Offshore staff

LONDON – High-impact gas exploration is a less of a priority this year, according to Westwood Global Energy Group.

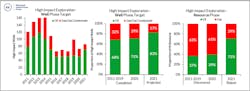

Last year, according to the consultant, 71% (52) of high-impact wells targeted oil prospects, with the focus on offshore Brazil, Suriname-Guyana, the Norwegian Barents Sea, and the US Gulf of Mexico.

Only in the Nile Delta were more than three-high impact wells drilled targeting gas.

This year close to 83% of wells are set to target oil, hot spots including Mexico’s Campeche Salt Basin (>10 wells), Brazil’s presalt (5-6 wells), Suriname-Guyana (>10 wells) and the North Sea (>5 wells).

Gas/gas condensate exploration will be mainly in the Levantine basin in the Eastern Mediterranean Sea, Myanmar’s offshore Rakhine basin and the South Caspian – all of which are close to local gas demand centers or which have routes to market with available export capacity.

Oil accounts for 71% of the total risked resource targeted in 2021, the consultant added.

Most of the world’s E&P companies have not so far committed to reducing their scope 3 emissions, and as such are not specifically targeting natural gas exploration as part of an energy transition strategy.

They are more focused on the near-term targets of reducing their scope 1 and 2 (operational) emissions in order to maintain a license to operate.

Another factor is that more than 60% of the discovered resource during 2012-2020 was gas, even though ~70% of the high-impact wells were targeting oil.

This was due to numerous giant gas finds, and companies proving gas in plays where oil was the primary target.

Westwood added that the industry has already found more natural gas than it needs or can commercialize, with ~36 Bboe of gas discovered in 2008-2016 stuck in the ground with no current plans for development.

And there appear to be few places where big gas prospects can be commercialized quickly, i.e. with access to an attractive gas market. So, for the time being, explorers will likely continue to favor oil.

03/18/2021