Understanding long-term production shortfalls vital to lowering costs

Focus should be on solutions that can be designed and executed faster

Shubham Galav

IPA, Inc.

The offshore oil and gas industry’s all-too-familiar project production shortfalls during the first two years after project start-up have been extensively documented.1

Sadly, little to no progress has been made towards fixing the problem, or for that matter even truly understanding the root cause of the issue. Many, perhaps, cling to the perceived notion that production rates improve over time and earlier-year shortfalls are temporary. A major initiative undertaken by Independent Project Analysis (IPA), Inc., challenges this long-held belief.

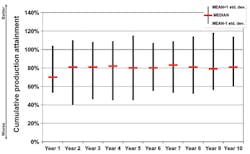

IPA’s recent research shows that projects, on average, do not deliver their production plans for as long as 10 years after startup. (Courtesy IPA, Inc.)

The extent of the E&P industry’s production attainment problem is actually much worse than many realize. The reality is that early year production shortfalls usually portend long-term performance disappointments. IPA’s recent research shows that projects, on average, do not deliver their production plans for as long as 10 years after startup, throwing cold water on any notion that cumulative production totals eventually offset early year losses, or that early year losses are overcome in later years. After decades of disappointing performance, we must ask ourselves: Does the industry actually know how bad things are, or have we just become too complacent to accept this performance? There are very few sectors where 80% functionality be considered acceptable.

The importance of addressing these production performance woes is more important today, given the current lower oil price environment. Owners survived by restructuring their projects organizations, high grading their project portfolios, and extracting discounts and savings from the supply chain. Although in most instances justifiable, these are tactics straight out of the “downturn survival playbook” and are unfortunately short-term focused.

Today, owners seeking to realize further long-term sustainable cost savings and capital effectiveness gains must look within.2

Turning to external stakeholders for cost savings is not an option at present. The supply chain cannot be squeezed any further, because service companies have contracted and suppliers have already given back some or all of their margins. Owner operators, facing margin pressure and the added threat of shale gas plays cutting into available capital, must now “go where the money is” and that is in fixing production shortfalls. Owners clearly have a lot to gain if the production attainment problem is fixed, since the impact of this performance goes beyond just subsurface estimation.

Normalized production data

Most operators measure production attainment to some extent usually for the first couple of years. In some cases they measure production attainment for the longer term, although that role is often dispersed in the organizations. In the past IPA has published production attainment norms for projects covering up to the first four years of production. But conducting a robust assessment of longer term production attainment entailed collecting a large swath of data that is difficult to come by, even for the project organizations that bring projects to life.3

To overcome this barrier, much of this long-term production information had to be acquired from various government entities, such as the US Bureau of Ocean Energy Management, the Norwegian Petroleum Directorate and other entities from around the world. It was expected, of course, that the public data would be a mixed bag. For instance, sometimes multiple projects from one block were combined in one production reporting line. Other times actual production volumes did not differentiate between production from originally sanctioned development and production from new pockets, additional blocks, or infill drilling.

Unless actual production is compared to like for like sanctioned scope, there is no way to truly know whether the project that was sanctioned is capital efficient or not. Normalizations were necessary to ensure production from additional blocks, new pockets, and infill drilling were not being compared with original production plans. IPA spent a substantial amount of time painstakingly normalizing actual production numbers to link with the estimated production profile from the production levels planned at sanction. All told, data from more than 150 global E&P projects in IPA’s proprietary upstream projects database were included in the analysis. Included were greenfield and brownfield developments sponsored by supermajors, nationally operated companies, and independents.

Production shortfalls

IPA’s new analysis confirms that the short-term production remains about where it has been for the last 10 years, around 70% attainment. Even more important is that the analysis showed that the cumulative production shortfalls continue for as long as 10 years after startup. The accompanying figure shows cumulative production attainment. The analysis found that even by year 10, a project’s cumulative production performance, on average, is just 80% of the plan at sanction. Worse, this performance is obtained only after drilling more wells than initially planned at sanction. On average the industry drills 17% more unplanned wells. By drilling extra wells to increase production, companies are investing more capital than originally authorized as part of the sanction business case. This means that the originally promised business case, upon which the corporation funded the investment, is no longer valid. Indeed, an E&P project’s long-term performance is not very much different from its short-term performance. In other words, a project’s first two years of production performance is a pretty robust harbinger of long-term performance.

These are bad numbers for the offshore oil and gas industry. E&P operators are losing significant value on capital employed as a result of these lower levels of production attainment. By IPA’s estimation, the average E&P project fails to return as much as 40% of its value estimated at sanction. The major contributor to this value erosion is production shortfall.

It is an opportune time to address this issue head on. A systematic fix to production shortfall is long overdue. Continuing to operate in this manner, in a lower-margin future, is surely not a sustainable path for the industry. But as a start, owners need to fully understand their current state: What is our current attainment? What is our root cause? IPA analysis shows that the root cause of attainment shortfalls differ by owners but follow a similar pattern within each owner. But such analysis is impossible without careful normalizations and comparisons with the sanctioned P10-P50-P90 production profiles. Beyond this, owners need to understand that the implications of these lower production levels extend beyond subsurface. The entire project delivery framework as it is currently applied must be examined, especially in relation to approaches to projects and depletion scoping.

Overcapitalization

Over the last decade, IPA has observed that the industry is spending significantly more time in concept and facility scoping and alternative selection. Operators and developers are taking a lot longer in the front end to scope an optimal facility solution. However, as the production data suggests, the industry is not delivering anywhere close to its P50 estimates for production. Not surprisingly, the result is that the facilities are severely underutilized. Let us take a step back and consider what typically happens. First, the industry designs its facilities to notionally deliver the P50. Often, in fact, the facilities are designed to deliver peak performance, although that is now starting to change. Then, through the design process, a bit of “design allowance” may be added, and perhaps even a bit of fabrication allowance. So, by the time that a facility has been installed, it can already handle more than the expected peak or plateau. The rub is that given the liklihood of a production shortfall, production facilities are often severely oversized and, by extension, over-capitalized.4

All of the above is detrimental to a project’s capital effectiveness.

Improvements in technology

Failure to attain projected production levels is not a new phenomenon; it is a decades old problem that still continues. Interestingly, in the same period the industry has made tremendous advances in technology and sciences, including estimating, forecasting and decision science. For instance, the industry has made tremendous progress in seismic interpretation and analysis, geological and reservoir modeling and simulation, and many other technology areas.

It has also improved its understanding on uncertainty analysis, estimating best practices, and decision sciences. Yet, production performance improvements are often nowhere to be found in these analyses. This is not to say technology is of no benefit to the development and execution of capital projects in general. In fact, it is. But with regard to production performance, however, technology advances have not enabled better production forecasts. Instead, one has to wonder if the decision-making analysis used for project development does not in fact undermine production expectations. For instance, if operators do not know that their P50 is not really a P50, based on real data, then no matter how good the technology gets, sub-optimal choices are likely to be made.

Delivery framework

Each company is different in terms of how year-to-year misses in production come to be. Each applies their project delivery framework and work process in a unique manner. Common to most companies, however, is that production targets are routinely optimistic. Therefore, each company must conduct its own deep root cause analysis, with real data – not relying on public information that is not normalized — to assess: (a) what its true production delivery looks like, (b) what its production DNA looks like — each company has a distinct pattern on where, how and why it misses its delivery, and (c) how to derive greater capital project value by fixing this production performance. Companies who have understood this have worked to integrate their functional workflows such that they can go from discovery to production much quicker. They spend less time on design optimization. Instead, they focus on “good enough” solutions that can be conceptualized, designed, and executed faster, increasing returns even if the project does not end up producing at 100%. As things stand now, offshore projects are competing with shale plays for limited capital project funds. Fewer offshore projects are being authorized today than in the past, especially in deepwater, and more capital is being allocated to shale asset investments. However, if industry is able to fix the production attainment problem, then more value can be delivered from conventional projects in a sustainable manner for the long term.

Perhaps the analysis presented here will come as a surprise to some; perhaps others will say: “We kinda figured that.” Either way, it is hoped that by highlighting how much opportunity exists to improve its own house, owners and operators can work to truly understand this phenomenon. If nothing else, maybe the industry can at least spend less time optimizing and finding a perfect facility design for a production plan that will likely not exceed 80% of the sanction P50.

Acknowledgment

IPA, Inc.’s Neeraj Nandurdikar and Geoff Emeigh contributed to this article.

References

1. Nandurdikar, Neeraj, S. and Wallace, Luke, “Failure to Produce: An Investigation of Deficiencies in Production Attainment,” Society of Petroleum Engineers (SPE) Annual Technical Conference and Exhibition Paper, 2011.

2. Geoff Emeigh, “Industry executives offer sustainable development strategies at second Offshore Leadership Forum,” Offshore, February 2018, page 24.

3. Another reason IPA conducted the research is because most reservoir functions argue that “you can’t understand a reservoir performance for 10 years or more.”

4. Some may argue that paying for slightly overcapitalized facilities is not as much in terms of capital against a potential risk of undersizing. As data shows, usually the risk is not undersizing and the capital inefficiency is very high if the choices push us into a bigger concept.