Compiled by Ariana Hurtado, Editor and Director of Special Reports

Recovery and trends in ultradeepwater fixture rates

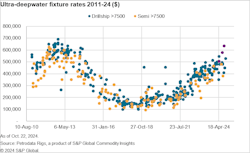

The ultradeepwater market has experienced significant fluctuations in fixture rates from 2011 to 2024. In 2012 drillship rates peaked between $600,000 and $700,000, while semisubmersible rates reached $500,000 to $600,000. However, a sharp decline began in 2014 due to falling oil prices, continuing until January 2016. Over the past five years, rates have rebounded as the market recovered, with drillships witnessing the most substantial increases. As of 2024, fixture rates for drillships range from $450,000 to $528,000, with some exceeding this due to specialized requirements, such as 20,000k BOP capabilities.—S&P Global

Global floating offshore wind project pipeline growing

The global pipeline of floating offshore wind projects has expanded in the last 12 months from 244 GW to 266 GW—an increase of 9%. The number of projects has increased globally during that time from 285 to 316. The pipeline includes projects at any stage: fully operational, under construction, approved, in the planning system or at an early stage of development. So far, 245 MW of floating wind are fully operational across 15 projects in seven countries. Norway has the most with 94 MW across three projects, the UK is second with 78 MW (two projects), followed by China with 40 MW (five projects).—RenewableUK

OSV market size projected to grow $36.3B by 2029

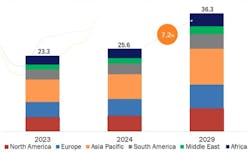

The global offshore support vessel (OSV) market size is expected to grow from $25.6 billion in 2024 to $36.3 billion by 2029, at a CAGR of 7.2%. There are various drivers responsible for the growth of the market such as government policies and incentives and technological advancements, among others. The rising global demand for energy, particularly from developing countries, such as in deepwater reserves and Arctic regions, pushes the need for increased offshore exploration and production, subsequently driving the OSV market and creating new opportunities for OSV operators and manufacturers.—MarketsandMarkets