Possibly one more merger left in the drilling rig market, analyst says

Bruce Beaubouef * Houston

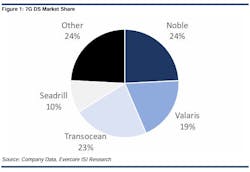

The offshore drilling industry has experienced a decade of active M&A, primarily led by the “Big 3” offshore drilling companies, as described by Evercore ISI in its latest Offshore Rig Market Snapshot. The “Big 3” include Transocean, Noble, and Valaris.

Transocean acquired Aker Drilling in 2011, Songa Offshore in 2018, and Ocean Rig in 2018, strengthening its position as a leader in ultra deepwater and harsh environment drilling.

Valaris also pursued accretive transactions, acquiring Pride International in 2011, Atwood Oceanics in 2017, and Rowan Companies in 2019.

Noble acquired Frontier Drilling in a $2.16 billion cash transaction in 2010 and Pacific Drilling in 2021 and merged with Maersk Drilling in 2022. Noble rolled in Diamond Offshore (transaction closed on Sept. 4), adding ~$2 billion to the backlog and 12 offshore floaters to its fleet portfolio. The company now operates a fleet of 41 offshore rigs, including 28 floaters and 13 jackups.

“We believe consolidation in the offshore drilling industry is becoming increasingly challenging and competitive due to regulatory risks involving antitrust laws and a lack of synergies,” Evercore wrote. “However, our view is that there may be one more merger left in the offshore drilling space, which could further strengthen the pricing power offshore drillers already have, boost earnings power, realize efficiency, and help deleverage.”

Evercore says that discussions on M&A continue to be brought up in its conversations with offshore drillers and earnings calls, and asset and/or corporate acquisitions are viewed positively among CEOs. As reported by Reuters, Simon Johnson, CEO of Seadrill, said at a recent investor conference in Norway that Seadrill is on the lookout for asset acquisition or a potential opportunity to merge with another driller. He also highlighted that the company is open to acquiring distressed assets or a competitor with a distressed balance sheet.

Anton Dibowitz, CEO of Valaris, said at an event in August that he does not feel compelled to have M&A to be a leading player in the offshore drilling business. However, according to Evercore, Valaris will continue to explore strategic M&A and pursue it if it is accretive for the company’s shareholders.

Evercore also notes that it recently met with Jeremy Thigpen, CEO of Transocean, and Patrick Schorn, CEO of Borr Drilling. While their current focus remains on free cash flow generation and deleveraging, they are willing to explore M&A opportunities, if accretive to shareholders.

Meanwhile, the international jackup market remains resilient, despite Saudi Aramco’s rig releases, according to Evercore ISI’s latest Offshore Oracle report.

The report concedes that Saudi Aramco’s decision to release jackup rigs continues to raise questions about the future prospects of the Middle East jackup market, which has been a region that has absorbed assets globally over the past few years.

The Kingdom’s decision to maintain the government’s maximum sustainable capacity (MSC) directive, issued in January 2024, at 12 MMBbl/d and the shift in priorities toward natural gas have resulted in the deferral of two oil expansion projects and decreased infill drilling in oil fields, leading to the release of ~22 jackups year-to-date.

The Kingdom expects to release an additional five jackups, bringing the total number of jackup rigs to 27.

However, jackup rigs from the initial releases have been picked up in other high-spec markets, including Southeast Asia, West Africa, and the Middle East/East Mediterranean. Following the first wave of releases, five jackup rigs have been recontracted at higher dayrates (double in some cases), including three ADES Admarine rigs, one COSL rig, and one Borr Drilling rig.

The report did state that rig demand is expected to further decline in the Middle East before recovering in 2026 and beyond. Demand in the Middle East dropped from the peak of 173 rigs to 157 rigs under contract in August (from 183 to 172 contracted rigs). Under contract demand is anticipated to remain suppressed in 2025 (average of ~150 rigs) before recovering in 2026 to ~175 rigs. The pickup in demand will be driven by a combination of at least 10–15 rigs of the 27 suspended rigs expected to return to Saudi Aramco and incremental demand in Qatar, the UAE, Kuwait, and the neutral zone.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.