Deepwater growth for 2005 specific to regions

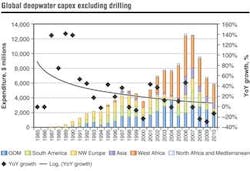

Although PFC Energy analysts project the total deepwater market for 2005 to exceed $8.7 billion (excluding drilling), which is up 10% on 2004, some significant regional trends bear examination.

After the reduction in deepwater expenditure in 1999 and 2000, the deepwater market returned to the strong growth path it experienced prior to the oil price crash of 1998. However, the 40% market growth experienced in 2001 and 2002 seems to have stalled in 2003. This is probably the result of the backlog of projects caused by the earlier market correction being cleared.

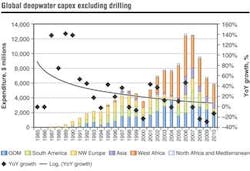

The relatively flat total market forecast for 2005 is actually the result of growth within West Africa and South America offsetting a forecasted 54% collapse in the GoM market. This collapse is due to the lack of project sanctions in 2003 and 2004 and will be particularly felt in the fabrication and installation businesses within the region. Interestingly, PFC expects expenditure on engineering, project management, subsea equipment, and flowlines and risers to remain fairly stable.

After the forecast reduction in the GoM market through 2005, we expect a return to steady growth until expenditure returns to 2003 levels of approximately $2.25 billion/year in 2007 and 2008. Unless there is a break with past trends, perhaps caused by a new high oil price environment, we expect the GoM market to experience another dip in 2010. This reflects the strong five-year cycle exhibited in this market since its first dip in 1994.

Within Brazil, another cyclic market (this time election-driven), we expect the market to more than double in size in 2005, rebounding from $0.5 billion in 2004 to $1.25 billion in 2005. This is more in line with historical averages. Engineering, hull and topside fabrication, and riser manufacture are the key growth areas in this market to 2007. After peaking at over $2 billion/year in this period, the market will fall once again in 2008. However, we do not expect the market to reach the lows of 2004.

Down from its peak in the 1990s, (when the deepwater market of northwest Europe averaged $1 billion to $1.5 billion/year) the market now averages only $0.4 billion annually, and we expect 2005 to maintain this level of expenditure. With such a small but constant market, annual fluctuations in sectors become significant. In 2004, 50% of total spending went to topside fabrication. In 2005 however, we expect this to migrate to 25% on topsides, 25% on subsea equipment, and 15% on engineering and project management. Flowlines, risers, hulls and moorings, installation, and export pipeline fabrication will split the remaining expenditure fairly evenly.

In 2006 and 2007, we expect the emergence of Norsk Hydro’s Ormen Lange project in Norway to dominate the market. The $0.4 billion 2006 annual expenditure should be evenly split between engineering and project management, subsea equipment, and export pipeline fabrication. However, in 2007, the market should quadruple to $1.6 billion, as manufacture of subsea equipment and export pipelines progresses and installation begins.

Deepwater exploration in the Asia Pacific region has experienced significant success in the last couple of years. PFC expects this success to have an impact on the development market in 2005. Historically, although the market has been sporadic, spending within the deepwater segment has averaged about $0.2 billion/year. However, with the start of major expenditure on Woodside’s Enfield development in northwest Australia, Murphy’s Kikeh development in Malaysia, and Reliant’s D6 development in India, we expect the market to triple in size.

PFC’s forecast also assumes that Woodside will award Laverda and that BHP Billiton will sanction Stybarrow in 2005. Currently, the analysis assumes both will choose converted leased FPSOs for their preferred development solutions for these fields. With these projects sanctioned, and Unocal progressing somewhat in Indonesia, the market could grow further to over $2.5 billion in 2006, subsequently falling back to $2 billion in 2007, and then establishing a new average level of perhaps $1 billion to $1.5 billion annually.

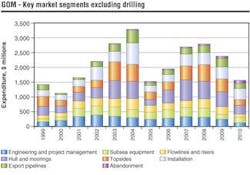

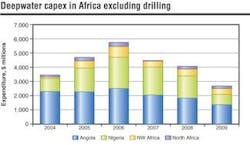

As mentioned above, West Africa has grown to dominate the deepwater market. In 2005, PFC expects this position to peak, with the region accounting for 51% of the global expenditure. Over the coming five years, the region will account for approximately 43% of all expenditure.

The development of the Nigerian sector is driving the continued forecast growth in the West African market. However, Angola is providing the foundation of the market, and PFC forecasts expenditure in Angola to remain fairly constant at approximately $2 billion/year. A steady stream of large projects, which seem to be progressing toward commercialization at a slow, but constant rate, is supporting this expenditure. Thus, three significant projects - Total’s Dalia, BP’s Greater Plutonio, and the completion of ExxonMobil’s Kizomba B - will drive expenditure in 2005. Projects that could see the start of expenditure or sanction in 2005 include ExxonMobil’s Kizomba C, BP’s Plutao, and Total’s Rosa-Lirio, Perpetua, and Bilondo (Congo). Since projects are at different stages and the flow of new projects is fairly constant, there is no real variation forecast between market segments in 2005 and beyond.

If the Nigerian deepwater projects that have been delayed for so long finally go ahead, spending in Nigeria could double from current levels of approximately $1 billion annually to $2 billion in 2007. Although completion of Shell’s Bonga and ExxonMobil’s Erha projects support this level of expenditure, it also assumes ChevronTexaco and Total will award Agbami and Akpo respectively.

Additionally, the forecast assumes early production systems in the form of leased FPSOs will be sanctioned for ExxonMobil’s Bosi development and Total’s Usan-Ukot project. However, with the current legal issues surrounding ownership of key development blocks and the sensitivity of project returns to variations in cost, schedule, and tax rates in Nigeria, it would not be a surprise if these projects slipped further and the projected growth in the market did not fully materialize. In terms of market segments, 2005 could see many key sectors, such as hull and topside fabrication as well as flowline manufacture, doubling in size over 2004. The exception to this trend is the subsea equipment market, which could more than triple in size from $93 million in 2004 to approximately $250 million in 2005. PFC expects the Nigerian market to grow in 2010 as a number of the deepwater gas developments begin.

Global outlook

The deepwater sector has grown strongly into a major segment of the offshore market since operators developed the first projects in water depths over 1,000 ft in 1985. During the first 10 years, the market grew an average of 65% per year and was fairly evenly split between Northwest Europe, Brazil, and the Gulf of Mexico. In the second 10-year period, the market in these core areas stabilized and development of West Africa drove growth. This is particularly true in the last five years, and has culminated in West African projects making up 51% of the deepwater market in 2005. Again, throughout this period, the deepwater market has experienced sustained growth, and although there have been regional fluctuations, the overall market has remained resilient to E&P spending fluctuations due to oil price variation. Only 2000 showed a substantial fall in the size of the overall market, and on average, growth of 10%-20% per annum has been achieved. However, the trend indicates that the market has been maturing. Whether this can be reversed is a matter for debate.

Beyond 2009-2010, the potential development of deepwater reserves in Mexico and stranded deepwater gas reserves in Asia, West Africa, and Russia all provide ample opportunity for further growth in the sector. However, the timing of developments in these areas will determine whether or not the total market will grow, or merely ensure it is sustained at $8 billion to $10 billion/year. In this regard, it took approximately seven years for expenditures in West Africa, Brazil, Asia, and the GoM to reach approximately $1 billion. So, allowing for drilling, it would not be unreasonable to expect it to be 2015 before deepwater Mexico becomes a significant investment area with non-drilling capital investment exceeding $1 billion/year.