Nigerian production sharing contracts hold key deepwater producing fields

Offshore staff

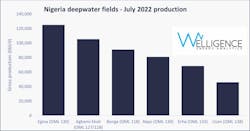

HOUSTON — Nigerian National Petroleum Corp. (NNPC Ltd.) has signed agreements with its IOC partners to extend production sharing contracts covering five deepwater licenses including OMLs 128, 130, 132, 133 and 138, which hold key deepwater producing fields including Agbami-Ekoli, Akpo, Egina and Erha, according to Welligence Energy Analytics.

It has been reported that only one of the licenses was renewed under terms of the Petroleum Industry Act (PIA), which states that contract renegotiations in the works prior to the effective date of the PIA can proceed, provided the contracts are signed within a year of the effective date.

"We believe the partners on the other licenses have benefited from this provision," Welligence stated.

Nigeria’s deepwater sector currently accounts for about 40% of the country's total output, but production across most of the fields is in decline.

The analytics firm added, "The extension of these licenses should pave the way for the inflow of new investment, particularly on licenses holding undeveloped fields like Preowei. But license extension on some key deepwater contracts is yet to be finalized."

In February, ExxonMobil agreed to sell its interest in Mobil Producing Nigeria Unlimited to Seplat Energy, a subsidiary of Seplat Energy Offshore.

A week ago, after wrangling with NNPC, the Nigerian president finally consented to Seplat Energy Plc's acquisition of ExxonMobil's Nigeria shallow-water portfolio. Welligence said the $1.2 billion transaction marks ExxonMobil's exit from the country's shallow waters and its joint venture with NNPC after 50-plus years as operator.

"However, the issue remains unclear as a contradictory statement from the Head of the Nigerian Upstream Petroleum Regulatory Commission has again cast doubt over the deal, with the regulator saying it has not been authorized," Welligence stated. "Assuming President Buhari's consent wins the day, the transformative deal will cement Seplat's position as Nigeria's leading independent—its production will almost triple. The company will also have exposure to more than 7 Tcf of undeveloped gas resources, a potentially significant value creation opportunity. However, the deal could put near-term pressure on Seplat's balance sheet, and bringing in a partner is possible."

In late July, TotalEnergies and partner NNPC started production from the Ikike Field offshore Nigeria. The field’s platform, 20 km offshore in the OML99 lease and in 20 m water depth, is tied back to the Amenam offshore facilities through a 14-km multiphase pipeline. By the end of this year, production from Ikike should hit a peak of 50,000 boe/d.

08.15.2022