Offshore staff

OSLO, Norway – Qatar’s decision last year to lift its moratorium on gas production from the giant offshore North Field could have a major impact on the global LNG balance, according to analyst Rystad Energy.

The decision will allowQatargas to export more LNG volumes, with plans to build three new liquefaction trains with a total capacity of 23.4 MMt.

This would increase Qatar’s total export capacity by more than 30% to 100 MMt, the analyst said.

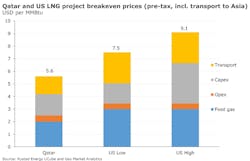

At the same time various liquefaction trains in the US are moving toward a final investment decision (FID). Qatar’s proposals represent a challenge for these projects because its breakeven price is the lowest of all planned LNG schemes around the world.

Rystad estimates around $5.60 per MMBtu (including transport to Asia) for the North Field brownfield expansion, roughly 34% below the breakeven price of the more competitive US projects, which are in the range $7.50-$9.10 per MMBtu (including transport to Asia).

The main reasons for the discrepancy are that Qatar’s natural gas production costs are below those in other regions, and its proximity to the major buyers in the Asian markets.

Earlier this year Qatargas signed a front-end engineering design (FEED) contract. The company has not so far disclosed the signing of long-term supply agreements, but according to Rystad, Chinese buyers could be especially interested in signing new agreements.

This is because exports from the US to China could eventually be subject to tariffs, assuming the trade war between the two countries continues to escalate.

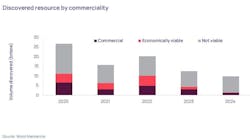

The analyst predicts that at least 56 MMt of new LNG supplies will be needed globally by 2025, and that if Qatar does commission the new trains, the volumes could come online by the start of 2023.

In that case an additional 33 MMt of capacity would be needed by 2025 to keep the market balanced.

Other prospective suppliers are theoffshore Mozambique LNG and offshore Equatorial Guinea FLNG schemes, both in advanced negotiations.

However, for these projects to provide the required additional capacity development would need to start by 2020. On the other hand, if too many projects move to FID, this could create a loose market with depressed prices post-2020.

Many of the planned offshore and onshore LNG projects have not secured project financing since the developers need to sign long-term supply agreements that can guarantee they can meet their financial obligations.

07/05/2018