More deepwater wells, new project sanctions expected in 2019

Offshore staff

LONDON – Political uncertainty globally will likely contribute to short-term volatility in the $50-80/bbl range for Brent crude, according to analyst Westwood.

Should demand keep rising, a supply shortfall will eventually drive up prices, said Dr Keith Myers, President, Research (taking into account the low levels of capital investment since 2015), but probably not in 2019. However, if demand falls back, the currently over-supplied market could last longer.

Last summer the larger E&P companies were reaping the benefits of $75/bbl average revenues with breakeven costs of $40-50/bbl.

At present, the mood in the boardrooms is cautious, Myers said, with the emphasis more on sustaining profitability and dividends rather than accelerating growth. This points to a modest capex rise this year of 8-10%.

Guyana has led the revival of deepwater exploration, with the ExxonMobil-led partnership discovering more than 5 Bbbl since 2015 at breakeven oil prices in the $30s/bbl.

Westwood counts 21 high-risk deepwater frontier wells globally last year, up from six in 2016, although only two – both off Guyana – were commercial discoveries.

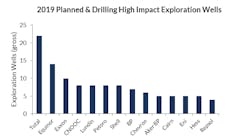

Total should be the main player to watch this year, with plans to drill the highest number of impact wells – 22 – of any company; eight of these will be in frontier plays.

Meyers highlighted northwest Europe and central and South America as the regions with most at stake – 22 high-impact wells in each case.

Last year 51 offshore projects were sanctioned, lower than in 2017 but still significantly up on 2015/16. Myers forecast up to 90 potential final investment decisions this year, bringing some relief to the hard-pressed supply chain.

This should also lead to increased contracting in 2019 but with limited price inflation.

01/25/2019