Offshore staff

OSLO, Norway – Global capex for exploration and production companies is expected to drop by up to $100 billion this year, about 17% versus 2019 levels, under Rystad Energy’s updated base case scenario of $34/bbl in 2020 and $44/bbl in 2021.

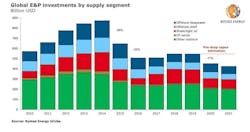

E&P capex in 2019 reached $546 billion, according to Rystad Energy estimates, having slightly recovered from a two-year slump in 2015 and 2016 before diving to around $510 billion from 2014’s historical high of $880 billion.

According to the analyst’s data, the expected decline this year will make 2020’s capex volumes, estimated at about $450 billion, the lowest in 13 years. Its estimates before the coronavirus pandemic had indicated E&P would remain flat year-on-year.

As April approaches, when OPEC+ producers are expected to flood the market with even more additional oil, Brent prices are now at nearly $25/bbl and are likely to decline even further.

In a low case scenario, where Brent averages $25 in 2020, global investments may plunge to around $380 billion this year, falling to almost $300 billion in 2021, a 14-year and a 15-year low respectively.

Rystad Energy’s upstream analyst Olga Savenkova, said: “As companies are now losing solid oil market ground for a second time in recent years, it will be far more challenging to act quickly and reach the same high level of investment revision without taking a heavy toll on E&P’s performance.”

The estimated cost cuts will be mainly achieved by lower activity within US shale, delays to projects that are yet to reach the final investment decision stage, deferred exploration activity, and cost cuts within development and production for conventional assets.

As the most flexible of the supply segments in terms of cost reduction, US shale players are expected to reduce their investments by about 30% year-on-year, the analyst said. These measures will be quickly reflected in the oil market supply, with shale oil supply growth set to slow down in 2020.

Among the world’s largest oil companies, Saudi Aramco is slashing its upstream capex by 20% to protect its balance sheet amid declining oil prices. Despite the turbulent oil market, the analyst expects the company to go ahead with strategically important projects, having one of the lowest costs per barrel within the industry.

ExxonMobil is also considering at least a 20% investment cut, but these plans have not yet been finalized. Considering the company’s underperformance, even deeper cuts may be required to meet most of its important operational targets; it posted weak numbers for 4Q 2019, announced $20 billion worth of divestments planned for 2020, and maintains big ambitions for exploration and development in Guyana.

Shell will also embrace a 20% total cut strategy, but the analyst expects that upstream budgets will only see reductions of about 14%. The company is also committed to a divestment program of more than $10 billion worth of assets, which could prove challenging to conduct in the current market.

BP has also announced potential plans for a 20% cost reduction. Even though the company holds a geographically diverse and resilient portfolio, the analyst believes its $15-billion asset-sale target might not be accomplished.

03/30/2020