Wind energy, decommissioning markets may offer some refuge

Matthew Fitzsimmons, Emil Varre Sandoy, Rystad Energy

Offshore exploration and production (E&P) investments have declined year by year since the oil price crash in 2014, as operators both scaled down activity and focused on cutting cost to make projects robust and commercial in the new price environment. The year 2018 marked a new low point, with offshore investments falling to $150 billion, down 55% from the previous peak in 2014. However, both oil prices and E&P companies’ revenues recovered significantly during 2018. Paired with the low activity and cost levels, the upstream industry made more money when Brent oil prices hovered around $70/bbl than they did amidst $110/bbl prior to the late 2014 crash. In fact, E&P enjoyed all-time high free cash flow in 2018.

With the operators flushed with cash and given a positive market sentiment, Rystad Energy was early to predict a new offshore investment cycle starting in 2019 with increasing investments levels. Now that 2019 is history, we can conclude that the beginning of the foreseen rebound in offshore investments indeed materialized, as greenfield commitments grew by more than $30 billion. This marked a long-awaited turning point for many players in a market that endured very challenging conditions over several years.

Entering this year, Rystad Energy expected the rebound to continue and even to gain momentum in 2020, estimating capital investments to grow by 9.2% year-on-year to $165 billion. However, the picture changed completely during the first quarter of the year, as the market was hit by two significant shocks. Firstly, the Covid-19 virus broke out in China, before spreading to other countries in all corners of the world, evolving into a pandemic. This took a severe toll on the global economy, with an immediate negative impact on oil and gas demand. Secondly, the OPEC+ group failed to reach an agreement on further production cuts, triggering a breakdown of the collaboration and leading several members to increase production in a bid to compete for market share. Practically overnight, the market was awash with oil and a huge supply shock was inevitable. Brent crude prices collapsed from around $60/bbl to the low $30s, spawning vast uncertainty regarding future prospects.

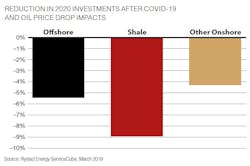

With these new market conditions, Rystad Energy now expects a fairly flat development in offshore investments in 2020 at $153 billion, growing by only 1.0% compared to 2019 levels, as companies will scale back activity and delay projects in response to the ongoing challenges. Investment levels this year are expected to remain relatively high as a large portion of the spending is related to ongoing and already sanctioned projects, so the sensitivity to recent market developments is quite low. However, the slowdown is expected to really make its mark next year, as Rystad Energy now forecasts offshore investments to decline significantly by 10.0% compared to 2020, driven by project delays.

High uncertainty regarding the near-term future

High uncertainty is the most significant characteristic of the prevailing situation in the upstream industry. Rystad Energy’s current forecast is based on an average Brent oil price of $40/bbl in 2020 and $53/bbl in 2021, assuming both that OPEC manages to reach a new agreement on production cuts by mid-2020 and that the Covid-19 virus outbreak is brought under control during the course of the year. Under such a scenario, oil supply would be reduced and global demand would start a slow recovery, resulting in rising oil prices from the second half of 2020 and through 2021.

However, the volatility in the market is currently so high that revisions of the base case assumptions are to be expected. Market conditions could develop in either direction compared to the Rystad Energy base case, but the downside risk currently seems to be greater than the upside.

Oil price slump puts floater demand at risk

Before oil prices collapsed in March, Rystad Energy forecasted that global demand for floating drilling rigs would grow by 12% this year, to 143 rig-years, versus 128 rig-years in 2019. If the oil price were to average $40/bbl this year, demand could slide to 135 rig-years – still representing a 5% improvement over 2019 – whereas an average of $30/bbl would likely cut 2020 rig demand by 5% to 122 rig-years. This means that as much as 15% of the intra-year demand for floaters is at risk. This would be on par with the decline of 14% that the market experienced in 2015, although that drop was from much higher initial activity levels and amidst cost structures and project portfolios that had not been scrutinized as we have seen in recent years since the previous downturn. Given these differing circumstances, we believe that the current project portfolio on the E&P side is more competitive than it was five years ago – which means the rig market is more robust now than during the previous downturn.

By evaluating the type of drilling programs that lie behind the overall floating rig demand forecasts for 2020, Rystad Energy anticipates that 24 rig-years are at risk in the exploration drilling segment and another eight rig-years are at risk within development drilling in light of the ongoing oil price crash. It is possible that all final investment decisions on new projects that had been anticipated this year could be cancelled or delayed. Although most of these projects have very low breakeven levels, operators will be much more cautious about moving ahead with additional sanctioning activity this year given the heightened market uncertainty. Exploration will probably be cut back as operators seek to reduce risk and save cash in the current environment. Exploration carries a double risk – there is no guarantee of success, and even if new discoveries are made, they may not be commercially viable in a world of oversupply. This makes exploration the top target for oil companies looking to cut costs and minimize risk.

Opportunities emerge for decommissioning prospects

While lower oil prices will spell work reductions for most sectors, the decommissioning market could see an uptick of activity. Looking at the maturity of producing fields in the main offshore regions, the Gulf of Mexico and Northwest Europe display the largest percentage fields nearing the end of their production lives, followed by Southeast Asia and South America. While the decommissioning markets in the Gulf of Mexico and Northwest Europe are already consolidated due to the numerous decommissioning projects already in place, South America and Southeast Asia may not be prepared to face the boom in decommissioning activity in coming years due to a lack of regulation and experience.

Across offshore decommissioning expenses, well plugging and abandonment (P&A) represent the biggest cost for operators, with over 45% of decommissioning work focused on well abandonment. In the Gulf of Mexico, most P&A activity is done with rigless equipment as this saves up to 50% in costs. In addition to vessel rates being significantly lower than rig rates, the set-up time for a rigless P&A spread is also much shorter, with an average of four to eight hours, whereas a rig can take 72 to 96 hours to get ready to work. In addition, the rigless approach allows for simultaneous operations on multiple wells, generally two to four wells at one time. However, rigs are still needed in some situations, for instance to handle complicated wells. During the past 10 years, about 90% of P&A operations in the Gulf of Mexico have been done rigless, leaving only 8% of the wells for the jackup market. Looking solely at P&A work on deepwater wells, on the other hand, drilling units are required in 30% of the cases.

Suppliers could seek refuge in offshore wind

Offshore wind farms are being erected with increasing speed, which in turn with drive the growth of the global market for wind turbine operations and maintenance (O&M). As offshore wind turbines age and experience wear and tear, they are bound to generate demand for repairs and maintenance services. This will unlock opportunities for oilfield service companies to leverage their offshore expertise by entering this market.

Following on the heels of Europe and Asia, North America is poised to be the next hotspot to drive demand for O&M services within offshore wind. The region has set ambitious targets and is expected to develop its offshore wind capacity potential to beyond 5 gigawatts by 2024. While the offshore wind supply chain in the US is still immature, it will not be so for long. Global offshore wind operator Orsted, for instance, has secured funding to open training centers in the US in a bid to establish a workforce trained in operating and maintaining offshore wind projects.

The offshore wind O&M market presents a golden opportunity for maintenance focused companies within oilfield and marine services. These companies must consider the best use of their own capabilities and develop sector-focused solutions to capitalize on an offshore wind market that is set to grow exponentially. •