Downturn may offer opportunity for more P&A work

Bruce Beaubouef

Managing Editor

Falling oil prices have negatively impacted drilling activity in theGulf of Mexico for more than a year, but there have been some signs of improvement in recent months. With the April numbers mostly in as of press time, marketed utilization in the US Gulf averaged about 71.5%, according to IHS Petrodata. This is an increase over the 69.2% averaged in March and the 68.4% averaged in February, but still below the 73.6% averaged in January. Looking back to April 2015, marketed utilization in the region averaged 83.7%.

The improvement in marketed utilization stems from a decrease in rig supply as a couple of units have moved out of the region, notably three Transocean drillships that mobilized to Trinidad for stacking, and two Rowan jackups, one of which was sold prior to its departure, that left for work elsewhere.

Activity in the shallow-water GoM is at its lowest level since offshore drilling began in the late 1940s. In late March there were just five shallow-water jackup rigs working in the US Gulf, two of which belong to Hercules Offshore. A third Hercules rig is preparing to start work in the region during the next several weeks. With little certainty on commodity prices and cash flows, operators are hard-pressed to move forward with drilling programs. Many of these have been deferred to late 2016 or 2017, or cancelled altogether.

There is still some activity indeepwater, but much of this is infield or appraisal drilling; or P&A work.

“It is a very challenging deepwater market at the moment in theUS Gulf of Mexico,” says Michael Acuff, SVP Sales and Business Development, Pacific Drilling. “Operators are diligently conserving capital and focusing on reducing their long-term cost structure for offshore projects.” The result of this, Acuff told Offshore, is a lack of new projects or deepwater exploration being sanctioned. “In some cases,” he noted “there has been a reduction of deepwater drilling activity as customers complete their current contracts or early terminate contracts for convenience.”

Contracted backlog

In terms of contracted backlog, “the US Gulf has definitely seen better days,” saysCinnamon Odell, senior rig analyst with IHS Petrodata. This is particularly true of the jackup market, she told Offshore. As of late April, only six jackups remained under contract, and two of those were due to roll off charter in a couple of weeks.

By way of comparison, 10 years ago there were 80 jackups contracted in the region, and that number was 37 five years ago. “The US Gulf used to be a major jackup player,” Odell said, representing about 22% of the world’s contracted units in April 2006. That figure dropped to just below 11% five years ago, and is now coming in at just under 2%, she notes.

Currently there are no jackups in the region contracted beyond the end of this year, and when considering only currently marketed units, only 9.5% of remaining days this year are booked. Even though demand for new projects is expected to remain low for at least the next couple of years, “this is a great opportunity for any operators looking to pick up a jackup for any minor work needed to keep their leases in good standing or for any plug and abandonment work they may have been putting off due to high rig rental prices,” as a number of units are available at very low rates, Odell observed.

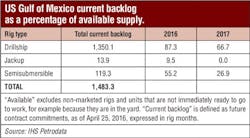

Looking at the floating rig sector, marketed drillships in the US Gulf have already been secured for about 87% of the days left this year and about 67% of next year. “However, the semi market is not nearly so tight,” Odell noted. About 55% of the days remaining this year are booked for marketed units, and only 27% of days are secured going into next year.

Complicating matters is the topic of sublet availability. While a large number of floating rigs are under contract, many of the operators that leased them are ready and willing to sublet them to another operator, should the opportunity arise. “This makes it extra challenging for rig contractors to secure new assignments in an already tough market with weak demand,” Odell observed.

Drilling permits

Meanwhile, the number of drilling permits seems to be holding steady ground in recent months, although the numbers are down significantly year-over-year. Evercore ISI’s US Drilling Permit Monthly report of April 2016 found a total of 13 new offshore permits, which it found to be “on par with the March and February figures.” However, the total is down 28% from April 2015.

New bypass permits halved from eight to four, an indication of better execution in new well drilling and development, according to the report. Similarly, new well permits grew 50%, from four in March to six in April.

Although ultra-deepwater permits have remained constant, this number did not necessarily reflect the full picture the sector faces, Evercore said. “New ultra-deepwater and midwater permits increased month-to-month, but have fallen 50% year over year,” the report noted. “Ultra-deepwater permits have remained relatively consistent due to their infrequency, although ultra-deepwater plans have all but evaporated heading into 2Q 2016.”

However, the sharpest decline year-over-year has been in shallow-water permitting, the report found, down 89% from this time last year, with just three total new permits issued for shallow water wells.

“Offshore drilling will continue to show anemic movement as long as shallow-water permits remain at historically low levels,” the report commented. “Hopefully, better permitting and a marginal increase in exploration plans offshore will buoy rig activity in the Gulf of Mexico, particularly heading into what we predict will be an offshore capex bottom in 2H 2016.”

Recent activity

Nevertheless, some work is going forward. Ensco says that retrofitting two of its semisubmersible drilling rigs has enabled it to find new work in the Gulf and keep its crews busy. By upgrading the mooring capabilities of theENSCO 8503 and the ENSCO 8505, the DP-enabled semis are now capable of both drilling and intervention work in both deep and shallow-water areas.

And, with operators taking advantage of the market downturn to perform intervention and P&A activities, Ensco says it has won contracts from Marubeni Corp. and Stone Energy Corp. as well as a sublet from Apache for this type of work by upgrading the two semisubmersibles.

“Currently, none of our customers are doing exploration,” said Jason Morganelli, VP-Marketing, Western Hemisphere for Ensco. “The intervention market represents the majority of work going on in the Gulf these days.” And it was feedback from operators that led Ensco to retrofit the two semis so that they could undertake this type of work.

TheENSCO 8505 has been working for Marubeni in the US GoM since last December under a contract that will run until January 2018.

TheENSCO 8503 has been working for Stone Energy in the Gulf under another multi-year contract. The primary contract, announced in October 2014, has a term of 30 months, and work began in 2Q 2015. The contract permits Stone to exercise options to extend the term up to an additional 12 months.

Elsewhere, Transocean reported in February that its newbuild ultra-deepwater drillshipDeepwater Thalassa started its 10-year contract for Shell in the deepwater Gulf. The rig is designed to operate in up to 12,000 ft water depth and drill wells to 40,000 ft.

And, at the end of January Chevron had moved Transocean’sDeepwater Asgard drillship to the deepwater Tiber prospect in Keathley Canyon block 102. The Deepwater Asgard, built in 2014, started a two-year contract with Chevron in April 2015. Like the Deepwater Thalassa, the Asgard can work in water depths down to 12,000 ft and drill down to 40,000 ft deep.

Transocean also reports that itsDiscoverer Clear Leader and Discoverer Inspiration drillships are working for Chevron in the Gulf with contracts that run to October 2018 and March 2020, respectively.

Pacific Drilling reports that itsPacific Santa Ana and Pacific Sharav drillships are continuing their work in the GoM for Chevron under contracts that end in May 2017 and September 2019, respectively.

Atwood Oceanics says itsAtwood Advantage drillship is operating under a contract for Noble Energy that lasts until August 2017, while its Atwood Condor semisubmersible is operating under a contract for Shell Offshore Inc. that will be completed this coming November.

But while some parts of the Gulf remain active, the downturn continues to impact the industry on other fronts. Noble Corp. recently announced that it had reached an agreement with its client, Freeport-McMoRan Oil & Gas LLC (FMOG), and FMOG’s parent company, Freeport-McMoRan Inc. (Freeport), in connection with the drilling contracts for the drillshipsNoble Sam Croft and Noble Tom Madden, which were scheduled to terminate in July and November 2017, respectively. In March, it had been reported that the ultra-deepwater drillship Noble Tom Madden would return to work for Freeport in the GoM after it had been laid-up earlier this year.

Pursuant to the agreement, the contracts will be terminated, with operations ceasing as soon as practicable, and Freeport will make a payment to Noble of $540 million. In addition, Noble can receive additional contingent payments from Freeport of $25 million and $50 million, respectively, depending upon the average price of oil over a 12-month period. Noble also expects to realize over $100 million in direct cost savings as a result of the contract terminations through crew reductions and stacking procedures.

Freeport recently announced a restructuring of its oil and gas business, which is operated through FMOG. As disclosed in Freeport’s public filings, FMOG has substantial debt and has been negatively impacted by the crash in oil prices. Noble Corp. officials say that the agreement will enable it to secure the economic benefit of these contracts by accelerating their value and removing counterparty risk and potential downtime exposure.

Well control rule

In mid-April, the Bureau of Safety and Environmental Enforcement (BSEE) issued the long-awaited (and controversial) final well control regulations. Specifically, the final rule addresses the full range of systems and equipment related to well control operations, with a focus on BOP requirements, well design, well control casing, cementing, real-time monitoring, and subsea containment. BSEE says that the measures are designed to improve equipment reliability, especially for BOP and blowout prevention technologies.

According to the BSEE, the rule requires operability of equipment through rigorous testing and provides for the continuous oversight of operations, all with the goal of improving the reliability of equipment and systems to protect workers’ lives and the environment from the potentially devastating effects of blowouts and offshore oil spills.

The regulations combine prescriptive and performance-based measures to ensure that oil and gas companies and offshore rig operators are cultivating a greater culture of safety that minimizes risk.

Key features of the rule include requirements for BOPs, double shear rams, third-party reviews of equipment, real-time monitoring data, safe drilling margins, centralizers, inspection intervals, and other reforms related to well design and control, casing, cementing, and subsea containment.

BSEE officials say that the regulations build upon findings and recommendations from several investigations and reports concerning the root causes of the Macondo well incident, and consultation with industry groups, equipment manufacturers, federal agencies, academia, and environmental organizations.

Most of the requirements do not become effective until three months after publication of the final rule. Several requirements have more extended timeframes for compliance.

Operators, industry groups, and analysts have expressed strong concerns about the rule, before and after it became final. A recent analysis by Wood Mackenzie found the regulations could raise drilling costs by 20% or more. In worst-case scenarios, the analysis said exploration could drop by as much as 55%, and less drilling could translate to $70 billion in lost state and federal tax revenues by 2030, and up to 190,000 lost jobs.

Last year, a study commissioned by the American Petroleum Institute estimated that the regulations would cost the industry $31.8 billion over 10 years. ExxonMobil Corp. has estimated that the new rule will cost as much as $25 billion over 10 years, according to several reports, and render many offshore discoveries worthless.

The government estimates the cost of compliance will be much lower, at about $890 million over 10 years. BSEE director Brian Salerno has responded to such criticisms by saying that the rules were drafted with industry involvement, and some final rules were tweaked to satisfy industry concerns. In a statement, the agency said that the new rule “is in harmony with industry’s best practices, standards, and equipment specifications.”

Macro outlook

Analysts expect more job losses and bankruptcies, but analysts also say that they expect the worst to be over sometime after June. Any recovery, however, will be slow as the industry reduces stockpiles. Moody’s Analytics, the economic research arm of the ratings agency, forecasts that crude will not reach $60/bbl again until early 2018.

There is some evidence that all this is beginning to happen. In mid-April, US production (onshore and offshore) fell below 9 MMb/d for the first time since October 2014, as the number of rigs actively drilling for oil continued to slide. Another eight oil rigs shut down in late April, leaving just 351 oil rigs left nationwide, according to the Baker Hughes rig count. The oil rig count is now down more than 78% from its peak of 1,609 in October 2014.

Meanwhile, the global economy is stabilizing after a recent period of turmoil, economists said, forecasting greater demand for oil. In the US, the economy is expanding at a steady pace, with the unemployment rate falling to 5% in March and wages finally starting to rise. With low prices at the pump, gasoline consumption is up 3% from a year ago, according to the Energy Department.

In mid-May, US crude oil prices hit a six-month high at more than $48/bbl, as investors weighed a forecast for tighter global supplies against signs of another storage build. Since its low of $26.21/bbl on Feb. 11, oil prices have climbed more than 60%. And prices for West Texas Intermediate could reach $51/bbl in the near-term, say some analysts.

As efficiencies have risen and services costs have come down, many companies can profit with oil at or above $50/bbl, analysts say. Some project that the rig count will begin to increase again in the fall.

Analysts also indicate that conditions now are different than the spring of 2015, when prices climbed temporarily only to plunge again. Since then, more companies have exited the marketplace, and more rigs have been shut down, meaning that new production cannot come back online so quickly, with the resultant deflationary impact on prices.

And yet, drilling contractors will continue to face a challenging market in the near term, and likely over the next year or so. In its mid-May update on the rig market, Evercore ISI observed that offshore drilling is in the midst of a cyclical downturn, one that will likely last “until 2018 at least.”