Offshore staff

LONDON – Twenty-one offshore oil and gas projects have passed final investment decisions this year, according to Westwood Global Energy Group.

The total value is $20 billion, with cumulative resources to be developed estimated at 1.5 Bbbl of oil and 25.5 tcf of gas, according to E&A analyst Joe Killen, and potential overall production of 100 MMboe/d.

Killen, speaking at Westwood’s recent Macro Overview webinar, said one of the largest projects was Farzad B in the Persian Gulf offshore Iran. ONGC discovered the giant gas field in 2008, but with the company reluctant to commit to development, the project was awarded instead to Petropars.

Indian companies may be brought onboard later, although at this stage it is unclear where the final destination of the gas might be, Killen pointed out, in which case it may be some time before the gas gets to the market.

Another large project going forward in the Middle East region is Energean’s 1.1-tcf Karish North subsea tieback to the Karish Main FPSO (Energean Power) offshore Israel.

The second most active region for new activity is Latin America, boosted by the recent FID for Equinor’s Bacalhau project offshore Brazil, which has a $35/boe breakeven target. The FPSO is designed to process 220,000 b/d of oil, with all the gas to be reinjected.

Third in terms of project size is Santos’ Barossa in the Timor Sea, a 4.5 tcfoe gas-condensate development based on an FPSO offloading condensate and exporting gas to the Darwin LNG complex. Other stand-out developments nearby include CNOOC’s Kenli in Bohai Bay off eastern China, and SapuraOMV’s Jerun offshore Sarawak.

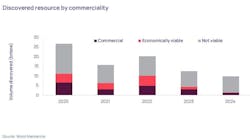

First-half offshore activity was up by 60% compared to the same period for 2020, Killen continued, helped by five new subsea tiebacks in Northwest Europe. At the same time, tiebacks only contribute around 10% of the new FID reserves.

While Norway has dominated new project activity so far this year in Northwest Europe, three larger-scale developments could go forward relatively soon in waters west of Shetland.

Siccar Point’s 160-MMbbl Cambo (FPSO) project could be the first later in the year, assuming it can clear environmental objections, and could be followed in 2022 by Equinor’s 220-MMbbl deeper-water Rosebank (also an FPSO) and bp’s 300-MMbbl Clair South development in 2023.

Developers are examining use of power from shore for these projects, and this could be critical to reduce the political risks, Killen suggested.

In Norway, the Aker BP/Equinor-led NOAKA project in the North Sea and OMV/Equinor’s Wisting in the Barents Sea are other large developments set to be enabled by power from shore, with plans likely to be submitted in respectively 2022 and 2023.

One potential constraint, however, is the capability of Norway’s service companies to handle these projects and the associated maintenance, he warned, in addition to their current workload.

08/05/2021