Some $30 billion expected to be sanctioned this year in offshore oil and gas

In 2019, the offshore energy service sector was just beginning to turn the corner with a material rebound in investments after the long downturn from 2014. Then the industry was dealt a one-two punch from the pandemic and a historic oil price crash in April 2020, resulting in a 19% year-on-year decline in offshore oil and gas capital expenditure last year. Now the service sector is again on the recovery path, but the future looks much different than it did in 2019. Due to a number of factors including the acceleration of electric vehicle adoption, Rystad Energy now expects oil demand to peak in 2026. Majors such as Equinor, Shell, TotalEnergies, and bp are all adjusting to the new reality and have announced significant growth targets for renewable energy investments. This shift is certain to challenge traditional suppliers as these major E&P companies must farm down or sell out some of their hydrocarbon investments to support the spending levels needed to reach their renewable targets.

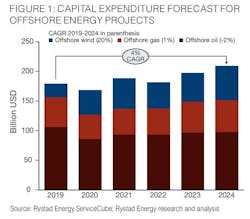

Rystad Energy is actively tracking the supply chain across all energy sectors and service segments. Figure 1 shows our near-term capital expenditure outlook for offshore oil, gas and wind. As oil demand weakens, we do not expect oil investments to return to 2019 levels this decade. Natural gas and LNG are likely to see better growth than oil, with a return to 2019 levels expected in 2023 as demand for LNG is set to keep rising to a peak in the mid-2030s. Growth in the energy service industry is going to be driven by the push for renewables, which for the offshore sector is primarily wind turbines. Investments in offshore wind are poised for the strongest growth, with a CAGR of 20%. Accounting for just 13% of total renewable investments in 2019, offshore wind will demand nearly one-third of all investments in renewables by 2024.

The growth in offshore wind creates opportunities for offshore suppliers as they are generally well positioned with strong competencies in advanced design, engineering, and construction in offshore environments. Development of deepwater oil and gas fields has, for years, required some of the most advanced materials, engineering, and ingenuity available in the market. This bodes well for the agility of the entire sector to contribute to the challenging development of offshore wind technologies. However, the suppliers will have their work cut out for them, as green energy investors are not just going to come knocking on the doors of incumbent oil and gas suppliers for their services. A concerted effort will have to be made to gain traction in these new markets, and patience will be required.

Key growth regions

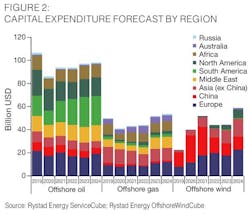

The capital expenditure forecast from offshore oil, gas and wind by region can be seen in Figure 2. This reveals that South America is keeping offshore oil investments afloat, driven by major developments in Brazil and Guyana. Australia and the Middle East are the only other two regions with positive trajectories in the years analyzed. Europe, Asia, the Middle East, and Africa are the key regions for offshore gas spending, while Asia and Africa are declining slightly.

The offshore wind market has not yet reached the global footprint of oil and gas. The market will be dominated by China and Europe for the foreseeable future, but the rest of Asia will be increasing to a 25% share by 2024. The North American market will increase to a 12% share by that same timeframe. We see the second half of the decade as an even faster growth phase for offshore wind, and this might even be a conservative case. A spending surge is likely coming as countries increase targets and incentives and offshore wind suppliers continue to develop cost-competitive enabling technologies. The emergence of floating wind structures toward the end of the decade will open up vast offshore locations for wind turbines.

It is important to note that within the Asian market, China is relatively closed off, with little opportunity to win work for international suppliers other than those already active in the country. China represents about 45% of Asian offshore oil investments between 2019 and 2024 and will account for three-quarters of this year’s Asian offshore wind spending. However, its offshore wind share will shrink to just over 40% by 2024, which means offshore wind opportunities should open up as more projects get under way in other Asian countries.

Growth is one thing, but it is also important to consider market share. Note that spend for offshore oil targeted projects will hold a majority of the market share until 2023 and gas targeted projects will maintain about a quarter of the market share throughout the period examined here. In the near term, the trend by the majors to shift to renewable energy will create delays and uncertainty for some projects in oil and gas as exploration and greenfield development stagnates. But the industry across the board has improved cost of supply throughout the extended downturn, which means these projects should remain value accretive. So, in the medium to longer term, the outcome could be positive. New and more focused E&Ps are likely to take over oil and gas assets as the majors withdraw. This will generate further economic activity from infill drilling campaigns, subsea enhanced oil recovery projects, development through subsea tiebacks, and platform lifetime expansion projects. While we expect peak oil demand in 2026, the curve is very much a plateau, above 100 MMb/d through the end of the decade. So, there is no doubt that someone will step up to fill the supply.

Upcoming project sanctions

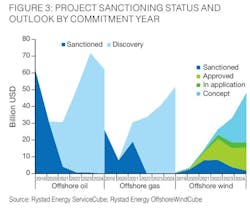

Project sanction is a milestone that suppliers watch for closely, since it gives the green light for operators to start bidding or finalizing contracts. A number of operators have strategically put major contracts like drilling, facility fabrication, and EPCI out for bid ahead of FID. In some cases, they have even awarded contracts ahead of FID, contingent upon the project reaching commercial sanction. The idea is that suppliers must shape their bids in such a way as to help keep the project commercial, and thus help get it across the line with the stakeholders. We are already over halfway through 2021 and at the time of writing, we have seen over $23 billion worth of commitments this year in offshore oil and gas, slightly over 60% of full year 2020. Figure 3 shows our view of greenfield project capex expected to be sanctioned in offshore oil, gas and wind. We expect roughly US$30 billion of commitments to be sanctioned this year in both offshore oil and gas targeted projects. Upcoming oil sanctions are led by South American giants, Buzios and Stabroek, and gas sanctions include the Pluto LNG Train 2 in Australia, Hail and Ghasha sour gas project in UAE, and QatarGas LNG extensions in Qatar. Dogger Bank, Hornsea Three, and Norfolk Vanguard in Great Britain are the most notable offshore wind sanctions on the horizon.

While offshore oil has traditionally taken the lead over offshore gas, 2021 is expected to be a close race as the markets balance out and oil resumes the dominant position. Meanwhile, the sanction process of offshore wind farms is still maturing. Rather than going from discovery to sanction, offshore wind projects take a few more steps from concept through application and approval by the governing administrations, before getting the green light for development.

Traditional offshore oil and gas suppliers have not had an easy go since the downturn in 2014. And while oil and gas are not on the growth path, it is not going anywhere for some time to come. Meanwhile, there is phenomenal growth coming from the offshore wind industry providing a light at the end of the tunnel, but offshore wind does not surpass oil and gas demand until the end of the decade. So, the near term will not be for the faint of heart, but savvy offshore suppliers that have managed to stay afloat till now should be able to strategically weather the transition and market volatility, and will be poised to unlock the next chapter of offshore energy conversion.