Texas at Austin.