Ted Moon

Special Correspondent

This year's Worldwide Survey of Deepwater Drilling Rigs shows a deepwater rig fleet on a continued pace of impressive growth. The survey can be found on the Deepwater Drilling Rigs Poster, between pp. 48-49 in this issue.

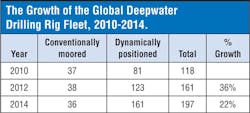

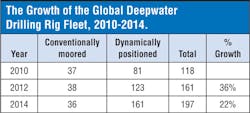

SinceOffshore published the last survey in 2012, the number of deepwater rigs capable of drilling in 4,000 ft of water or more and to reservoir depths of 25,000 ft or greater has grown to 197. This represents a 22% increase from the 161 rigs counted in the 2012 survey. It also represents a 67% jump from four years ago, when the deepwaterdrilling industry was still in the early days of the US drilling moratorium imposed after the Macondo well spill in the Gulf of Mexico (GoM).

As of late May 2014, there were 56 rigs actively working in the GoM, compared with 55 rigs just before theDeepwater Horizon accident on April 20, 2010, according to data from Baker Hughes. A key difference in activity now is that 41 of these active GoM rigs are searching for oil, many in deepwater regions beyond the outer continental shelf. Prior to Macondo, rig activity was split more evenly between oil drilling and natural gas drilling in the shallow waters of the shelf.

Dynamically positioned rigs are fueling this growth in rig counts. The total number of dynamically positioned rigs has essentially doubled in the past four years, as drilling contractors have transitioned their deep- and ultra-deepwater fleets to accommodate E&P projects moving to 7,000+ ft water depths and reservoir targets more than 30,000 ft below the seafloor.

Focus on newvessels

Contractors adding to their ultra-deepwater fleet in the past two years include Diamond Offshore Drilling, which took possession of theOceanBlackHawk and OceanBlackHornet drillships earlier this year. These vessels are rated for water and drilling depths of 12,000 ft and 40,000 ft, respectively, and will work for Anadarko in the GoM for the next several years. Diamond Offshore is expected to take possession of two additional drillships of the same design, the Ocean BlackRhino and Ocean BlackLion, by the end of this year or early next.

Danish contractor Maersk Drilling has added three ultradeepwater drillships (theMaersk Valiant, Venturer, and Viking) to its existing fleet of semisubmersibles for contract work in the GoM, and Seadrill has added six drillships, each rated for 10,00-ft water depths and 35,000+ ft drilling.

Other contractors are taking a different approach to building their fleets for ultra-deepwater plays. In 2013, Noble Drilling Corp. announced a plan to divest some of its older vessels into a new publicly traded entity,Paragon Offshore. By the time the plan is finalized in 2016, Paragon Offshore will be positioned as a standard specification driller, with 34 jackups, eight floaters, and two other vessels that will focus on operations in shallower waters. Noble will exist as a premium fleet provider consisting of newer, high-specification assets including 20 floaters and 15 jackups.

The average age of Noble's fleet will go from 25 years (in 2013) to 13 years (in 2016). Noble projects that by 2016, nearly three-fourths of its total revenue will come from deep and ultra-deepwater projects (57.3% from ultra-deepwater and 16.1% from deepwater). This represents a dramatic rise from 2013, when 54.5% of its revenue came from deep- and ultra-deepwater contracts.

Noble is not alone in this strategy. Transocean, the largest deepwater drilling rig contractor on this survey with 40 total rigs, sold 38 shallow-water drilling rigs for $1.05 billion to Shelf Drilling Holdings. The late 2012 sale was part of Transocean's strategy to become a more focused high-specification drilling operator. The company has also expressed an interest in spinning off its older fleet into a new entity.

Short-term caution

Despite a number of new discoveries around the world, a combination of rising development costs, project delays and concerns about equipment delivery are contributing to a more cautious outlook for the offshore industry in 2014 and 2015. Many deepwater operators are delaying field developments in the interest of improving their cash generation positions, which is likely to drive deepwater rig day rates down.

Contractors including Seadrill, Transocean, and Maersk anticipate a drop in day rates from the recent $550,000-$600,000 range to $450,000 or below for sixth-generation vessels. These companies are also seeing intensified competition due to a number of uncontracted rigs entering the market, leading to a short-term oversupply of vessels.

Earlier this year,Offshore pointed to the current uncertainty in rig demand and the growing number of uncontracted rigs as a leading cause of reduced newbuild activity. While 30 and 19 deliveries are slated for 2014 and 2015, respectively, only seven rigs were ordered for delivery in 2016 and five for 2017 as of the end of May 2014.

Long-term rebound

However, many industry experts expect overall drilling activity to increase on a global basis during the second half of this decade. Seadrill anticipates a healthier outlook for ultra-deepwater floating rigs designed for operations in 7,000+ ft of water, with most of this activity focused in the "Golden Triangle" of Brazil, the US GoM, and West Africa.

Transocean also sees significant long-term ultra-deepwater demand driven by exploration successes. The company is currently projecting a backlog from continuing operations of $9 billion in the period of 2018-2027, with $8.9 billion of this coming from ultra-deepwater floaters alone.

Editor's note:Due to space constraints, the Deepwater Drilling Rig poster in this issue of Offshore magazine lists all vessels under contract and rated for 5,000+ ft water depths and reservoirs of 25,000 ft or deeper. A larger poster with more photos and with rigs rated for 4,000-ft water depths and above is available atwww.offshore-mag.com.