Saipem, Subsea7 set to merge, forming subsea construction powerhouse

Just released!

Subsea Engineering Special Report 2025

The Subsea Engineering Special Report first published within the January/February 2025 issue of Offshore magazine. The report highlights technology advances and R&D, case studies and industry expert insights on the latest trends in the subsea sector of the offshore energy industry.

By Jeremy Beckman, Editor—Europe

Saipem and Subsea7 have executed a memorandum of understanding on a proposed merger.

The companies aim to reach agreement on the terms of the combination around mid-2025, and to conclude the process in the second half of 2026, following receipt of shareholder and other relevant approvals.

The combined operation would be renamed Saipem7, with a total contracts backlog of €43 billion ($45 billion), and revenue approaching €20 billion ($20.94 billion). Globally, Saipem7 would employ more than 45,000 people in over 60 countries, including more than 9,000 engineers and project managers.

Benefits would include complementary geographical footprints, competencies and capabilities, vessel fleets and technologies, all of which should be advantageous to the global client base.

Saipem and Subsea7 shareholders would each own 50% of the merged entity, which would be listed on both the Milan and Oslo stock exchanges. The combination should deliver annual synergies of about €300 million ($314 million) in the third year following completion.

Executive leadership

Main shareholders Siem Industries, Eni and CDP Equity have all expressed their support for the transaction, with a proposal that Siem Industries nominate the combined company’s chairman and that CDP Equity and Eni will nominate the CEO.

At present, Saipem general manager and CEO Alessandro Puliti is set to be named CEO of the combined company. Subsea7 CEO John Evans would become CEO of the entity that will manage its offshore business, comprising all of Subsea7 and Saipem’s Offshore Engineering & Construction activities.

Merger highlights

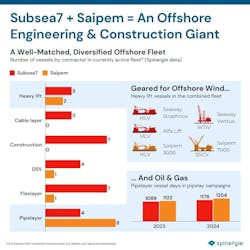

A combined powerhouse in offshore construction

By Spinergie

The move consolidates 40 currently active construction vessels, spanning subsea, heavy lift and renewables. It also brings together 12 pipelayers, creating the largest pipelay fleet in the industry by a wide margin. The fleet would be highly diversified strengthening its ability to execute complex offshore projects.

In offshore wind, the combination of the two fleets would enhance wind farm installation capabilities, bringing the semisub Saipem 7000 and WTIV Seaway Ventus together, along with a fleet of cable-layers with a strong track record. This could allow the company to execute full wind farm installation projects entirely in-house. Beyond installation, Seaway operates a fleet of heavy load aarriers, and Saipem has experience in jacket foundation manufacturing.

In oil and gas, the expanded pipelaying and subsea construction fleet could install rigid pipelines in J-lay, S-lay, and reel-lay along with a large flex-lay fleet with global reach.

With regulatory and shareholder approvals still pending, the deal—if finalized—will redefine competition in offshore construction.

Highlights of the improved offering the merger could bring to existing clients include:

- A comprehensive spectrum of offshore and onshore capabilities, from drilling, engineering and construction through life-of-field services and decommissioning. This should lead to more optimized project schedules for clients in oil, gas, carbon capture and renewable energy.

- A diversified fleet of more than 60 construction vessels, allowing the combined company to take on a wide range of projects, from shallow water to ultradeep water, deploying heavy-lift, J-lay, S-lay and reel-lay rigid pipeline services, flexible pipe and umbilical lay services, and offshore wind turbine, foundation and cable lay installation capabilities.

- Combined expertise would drive innovation in offshore technologies, notably solutions for complex projects.

New business units

The new organization would have four businesses: Offshore Engineering & Construction, Onshore Engineering & Construction, Sustainable Infrastructures, and Offshore Drilling.

Offshore Engineering & Construction, to be incorporated in an autonomous company named Subsea7 but branded as “Subsea7 – a Saipem7 Company,” would bring together Subsea7’s entire business and Saipem’s Asset Based Services business. It would be headquartered in London and likely led by John Evans.

Optimizing project schedules

During a presentation earlier today, Saipem’s Puliti said the combined operation would have a broader ability to optimize clients’ project schedules. Subsea7’s Evans claimed that clients would benefit from a more integrated service offering and an enhanced global presence, while the combined companies would gain access to a wider investor base and sources of capital.

Politi also foresaw greater opportunities in LNG and carbon capture.

“Saipem is the only contractor capable of carbon capture, transporting it by land and sea, and drilling wells for CO2 injection," he said. "With Subsea7, we will be even stronger in this segment.”

The two companies already have a good working relationship, Evans noted, with collaborations on the Seagreen offshore wind project in the UK North Sea and the Sakariya 1 and 2 subsea tieback developments in the Black Sea, deploying their complementary strengths.

Pre-existing alliances

As for existing involvement in other subsea engineering groups, such as the Subsea Integration Alliance between Subsea7, One Subsea and Aker Solutions, “we don’t see issues there,” Evans said. “In fact, we will offer the alliance and enlarged capability. But conversations will take place over the next few months.”

Evans elaborated, “Contracts are getting larger and more complex…and having a larger vessel fleet will be good for our respective clients. The industry has a challenge of moving large energy assets halfway round the world to meet clients’ needs, and having a huge fleet helps.”

Saipem also has a cooperation agreement with TechnipFMC. Puliti said the company plans to honor this and does not see the arrangement necessarily ending.

Enhanced schedule flexibility

As for reactions to the planned merger from offshore operators, Puliti said that “the initial feedback has been positive. Clients need flexibility on fleet utilization. If they have to accommodate a late change to the agreed schedule, [having access to a larger fleet] makes this much easier.”

Puliti added, “We sign contracts that are executed 18 months to two years later. [The schedule] is more rigid with a smaller fleet; if clients then say, I need you to come two months later, we can do this with a larger fleet.”

Want more content like this?

Offshore's monthly Subsea Report e-newsletter provides a detailed review of advances in subsea wells, tieback technology, flow assurance methods and challenges in deepwater operations.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.