Offshore staff

LONDON – The oil price slide reduced the valuation of the global upstream oil and gas industry by $1.6 trillion, according to Wood Mackenzie.

Andrew Pearson, vice president, upstream, said: “This figure captures the impact of Wood Mackenzie’s downgraded long-term Brent price assumption – now $50/bbl (2020 terms), rather than the previous $60/bbl – and much more.

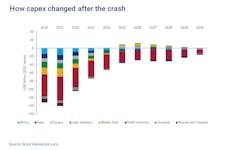

The analyst now estimates that global upstream development spending will be 30% lower than its pre-crash assessment, with only nine major field investment decisions likely to be approved this year (against a previous expectation of around 50 new project approvals).

Fraser McKay, vice president, upstream, said: “In early March, we anticipated the industry’s response would be rapid and decisive. It has been. Tough calls have been made, despite a lack of clarity how the COVID-19 pandemic will have on oil and gas demand, both in terms of depth and duration.”

According to the analysis, the US Gulf of Mexico is already lean and nimble after the previous price collapse of 2014, and therefore better prepared to weather the current downturn. The region is resilient at low oil prices: more than 80% of its oil production has a short-run marginal cost of $10/bbl Brent.

Nevertheless, GoM operators have implemented swift budget cuts, shutting in some fields due to unprecedented low oil prices, and with investment, exploration and FIDs all undergoing major recalibrations.

Latin America has made the biggest cuts to 2020 capital spending globally, led by the NOCs, which have mostly deferred rather than canceled projects (mainly in presalt basins).

Exploration remains vital to the region’s future growth, so Wood Mackenzie is forecasting a return to previous levels of activity and investment in Latin America in 2021.

Across the North Sea, operators have acted to rein in spending, cutting 2020 budgets and deferring or cancelling new projects, infill drilling campaigns and most discretionary spending.

While production will fall, longer-term output depends on FID approvals. North Sea operators will likely look for more clarity on the market situation before moving ahead with new developments.

Africa’s upstream spending in 2020 has fallen by $14 billion compared with the analyst’s pre-crash view, with major capex cuts and deferrals for deepwater West Africa projects and LNG projects offshore/onshore Senegal/Mauritania and Mozambique. Targeted FIDs over the next 18 months are down from 22 to three, with upstream value in Africa one-third lower ($200 billion).

In Asia/Pacific, more than $60 billion of planned expenditure has been cut over the next five years, the analyst claims, those hit including pre-FID LNG projects in Australia, with lower NOC spending in Southeast and southern Asia.

06/25/2020