Review of analytical models can help operators properly determine well P&A costs

Editor's note: This feature article first appeared in the November-December 2023 issue of Offshore magazine. Click here to view the full issue.

By Mark J. Kaiser, Louisiana State University

In 2016, as part of a broader review of US Gulf of Mexico operations following the Deepwater Horizon tragedy, BSEE began to require operators to submit decommissioning expenditures within 120 days after completion of permanent plugging of any well, removal of any platform or facility, and clearance of any site (NTL No. 2016-N03).

From 2016-2021, 500 wells were permanently abandoned in the US Gulf of Mexico in water depth greater than 400 ft (122 m). Of the 500 permanently abandoned wells, a total of 83 wells were abandoned in 401 to 1,000-ft water depth (almost all dry tree wells) and 417 wells were abandoned in >1,000-ft water depth (about half subsea wells).

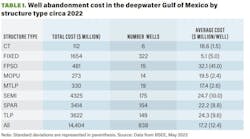

The average abandonment cost for the 838 wells in the deepwater US Gulf of Mexico c.2022 with probabilistic cost reported is $17.2 million per well. The average dry tree abandonment cost is estimated at $1.4 million/well.

This is the second article in a four-part series whose larger goal is to evaluate BSEE cost estimates in the deepwater US Gulf of Mexico, defined as water depth greater than 122 m (400 ft), across the main decommissioning stages and to infer unit cost statistics and cost functions in the region.

Cost estimation methods

An analysis of some of the various BSEE cost estimation methods is provided below.

Statistical vs. work decomposition methods. BSEE performs two types of cost estimates in deepwater, statistical and work decomposition, depending on the type of operation and quantity of (collected) data available.

Statistical methods are based on cost data provided by operators and apply statistical and empirical techniques where job attributes are correlated with operator data.

If the data sets are reasonably large and diverse, and best-practice (standard) techniques are applied in cost estimation, the results of statistical methods will valid. If data sets are too small or diverse, or if asset attributes or estimation techniques are not properly selected or applied, results will be less useful and defensible.

In cases where project data are sparse or unavailable (e.g., floater decommissioning), statistical techniques cannot be applied and other methods of cost estimation are required.

Work decomposition methods are formal hypothetical cost estimates which are performed by breaking down operations into several tasks that need to be performed and then estimating the time and cost of each task using available data and appropriate market conditions. Work decomposition methods are time consuming and detail-oriented, but they are the only acceptable method available in such circumstances.

Work decomposition methods may or may not be calibrated or compared to actual jobs and generally lack a high degree of confidence in the results, but for specialized/unique operations and/or where sparse data sets dominate, they are widely accepted.

Probabilistic vs. deterministic methods. BSEE methods are not disclosed, but it is reasonable to surmise that when probabilistic cost estimates are reported there is an adequate sample of operator-data to derive (probabilistic) cost statistics, while deterministic approaches are applied where probabilistic descriptions are not feasible (e.g., large data spreads and/or small samples) or possible (e.g., specialized and diverse operations).

For each well, structure, pipeline segment, and site clearance on deepwater leases, BSEE reports either one (deterministic) cost estimate or three probabilistic (P50, P70, P90) estimates per asset.

All the wells in the deepwater US Gulf of Mexico and about half the fixed platforms (those in water depth <200 m) are reported using probabilistic values, while most deeper water fixed platforms (>200 m) and all the floater cost estimates are reported using deterministic cost estimates.

Some wells also report deterministic cost, but these are small subsamples or specialized well types, while for floaters, pipelines and site clearance and verification, only deterministic estimates are reported.

The use of a single statistic (average or median) based on operator-data without distribution values attached is classified as deterministic, as well as all estimates made using work breakdown methods.

Well abandonment cost

The total plug and abandonment expense for the 838 wells in the deepwater US Gulf of Mexico c.2022 with probabilistic cost reported is $14.4 billion, or about $17.2 million per well (Table 1).

Specialized wells such as drill stem test and monitoring wells were excluded from analysis because of their unique nature. About 100 of these specialized wells cost on average $10.2 million (DSI, 66 wells) or $17.9 million (DRL, 16 wells). Most of the specialized wells are wet wells.

Dry tree vs. wet tree wells

Dry tree wells on fixed platforms are significantly cheaper to decommission than wet tree wells because the well can be accessed by a rig located on the platform. For wet wells, a MODU or well intervention vessel is required to gain access to the wellbore, which increases cost considerably.

In practice, water depth and well depth determines the type of vessel required, the market conditions at the time of operation determine vessel dayrates, and the complexity and success of the operation determine duration.

For floaters, subsea wells dominate well inventories, but dry tree wells are also present for several floater classes. Fixed platforms were installed to drill and maintain dry tree wells, but later in their life they may also serve as host to subsea tiebacks.

Thus, both dry tree and wet tree wells are used on most deepwater structures, but the relative contributions are different with fixed platforms dominated by dry tree wells and floaters dominated by wet tree wells.

TA vs. PA

A well in which all the required plugs are in place but the casing or riser is not cut is called a temporary abandoned (TA) well. All things being equal, the average cost to take a TA well into permanent abandonment (PA) status will be less than taking the average completed well into PA status, since in the former case the well has already been plugged and the cost associated with this activity no longer needs to be performed.

For dry tree wells, after the well plugs are placed, the casing and conductor is cut and pulled, which may occur during well operations or later before structure removal.

If operators cut and pull conductor casing as part of structure removal activity, BSEE requires the operator to report these costs separately, along with the number of conductors removed, so that BSEE can (re)allocate these costs to well abandonment expenditures and more accurately represent the cost of well abandonment.

For wet tree wells, TA definitions may be used more loosely and refer to any operation where the well is shut-in for an extended period, but like dry tree casing, risers will not be removed until wet wells are permanently abandoned.

Dry tree wells

Of the 320 wells hosted at fixed platforms c.2022, 243 are dry tree and 77 are wet trees. The average dry tree PA cost is estimated at $1.4 million/well, and for wet wells, the average PA cost is estimated at $16.9 million/well (Table 1).

Like shallow water, BSEE uses water depth and measured depth to estimate P50 PA well cost for dry tree wells on fixed platforms. Unlike shallow water, however, there are many fewer fixed platforms in deepwater and less data to estimate cost model parameters.

P50 PA cost for completed dry tree wells on fixed platforms in deepwater Main Pass (MP288, MP289), South Pass (SP49, SP70), West Delta (WD152), and Viosca Knoll (VK900) are plotted as a function of measured depth in Figure 1.

The PA cost curves for completed dry tree wells are upward sloping, essentially fall on straight lines, and are more-or-less parallel to one another for different area blocks.

Blocks that are physically close to one another in the same protraction area (e.g., MP288, MP289) will have similar (but not identical) average water depths and therefore line segments that overlap or are close together, and as one might expect, cost curves for wells in greater water depth will lie above (i.e., have greater costs) than cost curves for wells in lower water depth.

The P50 PA dry tree well cost function is computed by protraction area using the generalized form:

P50 PA Dry Well Cost = α WD + β MD

where P50 PA dry well cost is described in U.S. dollars, water depth WD in meters, and measured depth MD in feet.

The coefficients used in the model are obtained from reported data and are specific to each protraction area. For Main Pass, for example, α = $6697/m, while for South Pass, α = $4857/m. The values of β vary between $28/ft to $42/ft in deepwater protraction areas.

Wet tree wells

For wet tree wells, BSEE P50 PA well cost models depend only on measured depth as illustrated for 13 blocks in Mississippi Canyon (MC), one of the most prolific producing areas in the deepwater Gulf of Mexico (Figure 2). In Figure 2, water depth ranges from 899 m (MC546) to 2,360 m (MC612), and the relation shown applies to both completed and temporarily abandoned wells.

P50 PA Wet Well Cost = 1156 MD

where P50 PA wet well cost is reported in dollars and measured depth MD is described in feet.

The results show that BSEE applies a simple linear function in cost estimation for all subsea (wet) wells regardless of water depth, (host) floater type, area block, or well status.

For the P70 and P90 PA wet well cost curves, the model coefficients are 1348 and 1633, respectively. The multipliers in the P70 and P90 probabilistic cost estimates relative to P50 multiplier are 1.17 (=1348/1156) and 1.41 (=1633/1156). These multipliers can be thought of as representing the effect of contingencies, weather, and other unexpected events that escalate cost beyond their ‘expected’ value.

In offshore cost estimation, work contingency is often assumed to range from 7% to 10% of total project cost, and weather downtime is often assumed to range between 10% to 20% of total project cost, which are approximately represented cumulatively in the values of the ratios.

Relevance and validity

Since the release of NTL No. 2016-N03, well abandonment cost reported to BSEE constitutes a large and diverse sample, and statistical methods should be adequate to establish reliable statistics for well abandonment in the deepwater US Gulf of Mexico.

In BSEE well abandonment cost modeling, the most significant description of a deepwater well is whether the well is wet (subsea) or dry, along with the measured depth of the wellbore. For fixed platform dry tree wells, the water depth of the platform is a key metric. Water depth is not used in BSEE cost models for wet wells, nor does (host) floater type, area block, or well status play a role.

BSEE applies measured depth relations throughout their deepwater (and shallow water) well cost estimates, and this may be suitable in a methodological sense. But the widespread application of such a relation has not (yet) been shown to be valid or meaningful in offshore PA well cost estimation. It is certainly convenient to use, but its relevance and validity must be demonstrated to become an acceptable (and valid) practice.

The author

Mark J. Kaiser is a professor at the Center for Energy Studies, Louisiana State University, Baton Rouge, Louisiana.