Editor's note: This article first appeared in the 2023 Executive Perspectives Special Report, which published within the November/December 2023 issue of Offshore magazine.

By Amy Chronis, Deloitte

The oil and gas industry has outperformed the broader S&P 500 by more than 45% since 2021. Recently, Wall Street has set forth a threefold mandate for the oil and gas (O&G) industry: Uphold financial stability, sustain high dividends and augment investments in low-carbon ventures. These heightened investor expectations may seem paradoxical, but they may act as a catalyst, helping to propel the management of O&G companies to improve in both emissions reduction and economic performance. O&G companies continue to explore growth opportunities in both their core business and in lower carbon technologies.

What are the different expectations surrounding the energy transition that could potentially influence industry capital allocation strategy or deployment of free cash flow? Deloitte recently surveyed 150 industry executives and 75 institutional investors globally to find out if there might be capital deployed either back into the core business, back to shareholders or into new low-carbon fuels and technologies.

Areas of divergence

The challenge in increasing clean energy investments lies not in capital availability, but in the returns and the ever-evolving demand landscape of low-carbon fuels. Approximately 60% of surveyed O&G executives state that they would invest in low-carbon projects if returns from these projects exceed 12% to 15%. This required return is about 1.5 to 2 times higher than that of renewable power projects (primarily solar and wind), which averaged 6% to 8% over last three years.

Similarly, it is acknowledged that the O&G industry offers a high and stable dividend yield, which averaged 3.75% in 2022. But when investors were asked about their willingness to reduce dividends in favor of allocating more resources toward low-carbon technologies, investor respondents seemed more receptive than surveyed executives expected. But investors were clear that any reduction in dividends would still be contingent on a minimum yield. About 80% of the surveyed investors were willing to reduce dividends in favor of increased low-carbon investments, provided that the dividend yield remained above 3%.

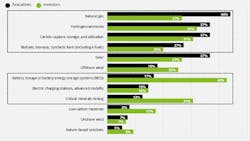

The divergence is also evident in the allocation of capital and the metrics employed to measure emissions reduction success. Concerning capital allocation, surveyed O&G executives were more bullish on natural gas and adjacent fuels such as biofuels and hydrogen/ammonia. In contrast, surveyed institutional investors display more enthusiasm for transformative energy sources, such as battery storage and mobility solutions (Figure 1). In terms of metrics, surveyed O&G executives assess their progress through outcome-based criteria such as operational efficiency enhancements and reduction in Scope 1 and 2 emissions. Conversely, surveyed investors emphasize outputs when assessing their firm's progress, focusing on the proportion of investments in wind, solar and carbon capture projects.

From divergence to convergence

Given the swift, complex and uncertain nature of this energy transition, it is natural for expectations to vary. However, both groups surveyed firmly concur on key points: the imperative of swift decision-making to maintain momentum; the critical role of policy support in fostering innovation and mitigating investment risks; and the vital necessity of effectively scaling low-carbon operations through measures like carbon pricing, robust offtake agreements and the seamless integration of diverse low-carbon sources.

The majority (75%) of both surveyed executives and investors express confidence in the industry's capacity to balance its economics stewardship and environmental responsibility. This unified high level of confidence underscores the notion that continuing a shareholder-centric approach and aligning on energy transition goals can help O&G companies assume a leading role in the transition toward a low-carbon world.

About the author: Amy Chronis is vice chair, US Energy & Chemicals leader, with Deloitte LLP.