Bruce Beaubouef

Managing Editor

Entering the new year, operators, contractors, and suppliers are looking forward to an increased level of E&P activity in the US Gulf of Mexico, both in terms of drilling and production. Once again, activity in the deepwater portion of the Gulf is expected to drive the bulk of capital expenditures.

Despite being one of the most mature hydrocarbon basins in the world, the GoM remains a source of significant growth potential for supermajors, large independents and, by extension, oil service, capital equipment, and rig companies. In fact, a recent analysis by investment research firm ISI noted that "the deepwater Gulf of Mexico is in the early stages of an extended growth cycle and is poised to be the strongest offshore market in the world through 2015." ISI notes that this growth will be fueled by further exploration and the development of plays like Lucius, Hadrian, Big Foot, Jack/St. Malo, Tiber, and Kaskida.

Another recent analysis, this one conducted by consulting firm Wood Mackenzie, indicates that the deepwater Gulf of Mexico is experiencing a strong resurgence of E&P activity and is well on its way toward reaching a "new equilibrium" in 2013. The vast exploration success in the deepwater Gulf over the 10 years preceding the Macondo incident "built a momentum that has been slowed, but not diminished in the two years succeeding it," notes Wood Mackenzie. As activity in the GoM begins to rebound, the Gulf is being increasingly defined by a high level of investment, a wide range of opportunities, and a large number of explorers.

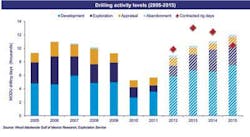

According to Wood Mackenzie, development drilling activity is expected to reach a new peak in 2013, which will then likely be superseded in the following two years. Investment levels in 2012 were expected to equal the pre-Macondo peak and push well beyond this in 2013, with major commitments to fields such as Atlantis, Mad Dog, Bigfoot, Hadrian, and Thunder Horse.

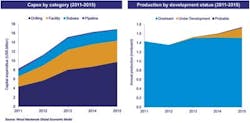

Further, it is estimated that over $20 billion will be spent on drilling development wells for onstream projects through 2015. Subsea and facility spend will become big drivers as new projects like Jack/St. Malo and Hadrian move forward in development. Together, these two categories represent $27 billion spent through 2015, says Wood Mackenzie.

By 2017, an additional 2 Bboe of reserves are expected to be produced by subsea tiebacks from fields under development; probable developments; and those yet to be discovered.

Permits picking up

One favorable sign is that the pace of permits is picking up. In 2012, the Obama administration issued the most deepwater drilling permits for the GoM since 2007. By mid-October of last year, the US Bureau of Safety and Environmental Enforcement had issued 89 permits for new wells in waters deeper than 500 ft (152 m). By way of comparison, the federal government issued 76 for all of 2009; 32 in 2010; and 38 in 2011. In 2007, 106 were issued.

"We're just now seeing the permitting return to pre-Macondo levels," said Andy Lipow in mid-October. With oil prices hovering around $90 to $100/bbl, Lipow noted, it makes sense for operators to increase their E&P activities in the Gulf. Lipow, president of the Houston-based consulting firm Lipow Oil Associates LLC, was quoted in a Bloomberg report.

To be sure, the new regulations have slowed the pace at which energy companies receive federal permits. Exploration and development plans now take about 150 days compared with 54 days in the past, according to investment bank Tudor Pickering & Holt. Permits to drill specific wells now take about twice as long as before the Macondo incident.

But the number of permits is on the rise. "Today we see cooler heads and more pragmatic leadership with the regulators in Washington," observed James Noe, general counsel for Hercules Offshore. "Things are now working more smoothly in the Gulf," Noe told the Wall Street Journal.

Major commitments

The major international oil companies such as BP, Shell, and Chevron Corp. have long dominated deepwater drilling in the Gulf, and they are at the forefront of the drilling resurgence. Out of the 44 deepwater drilling permits issued in 1Q 2012, BP (with 13) and Chevron (with 14) garnered the majority.

BP, which will invest about $4 billion a year in the Gulf over the next decade, has six deepwater rigs at work in the Gulf, and planned to add two more in 4Q 2012, a record for the company.

Another major, Royal Dutch Shell, is also increasing its commitments to the Gulf. In early 2012, Shell spent more than $403 million to lease several new areas there. "The importance of the Gulf continues to grow for Shell, with significant discoveries and major projects in the pipeline," Marvin Odum, president of Shell Oil Co., told the Wall Street Journal.

The inventory of future Gulf projects continues to grow. In June of last year, 56 companies bid $1.7 billion for the rights to explore more than 2.4 million acres of the Gulf controlled by the federal government. Success in these new areas will not come easily, according to Tudor Pickering. Much of the drilling will tap into the Lower Tertiary, where completed projects so far have produced about one-third the daily rate of earlier deepwater fields and have taken about 30% longer to drill.

While an increase in deepwater drilling activity is widely expected in the GoM, ISI says it believes that the magnitude of the increase is underappreciated, as it bodes well for the revenue and profit potential for service companies. These greater opportunities for drillers will be due to the higher concentration of ultra-deep and highly service-intensive wells to be drilled into the Lower Tertiary and Miocene trends.

Based on its evaluation of discoveries and future drilling plans by most operators in the region, ISI forecasts that the deepwater rig count in the GoM will grow from approximately 36 floating rigs in mid-December 2012 to approximately 50 deepwater rigs by mid-2014, and as many as 60+ rigs by the 2015-2017 time frame. This activity will be fueled largely by the development and further appraisal of multiple Lower Tertiary and Miocene discoveries made over the last five years. In fact, ISI forecasts the balance between exploration and development wells drilled in the deepwater GoM will return to roughly 50/50 for the first time since the early-2000s, which implies almost three times the annual development activity as the peak of the last deepwater cycle in 2006-2008.

Although the forecasted increase in activity is already tightening the deepwater rig market, ISI says that the benefit to rig contractors has been felt largely through higher rates and long-term contracts, while most of the upside seems likely to accrue to large cap service and capital equipment companies, as well as select offshore supply vessel contractors. According to the firm, several factors are likely to drive upside in the region, most notably the surge in development and completion activity on more complex Lower Tertiary and Miocene wells, creating a greater-than-expected increase in demand and pricing for a number of services including higher technology drilling, evaluation, and completion tools, as well as subsea trees, subsea processing, wellheads, ROVs, and OSVs.

Drillers step up activity

In response to increased operator involvement, drilling contractors are also making plans for renewed and expanded drilling campaigns. Houston-based Ensco is one of these. "We have significantly increased our deepwater presence in the US Gulf of Mexico in recent months with the commencement of operations forENSCO 8505 in June, the delivery of ENSCO 8506 to begin work for Anadarko in January 2013, and the arrival of ENSCO DS-3, under contract with BP, to work in the Gulf after working in West Africa," Steve Brady, Ensco senior vice president, Western Hemisphere, told Offshore.

Ensco, which currently has 16 rigs in the Gulf, drilled the North Platte discovery announced Dec. 5 by Cobalt and Total with itsENSCO 8503 drill rig, and also drilled the Big Bend discovery announced by Noble Energy at the end of November with its ENSCO 8501 drill rig.

Noble Corp. is also stepping up its drilling activities in the Gulf. Noble's active fleet in the GoM includes five semisubmersibles (theNoble Jim Day, Noble Danny Atkins, Noble Jim Thompson, Noble Amos Runner, and Noble Driller), all of which are under contract entering this year. Noble says that there are some open days later in 2013 on two of these units (Runner and Driller); however, the Noble Jim Day and Noble Danny Atkins have contracts into 2014 and 2016, respectively. Noble's Gulf fleet also includes two active drillships, the Noble Globetrotter I and Noble Bully I, which are contracted until 2022 and 2017. Overall, Noble says that this paints a picture of encouraging levels of interest in the Gulf and the offshore industry as a whole.

In addition, Pacific Drilling reports that thePacific Santa Ana, a deepwater drillship built to Chevron's specifications, began operations in the GoM this past May. The first drillship designed with the capacity to perform dual-gradient drilling, the Pacific Santa Ana is operating under a five-year contract with Chevron.

Deepwater drilling contractor Transocean says it recently contracted theDeepwater Invictus for work in the GoM for a period of three years, starting in 2Q 2014.

Deepwater production

Deepwater GoM will be a key production growth area for a number of the majors' portfolios over the next four years. BP stands out with the return of production from deepwater GoM representing 45% of its global increase over this period. The region is also a key driver of near term expansion for Shell, Chevron, ExxonMobil, and Statoil.

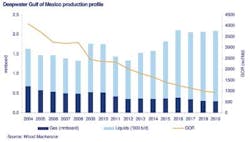

But if this growth is to be achieved, the recent decline in deepwater GoM production will need to be reversed. Production declined almost 18% to 1.4 MMboe/d in 2011, and was expected to continue falling in 2012 because of past permit-approval constraints and the tight rig market, which delayed developments.

With the predicted spending on development drilling, however, production is expected to improve steadily post-2012 to 1.6 MMboe/d by 2014. Activity at several key fields, including the four with the greatest declines, and additional production from several new fields will be key to reversing this trend. The return to the pre-Macondo level is expected by 2015 and a new high of over 2.0 MMboe/d is expected in 2016. Growth from 2014 to 2016 will be spearheaded by many new, large fields, such as Hadrian, Jack/St. Malo, and Lucius, as well as development activity at legacy assets.

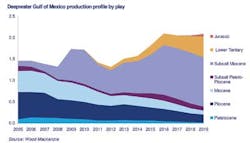

At the same time, future production in the deepwater Gulf will be more challenging. Production is migrating to greater water depths; the majority will be from ultra-deepwater (> 1,500 m or 4,920 ft) by 2015. It is also moving to the oil-rich subsalt Pliocene/Miocene and Lower Tertiary plays. These frontier fields will require innovative advancements in engineering and technology, and will be more expensive to develop. High oil prices and technical lessons learned from the Perdido hub and Cascade/Chinook projects should facilitate progress in these emerging plays.

Almost all production growth until 2016 will be from fields located within four protraction areas. Green Canyon and Mississippi Canyon contain the top producing legacy fields, while the frontier Walker Ridge and Keathley Canyon areas hold the majority of the new subsalt and Lower Tertiary fields found to date.

The other protraction areas are expected to see production declining. For Ewing Bank and Lloyd Ridge, production will stop as the Ewing Bank 998 and Cheyenne East fields cease production in 2016 and 2017, respectively.

Subsalt fields

Growth will be driven mostly by subsalt fields, which will account for over 65% of production by 2016, says Wood Mackenzie. High oil prices and technological advancements will support the development of these large, technically challenging, and expensive fields.

Growth over the next three to five years will come primarily from the subsalt Pliocene/Miocene play and the subsalt part of the Lower Tertiary play. Development work at the legacy, subsalt Miocene Atlantis, Mad Dog, and Thunder Horse fields, as well as the supra/subsalt Mars project, will contribute a combined 290,000 boe/d by 2016.

By 2016, production from the new subsalt Pliocene/Miocene Hadrian and Lucius fields is expected to contribute a combined 175,000 boe/d. Meanwhile, the subsalt Lower Tertiary Jack/St. Malo and Cascade/Chinook developments will add a combined 150,000 boe/d.

Looking forward

The deepwater GoM is expected to remain an attractive region and will be a vibrant hub in the long term, with more than $70 billion to be spent on exploration in the region by 2030, according to Wood Mackenzie - more than all the other key deepwater provinces combined.

To be sure, there are still obstacles to achieving this outlook: capital, equipment, and personnel constraints in GoM and globally will affect project prioritization. The recent lack of exploration drilling will impact the timing of long-term reserves replacement, and the Paleogene play still faces substantial technological risks, in an ultra-deepwater environment with challenging reservoir qualities. Nevertheless, outlook for E&P activity in the GoM in 2013 appears to be very bright.

"Bottom-line, the Gulf of Mexico is in considerably better shape than even the most ardent optimists envisioned following Macondo," said Bill Herbert, a managing director with investment bank Simmons & Co., in a Wall Street Journal report.