BOEM proposes stronger financial assurance requirements for decommissioning

Offshore staff

WASHINGTON, DC – The Bureau of Ocean Energy Management (BOEM) has announced proposed changes to modernize financial assurance requirements for the offshore oil and gas industry.

The agency says that the proposed change would be designed to better protect American taxpayers from incurring the costs associated with the oil and gas industry’s responsibility to decommission offshore wells and infrastructure, once they are no longer in use.

The proposed changes will publish in the Federal Register on June 29, which will open a 60-day public comment period that ends on August 28.

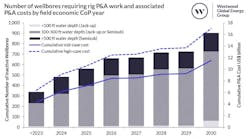

The Government Accountability Office reported that as of 2015, the Department of the Interior held less than $3 billion in bonds to cover approximately $38.2 billion in decommissioning costs, with approximately $2.3 billion in costs at highest risk of needing to be covered by American taxpayers.

BOEM says that recent corporate bankruptcies in the offshore oil and gas industry have underscored the need for regulatory reform. If BOEM holds insufficient financial assurance at the time of bankruptcy, the government may end up having to perform the decommissioning, with the cost being borne by the American taxpayer, the agency says.

The proposed rule would establish two metrics by which BOEM would assess the risk any company poses for the American taxpayer.

First, to accurately and consistently predict financial distress, BOEM would use credit ratings from a nationally recognized statistical rating organization, or a proxy credit rating generated through a statistical model. BOEM would require companies without an investment-grade credit rating to provide additional financial assurance. BOEM is seeking public feedback on whether it should rely on credit ratings to make these determinations and what credit rating threshold would best protect taxpayer interests without imposing undue burdens on industry.

Second, BOEM would consider the current value of the proved oil and gas resources on the lease itself when determining the overall financial risk of decommissioning, given that any lease with significant reserves still available would likely be acquired by another operator that would then assume the liabilities in the event of bankruptcy.

BOEM says that the proposed regulatory changes would provide additional clarity and reinforce that current grant holders and lessees bear the cost of ensuring compliance with lease obligations, rather than relying on prior owners to cover those costs. BOEM says that it is interested in public comments on the costs and benefits of considering predecessors when determining how much financial assurance a company must provide.

BOEM would use decommissioning estimates based on industry reported data collected by the Bureau of Safety and Environmental Enforcement (BSEE) at a level that would adequately cover estimated decommissioning costs without being overly burdensome. BOEM is requesting comments on whether the level it proposes strikes an appropriate balance. This proposed rule would allow current lessees and grant holders to request phased-in payments over three years for new financial assurance amounts.

06.29.2023