Dollar’s strength provides some relief for hard-pressed operators

Offshore staff

OSLO, Norway – One positive of the oil price fall and the associated strengthening of the dollar is lower lifting costs, according to Rystad Energy.

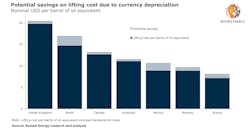

The consultant estimates Brazil’s present lifting cost at around $14.70/bbl, $2.30 lower compared to the pre-downturn level.

Mexico’s lifting costs are down by $1.80 to $8.90/bbl. Other beneficiaries include the UK, Norway, and Australia.

Overall, Russia should gain the most for the remainder of 2020 due to the scale of its production, realizing $8.70 billion in reduced opex, followed by Brazil with $2.6 billion, Mexico and Canada with $1.6 billion each, Norway with $1.2 billion and the UK and Australia with $0.5 billion each.

Rystad oilfield services analyst Sara Sottilotta cautioned that currency depreciation could have a mixed effect on oil and gas projects, with some fields under development facing higher costs, as most of the contracts were awarded in US dollars.

In Brazil most capex for exploration, wells and facilities is typically procured in US dollars. However, nearly 80% of opex is paid in the Brazilian real, driven mainly by salaries, transport fees and taxes, and activities provided by local service companies.

With no sign of an upturn in the oil price, operators are exploring all available avenues for further cost reductions, although the present downturn appears unlikely to generate the same level of efficiency and productivity gains that followed the slump of 2014-2016, Rystad warned.

“Under these circumstances, currency gains could emerge as a free boost, helping operators to maintain profitable operations at producing fields even amidst the brutal prevailing oil market conditions,” Sottilotta said.

04/20/2020