Offshore activity growing, but vessel pressures causing concern

Offshore staff

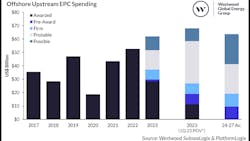

LONDON — Offshore engineering, procurement and construction (EPC) investments for 2023 could total $62.5 billion, with $29 billion awarded in the year to date, according to Westwood Global Energy Group.

Main regions for activity in terms of spending are the Middle East (48%), Southeast Asia (20%) and Latin America (8%).

Offshore drilling rig contracting has also surged this year, Westwood said, with 125 years of rig backlog added in the third quarter alone. And there is a trend toward extended duration of new contracts and tenders, as offshore operators move to secure long-term capacity.

Average day rates for the marketed jackup fleet reached $165,000/d in the third quarter, with drillships commanding nearly $425,000 per day for new assignments and day rates for harsh environment semis up to $500,000 per day for the first time since 2015.

Vessel forecast

There has been a knock-on effect on support activity, with the number of offshore support vessels active rising to 3,077, mostly platform supply vessels (PSVs).

PSVs in the 2,000-4,000 dwt category have seen the biggest increase in activity. While for anchor-handling tug supply vessels, the main growth has been in the 12,000-16,000 bhp segment. Much of this is due to owners shifting vessels to the Middle East to support drilling activity in the region.

Of the 620 laid-up vessels globally, about 40% are premium (less than 15 years old), a 4% drop on 2022 as vessel reactivation has picked up.

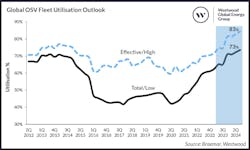

Westwood expects the global effective vessel utilization (excluding laid-up vessels) to reach 83% by third-quarter 2024.

However, pressures to comply with local content, age restrictions and operators’ demands for low emissions are impacting owners of aging fleets.

Over the next two years, more than 600 vessels will be more than 15 years old, the consultant predicts, and with only 25% of newbuild vessels in the Tier 1 category (those set to be delivered in the next 12-24 months), the premium fleet could contract markedly over the next few years without a further influx of new orders.

And the shortage of vessels under 15 years old is causing E&P companies to reassess their age restrictions for future operations.

10.10.2023