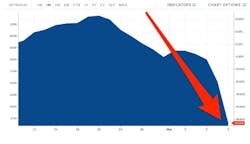

Oil prices plunge as much as 30% after OPEC deal failure sparks price war

March 9, 2020

Offshore staff

VIENNA – Oil prices plunged to multi-year lows on Monday as tensions between Russia and Saudi Arabia escalated, sparking fears that an all-out price war is imminent.

As reported by CNBC, the sell-off in crude began last week when OPEC failed to strike a deal with its allies, led by Russia, about oil production cuts. That, in turn, caused Saudi Arabia to slash its oil prices as it reportedly looks to ramp up production.

US West Texas Intermediate crude and international benchmark Brent crude are both pacing for their worst day since 1991.

WTI plunged 18%, or $7.36, to trade at $33.92/bbl. WTI is on pace for its second worst day on record. International benchmark Brent crude was down $8.44, or 18.7%, to trade at $36.80/bbl. Earlier in the session WTI dropped to $30 while Brent traded as low as $31.02, both of which are the lowest levels since February 2016.

“We believe the OPEC and Russia oil price war unequivocally started this weekend when Saudi Arabia aggressively cut the relative price at which it sells its crude by the most in at least 20 years,” Goldman Sachs analyst Damien Courvalin was quoted to say in the CNBC report. “The prognosis for the oil market is even more dire than in November 2014, when such a price war last started, as it comes to a head with the significant collapse in oil demand due to the coronavirus.” Goldman reportedly cut its second and third quarter Brent forecast to $30/bbl, and said that prices could dip into the $20s.

03/09/2009