Recent consolidation set to pay off as market fundamentals improve

James West, Evercore ISI

What awild ride it has been. We delivered a speech in 2014 when we first joined Evercore ISI at a deepwater conference in London. In our speech we discussed the challenges facing the deepwater and offshore markets, including collapsing returns for the majors (even before the oil price drop); persistent cost overruns; a significant lengthening of time from discovery to first oil; and the threat of relatively new short cycle shale. In our view, major industry changes were needed – collaboration, cooperation, and standardization to name a few.

And customers have awoken to the idea of increased collaboration. The oil companies now understand the need for change. These changes include the need to drive better collaboration in order to improve project planning and the contract negotiation process; partnering to improve outcomes and speed up the timeline to bring R&D to market; leveraging digitalization to enable smarter decision making; and changing employees’ mindsets to work differently.

This down cycle has witnessed an unprecedented number of changes to the offshore industry including. These are detailed below.

Subsea first. The subsea and marine construction companies moved first, initially with joint ventures (OneSubsea was a JV with Schlumberger and Cameron; Forsys Subsea was a JV with Technip and FMC Technologies) and then alliance agreements (Helix joined SLB and OneSubsea to create the Subsea Services Alliance, and separately a few months later Subsea 7 and SLB announced a global alliance) while at the same time, Baker Hughes teamed up with Aker (now with Vetco as part of the new BHGE); then BHGE subsequently formed an alliance with McDermott. In 2015, Schlumberger agreed to buy Cameron; and this was followed in 2016 with Technip and FMC Technologies agreeing to merge. Thus two offshore/subsea powerhouses were created. These two companies are pioneering new ways of collaborating and standardization; they are evolving the industry.

Drilling adjustments. Faced with collapsing demand, falling day rates and heavy debt burdens, the 2015-2017 period was extremely difficult for the offshore drillers. Many went bankrupt, many issued equity and were forced to issue secured debt, and difficult revolver negotiations ensued. Next, the companies slashed and burned costs. They found that reductions in cost structures of 30-50% were plausible. New ways of working evolved; rig equipment suppliers took on risk; performance-based contracts permeated the industry; and the adoption of big data analytics and automation unfolded.

Contractor M&A. As the industry begins to climb out of the most horrific downturn since the 1980s, an M&A cycle has begun in earnest. Transocean bought Songa and Ocean Rig. Ensco grabbed Atwood and is now merging with Rowan. Noble is picking off assets in the shipyards. Borr Drilling, a scrappy upstart, has systemically scooped up jackup rigs at the market bottom. The great consolidation wave is here and it could not come at a better time. Day rates have already moved substantially higher for harsh-environment floaters, and day rates are jumping 30-40% off the bottom for high-specification jackups. We believe that the move for high-specification drillships is next.

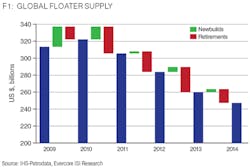

Despite the recent pullback in oil prices, the offshore rig market outlook remains encouraging with demand still healthy at $60 Brent. Notably rig contractors are continuing to proactively manage supply, with three additional newbuild floaters and 12 newbuild jackups deferred over the past month. The industry is on track to take delivery of only one to four newbuild floaters and 16 to 21 newbuild jackups this year (with three and five respective newbuilds scheduled between now and year-end). This is a far cry from 22 floater and 64 jackup newbuilds scheduled at the start of the year, which combined with ongoing rig attrition (17 floaters and 35 jackups YTD) implies a net reduction of at least 14 jackups (2.6%) and 13 floaters (5%) for the year. Overall, global floater supply has contracted by 83 units or 25% from the October 2014 peak with retirements exceeding newbuild additions for four straight years, while the global jackup supply is down 16 units or 3% from the January 2018 peak.

There is now a visible path to higher day rates. Reflecting our demand forecasts and assumptions for incremental retirements and modest newbuild additions, we see a visible path to effective utilization improving to 82% for jackups and 74% for floaters in 2019 and 86% for jackups and 82% for floaters in 2020. While there is no firm timeline for when day rates will begin to move up, pricing power tends to swing to the contractor when utilization gets back to the 80s.

There are other positive trends: projects seem to be moving toward FID; the need to replace reserves is becoming a major concern; and oil prices remain supportive. Offshore FIDs are growing (31 projects sanctioned in 2016 compared to 40+ in 2018). Underpinning our bullish thesis for the offshore market is the fact that the necessary supply of global oil cannot come solely from the Permian basin. For years, IOCs have enacted capital discipline while exploration activities (and thus, new reserve discoveries) and infrastructure have received scant attention. While the timing remains uncertain, we remain steadfast in the belief that eventually, the necessity of supplying the incremental barrel of oil to support global demand growth will have to come from outside of the North American land market. Reserve replacements are at a 20-year low; the industry is replacing only one-third of offshore production; and delays in project FIDs over the past four years have removed 6 Mb/d of 2025 supply.

We believe that deepwater development will play a sizeable role in global supply and while well breakevens have come down, the industry remains laser focused on making deepwater development competitive with shale. The subsea and marine construction companies want to be in the forefront to drive fundamental changes around how deepwater discoveries are developed, and how interactions with customers take place. They want to leverage their portfolios to lower operators’ capex and opex requirements, and make better use of technology to unlock data and better enable decision makers. They also want to leverage flexible partnerships and commercial models, and standardize equipment to help drive lower total cost of ownership. •