New policies designed to attract investment

Bruno Triani Belchior•Leandro Duarte Alves

Mayer Brown

The major advances in the Brazilian oil and gas industry have always been connected with regulatory adjustments and Petrobras’ activities. In 1953, following a heavily nationalist debate over policy for the exploration and production of oil and natural gas, Petrobras was incorporated as a government-owned company.

Petrobras played the monopoly role in the Brazilian oil sector until the industry opened to other companies in the late 1990s, when the concession regime was introduced in Brazil. This was accomplished by Amendment #9 of the Brazilian Constitution and the enactment of the Petroleum Law, and the creation of the National Petroleum Agency (ANP) - leading to the development of the bid rounds model adopted in Brazil for the granting of exploration and production rights.

From 1999 to 2008, the ANP carried out 10 bid rounds under the concession regime, one per year, and established an initial regulatory framework. By that time, in parallel to the development of oil and gas operations, the Brazilian economy experienced significant growth following a long period of low stagnation and hyperinflation. The future had never looked brighter.

In 2007, huge oil reserves in ultra-deepwaters of the presalt layer of the Campos and Santos basins were discovered and oil companies turned their attention to Brazil. But so did the Brazilian government, which created a working group to study the best way to exploit these huge resources. In 2010, a new legal framework (Pre-salt Law) implemented drastic changes, including a mandatory production-sharing regime (PSC) and designation of Petrobras as the sole operator in the pre-salt area.

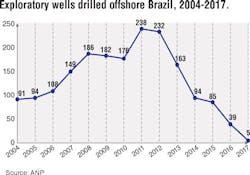

No offshore bid rounds took place from 2008 to 2013, primarily due to protracted studies and geophysical speculations. This inactivity, combined with the decline in oil prices, negatively impacted the industry. Indeed, while the drilling activities almost tripled during the period from 2004 to 2011, today there are only five exploratory wells being drilled.

Such reduction in offshore exploration activities, combined with a stagnant Brazilian economy, have caused the Brazilian government to realize the importance of the oil industry and to implement needed reforms. Starting in mid-2016, new policies and regulations emerged, designed to attract national and foreign investment. These changes have also been facilitated by Petrobras’ ongoing massive divestment plan, which includes not only upstream, but also midstream and downstream assets. These changes may represent a significant shift in the entire chain of the Brazilian oil and gas sector, with the entrance of new players in the market.

Despite the current slowdown, the Brazilian oil and gas sector is fairly mature these days, boasting the participation of several major oil companies and large independents. Petrobras remains the principal operator and producer, but other big oil companies, such as Shell, Statoil, and Total have demonstrated their appetite by investing significantly in Brazil. In view of the launch of Petrobras’ divestment plan and the new regulatory framework for the oil and gas industry, one can also argue that the current opening is more significant than that of the late 1990s.

Reforms and bid rounds

The reforms actually began with the amendment to the Pre-Salt Law in November 2016, through which Petrobras was granted the option to be the operator in the presalt areas offered in a bid round under the production-sharing regime. This was an important turning point to the industry, as Petrobras would not be the sole operator (mandatory).

In April 2017, the National Energy Policy Council (CNPE) launched several reforms, of which the most relevant at the moment are: (i) the release of a schedule of bid rounds under both concession and production-sharing regimes; and (ii) a more flexible local content policy.

Bid rounds schedule

For the first time, the CNPE has approved a multi-year bid round calendar for exploratory blocks and mature onshore fields. These include nine bid rounds from 2017 to 2019 - five under the concession regime and four under the production sharing regime (presalt).

The next concession bid round is scheduled for Sept. 27, 2017 (Bid Round 14), and will offer 287 blocks located in 29 sectors of nine sedimentary basins. Similar to the previous concession rounds, the blocks offered in the Bid Round 14 are located in basins classified as (i) high potential basin (with the purpose of recovery and expansion of reserves and the production of oil and gas in Brazil); (ii) new exploratory frontier basins (areas where there is still limited geological information or technological barriers); and (iii) mature basins (highly exploited areas with opportunities particularly suited to small and mid-sized oil and gas companies).

In order to increase the number of players, the preliminary tender rules of Bid Round 14 established innovations, such as: (i) differentiated royalties, taking into consideration the geological risks, production expectations and other pertinent factors; (ii) reduction of the minimum net worth to qualify as a non-operator, which will be 25% of the value required for qualification as an operator; and (iii) adoption of a single exploration phase.

Under the concession regime, the bidding process takes into account only the value of a signature bonus and minimum exploratory program offered by the bidder (no local content anymore). Execution of a concession contract with ANP obligates the concessionaire (i) to perform a minimum exploratory program, and any further exploration activity that the concessionaire may decide to carry out, and (ii) in case of any discovery, the appraisal, development and production of oil and natural gas. Once the natural resources are exploited, the ownership of these hydrocarbons belongs to the concessionaire, subject to the payment of the government take, including royalties, and additional taxes.

Local content changes

In a significant departure from the past, local content will not be a specific component of the offer in the bidding process. Rather, minimum local content requirements will be imposed. However, at this time the requirements are considered to be more flexible and able to attend to industry needs.

Therefore, in addition to not being part of the offer in the bidding process, it was defined for the Bid Round 14 as a minimum of 50% for onshore blocks and, for the offshore areas, the minimum local content percentages are: (i) exploration phase - 18%; and (ii) production and development period - 25% for the well construction, 40% for the collection and offloading system, and 25% for the stationary production unit.

The purpose of such changes is to guarantee that the commitments represent a more realistic scenario, aiming at avoiding unnecessary disputes and possible huge penalties from ANP in the event of non-compliance or denial of waiver requests.

Production-sharing contracts

With respect to the production sharing regime, the bidding process carried out by ANP has different judgment criteria. Beyond the payment of a fixed signature bonus stated in the tender rules, the winning proposal is the one that offers to the government the highest portion of profit oil. Also, the winning bidder must enter into a production-sharing agreement with the Ministry of Mines and Energy (MME), as well as execute a consortium agreement with the government-owned company called Pré-Sal Petóleo S.A. (PPSA) and, depending on the case, with Petrobras.

The next bid rounds under the production-sharing regime are the 2nd and 3rd Pre-Salt Bid Rounds, both scheduled for Oct. 27, 2017. For each of the eight areas to be offered during the auctions, the CNPE has already defined the fixed signature bonus, the minimum percentage of the government’s profit oil, and modest percentages of local content.

As to the 2nd Pre-Salt Bid Round, ANP will offer non-contracted unitization areas - open acreage - in which the winning bidder shall enter into a unitization agreement negotiated between PPSA and the concessionaire(s). Over time, the unitization agreements may be amended by the winning bidder and the concessionaire(s) and submitted for the ANP’s approval.

Local content requirements

For the unitization areas to be offered in the 2nd Pre-Salt Bid Round, the CNPE determined the minimum local content as follows: (i) Carcará and Sapinhoá - 35% during the exploration phase and 30% during the development phase; (ii) Gato do Mato - 38% during the exploration phase and 60% during the development phase; and (iii) Tartaruga Verde - 55% during the exploration phase and 65% during the development phase.

In relation to the 3rd Pre-Salt Bid Round, the minimum mandatory local content must adhere to the following percentages: (i) 18% during the exploration phase; and (ii) in the development phase - 25% for well construction, 40% for the collection and offloading system, and 25% for the stationary production unit.

Petrobras’ role

In this context, in order to proceed with the upcoming bid rounds under the production sharing regime, the government decided to define in greater detail the role of Petrobras in the presalt area. As previously mentioned, the Pre-salt Law was amended in November 2016 to eliminate Petrobras’ exclusive right to serve as operator. Nonetheless, this amendment also established that Petrobras would have a preferential right to choose the areas in which the company intends to operate.

On May 2, 2017, the Brazilian president issued Decree No. 9.041 to regulate this concept. The Decree established that Petrobras has 30 days from the applicable CNPE resolution date to express its intention to assume the role as operator, indicating the chosen blocks and the participating interest intended, which cannot be lower than 30%.

The CNPE, in turn, after Petrobras’ expression of interest, shall propose to the President of the Republic the blocks to be operated by Petrobras, indicating its minimum participation in the consortium (between a minimum of 30% and that indicated by Petrobras).

According to the Decree, if Petrobras opts not to exercise this preferential right, the blocks can be offered in the bidding round, and Petrobras may participate on equal terms and conditions with the other bidding companies.

Still a hot topic of debate, for Petrobras’ interest areas, the Decree provides the company with the “pull out option” that allows it to refuse to enter into a production-sharing agreement with another company or consortium declared as the winner of the bidding round. This only applies in cases where the federal government’s profit oil percentage offered by another consortium is higher than the minimum percentage established in the tender protocol. In such cases, however, if the federal government’s profit oil offered by another consortium (winner) is equal to the minimum established in the tender protocol, Petrobras must join the consortium with the winning bidder.

This same Decree establishes that if Petrobras does not integrate into the consortium the winning bidder shall appoint the operator and the participating interest of each integrating party of the consortium - a necessary condition for the award of the block by the ANP.

It is expected that the tender protocol for each Pre-salt bid round will define the procedures related to the new composition of the consortium in the cases in which Petrobras enforces its “pull out option.”

Regarding the 2nd and 3rd Pre-Salt Bid Rounds, Petrobras has formally submitted to CNPE its interest in being the operator of three areas. With a minimum participating interest of 30%, Petrobras intends to operate the unitization areas adjacent to Sapinhoá Field - 2nd Pre-Salt Bid Round, and the areas of Peroba and Alto de Cabo Frio Central - 3rd Pre-Salt Bid Round.

With respect to the other five areas offered, Petrobras may participate on equal terms and conditions with the other bidding companies.

Concluding thoughts

In addition to the topics above, several other measures exist that aim to transform the oil and gas regulatory environment, such as: (i) better predictability for the obtaining of environmental licenses; (ii) encouragement of technological developments; (iii) increase in investments and competitiveness; (iv) encouragement of the exploration of new frontiers; and (v) “permanent offer” exploration and production areas.

Overall, the outlook for foreign oil and gas companies is bright in light of the significant investor-friendly regulatory reforms. While further reforms and adjustments are needed (better definition of the presalt polygon and elimination of Petrobras’ preferential right are some of them), the Brazilian oil sector is clearly seeking the right path toward creating a more robust future.

The authors

Bruno Triani Belchior is a partner of Tauil & Chequer Advogados in association with Mayer Brown in the Rio de Janeiro office. He is a member of the Corporate & Securities and M&A practices group and advises domestic and foreign companies in connection with project developments and business transactions in Brazil, Latin America and West Africa.

Leandro Duarte Alves is an associate in the Corporate and M&A practice of Tauil & Chequer Advogados in association with Mayer Brown in the Rio de Janeiro office. He focuses his practice on advising domestic and foreign oil and gas companies in Brazil.