Editor's note: This story first appeared in the March-April 2023 issue of Offshore magazine's Energy Transformation Strategies Special Report.

By Laith Amin, DNV

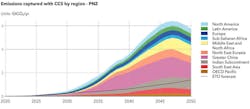

As an essential decarbonization tool, the need to fast-track carbon capture and storage (CCS) technologies is resounding. Over the next three decades, the use of CCS to reduce emissions from hard-to-abate sectors must increase dramatically.

According to DNV’s latest Energy Transition Outlook report, closing the gap between the current 2.2°C trajectory—and the 1.5°C future the planet needs—requires substantial CCS deployment. The "Pathway to Net Zero Scenario" presented in the report highlights the need to scale up current capacity more than 100 times by 2050.

Hastening progress

Carbon capture utilization and storage (CCUS) technologies are mature and have been used since the 1970s, initially as a means to enhance oil recovery. Over the past decade, DNV has delivered more than 200 projects spanning the full CCS value chain. Europe, Canada and the US have been leading the charge and scaling up activities. Large-scale commercial CCS facilities, such as Quest in Canada and Sleipner in Norway, are operating today, and a number of hub style projects are progressing such as Northern Lights in Norway, which is being constructed, and the East Coast Cluster in the UK, which is in development.

In recent years, there has been an exponential growth in the CCS project pipeline globally. Today about 30 facilities are storing more than 40 MMtonnes of CO2 annually. With 61 facilities added to the pipeline in the last 12 months, the total number of facilities in operation and under development has grown to 191, representing a capture capacity of 244 mtpa.

The global sprint for CCS

The US is the frontrunner with 15 facilities operational and more than 70 that are currently in development. Many more projects are expected to emerge over the next five years thanks to multibillion-dollar funding from the Infrastructure Investment and Jobs Act and enhancements to the 45Q tax credit enabled through the Inflation Reduction Act.

A huge CCS cluster is proposed around the Houston Ship Channel. Led by ExxonMobil, the project aims to capture CO2 from refineries and industrial sources. Last year, Shell, along with Air Liquide and BASF, joined 11 other companies in supporting the project. It is suggested that the project will store CO2 offshore, handling up to 50 MMtonnes of CO2 per year by 2030 and 100 mtpa by 2040.

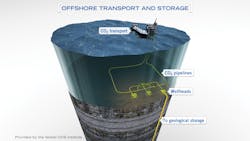

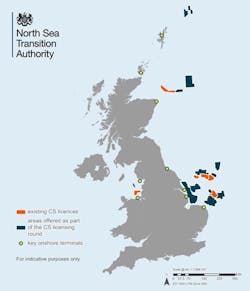

In addition to the much-heralded Northern Lights project, Norwegian authorities last year awarded three exploration licenses for CO2 storage, one in the Barents Sea and two in the North Sea. With CO2 storage projects also being developed in Denmark and the Netherlands, it is anticipated that the North Sea will host a number of offshore CO2 storage facilities in the coming years.

Southeast Asia, China and the Middle East, regions reliant on fossil fuels to drive growth, are galvanizing CCS initiatives. The Indonesian government, for example, is working on regulations to allow CO2 imports to be injected into existing reservoirs in the country but will prioritize domestic emitters. SKK Migas, the Indonesian regulator, approved the expansion of bp’s Tangguh enhanced gas recovery project in 2021. The project, which is expected to begin operation by 2027, will inject CO2 offshore in the Vorwata reservoir.

In China, the country that produces the greatest volume of greenhouse-gas emissions, the world’s first 1-MMtonne CCUS project recently entered operation. Developed by Sinopec, it captures CO2 from the Qilu Petrochemical plant. Plans are in place for a further two plants of similar size by 2025.

With COP28 taking place in the United Arab Emirates later this year, all eyes will be on the Middle East to turn discussion on decarbonization into urgent action. Today there are three operating CCS projects in the region, accounting for 10% of the global CCS capacity. Expansion plans are being developed at Al Reyadah where capacity is expected to grow to circa 5 mtpa in the coming years.

Social license and best practice

In the establishment of a new carbon capture industry, it is imperative that the public in general and local communities be considered essential stakeholders.

Ensuring that communities are consulted early on and collaboratively goes hand in hand with equitable project development plans. Likewise, addressing perceived risks and improving general understanding of CCS technology will go a long way to assuage public uncertainty.

This will, in turn, provide an important foundation for meaningful policy and regulatory support, both of which are critical to scaling up this important decarbonization technology.

About the author:

Laith Amin is head of CCUS, Energy Systems, with DNV. References for this article are available upon request.