Offshore staff

LONDON – Westwood Global Energy anticipates final investment decisions for 83 offshore greenfield developments this year, incurring total expenditure of $115 billion on infrastructure, equipment, and associated drilling services.

This figure includes $19.2 billion on FPSO/FLNG vessel awards, of which $5.5 billion will likely go on newbuild FPSOs.

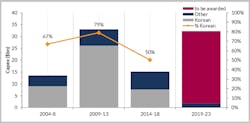

According to Westwood senior analystMark Adeosun, the three South Korean yards – Samsung Heavy Industries (SHI), Hyundai Heavy Industries (HHI), and Daewoo Shipbuilding & Marine Engineering (DSME) – dominated this sector until recently, accounting for 55% of orders and 73% of spending between 2004 and 2013.

However, oil companies have revised their approach to procurement in recent years, and this, alongside the improving EPC capabilities of rival yards in Singapore and China, has cut the South Korean share to 38% of orders and 50% of expenditure over the past five years.

Recent FPSO tenders such as Equinor’sJohan Castberg in the Barents Sea, Energean’s Karish in the Mediterranean Sea, and BP’s Tortue offshore northwest Africa, all went to non-Korean yards, via engineering specialists such as BW Offshore or TechnipFMC.

This was on reason for HHI’s proposed acquisition last month of DSME, which should close by 4Q, with HHI purchasing Korea Development Bank’s (KDB) 55.7% stake in DSME for around $1.78 billion.

In a statement, KDB chairman Lee Dong Gull said: “In order to fundamentally enhance the competitiveness of the industry, it is crucial to eliminate the inefficiency caused by overlapping investment under the current ‘Big Three’ structure.”

HHI reported last month that KDB would make a contribution-in-kind to the tentatively named Korea Shipbuilding & Offshore Engineering (KSOE), which will be established as a sub-holding company spun off from HHI to control the group’s shipbuilding companies, including HHI, by transferring its shares in DSME in return for an equity stake in KSOE.

In addition, the parties plan to establish the Korea Shipbuilding Industry Development Commission (again a tentative name), comprising industry, government, and academia experts to restore the shipbuilding industry’s ‘ecosystem.’ DSME’s management structure would remain unchanged

HHI will hope that improved cost efficiencies and reduced competition arising from the merger will position it better to challenge for the $30 billion of newbuild FPSO/FLNG projects set to be awarded over the next five years, Adeosun said. However, it still requires approval from anti-trust regulators in various countries especially from rivals elsewhere in Asia.

04/08/2019