Testing supply and accelerating alliances: Tiebacks drive subsea rebound

Key highlights:

- Subsea project sanctioning activity is expected to rebound over the next three years, peaking in 2028, with tiebacks accounting for more than 50% of capital expenditures.

- Supply chain constraints and capacity challenges may cause delays and shortfalls in subsea tree deliveries, especially for high-risk projects in regions like Angola, Nigeria and Brazil.

- Major operators are increasingly forming strategic partnerships with key subsea tree suppliers to ensure supply reliability.

- The growth in subsea tiebacks is driven by the need to leverage existing infrastructure, offering lower costs and shorter lead times, with Norway, Guyana and West Africa as key regions.

- Market competition is intensifying among a limited number of suppliers, with alliances and integrated contracts playing a crucial role in securing project awards amid rising demand.

By Marit Lenes, Rystad Energy

A rebound in sanctioning activity of subsea projects is expected over the next three years, following a brief dip in 2025. Accelerating subsea final investment decisions (FIDs) are expected to drive increased subsea tree award activity, peaking in 2028. The anticipated upswing coincides with a subsea supply chain already operating under capacity constraints, potentially straining execution capabilities and delaying the progression of some projects.

A key focus for operators moving forward with new subsea projects is the growing emphasis on subsea tieback developments. Leveraging existing infrastructure, tiebacks offer lower costs, shorter lead times and risk mitigation. As a result, tiebacks are expected to represent a significant share of the upcoming near-term increase in subsea tree awards, with a compound annual growth rate (CAGR) of 30% over the next three years.

Despite the advantages of tieback developments, questions remain about the ability of subsea tree suppliers to meet rising demand. Major operators are expected to strengthen their market presence, with an increasing focus on strategic partnerships with subsea tree suppliers to navigate the challenges of tightening availability. The pressure on suppliers to deliver the required volumes may challenge their capacity and test whether current operator strategies and partnership models can meet rising demand.

What is a subsea tieback?

Rystad Energy defines subsea tiebacks as offshore production facilities that are completely submerged with a wet wellhead located at the seabed, consisting of subsea templates, wells, trees and manifolds. Subsea installations are tied into a floating, fixed or onshore installation for processing and export.

Last year’s subsea sanctioning activity has seen a modest decline in greenfield investment commitments. Heightened geopolitical tensions and oil price uncertainty have led operators to adopt a more cautious approach, resulting in delays to FIDs.

Despite the current slowdown, activity is expected to accelerate over the next three years. Rystad Energy assesses that most projects are being deferred rather than cancelled as operators wait for more favorable market conditions. Subsea tieback developments are expected to represent more than 50% of upcoming sanctioning activity in terms of capital expenditures (capex) over the next three years, with an anticipated annual growth rate of 15%. Europe is expected to account for one-third of these investments during this period.

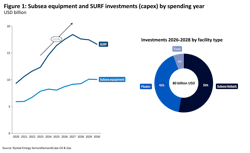

Subsea spending allocations indicate that subsea umbilical, riser and flowline (SURF) capex will experience an 11% CAGR from 2023, peaking in 2027 (Figure 1). This growth is primarily driven by the increased use of subsea tieback developments—a trend expected to continue through 2027.

After this peak, SURF spending is anticipated to decline slightly but remain at a relatively high level throughout the decade.

By contrast, subsea equipment capex is expected to increase steadily over the decade. While this growth is also largely driven by subsea tieback developments up to 2027, it is further maintaining its investments beyond 2027 due to a stable share of floater activity expected. Compared to tiebacks, SURF capex is less impacted by floater developments; floaters require fewer kilometers of SURF lines per subsea tree than tiebacks, which contributes to the expected slight decline in SURF spending after the tieback peak in 2027.

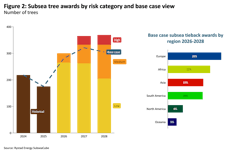

Considering subsea trees specifically, a peak in awards is expected in 2027-2028. As demand rises, uncertainty grows over whether industry supply capacity can keep pace, raising the risk of annual delivery shortfalls.

In Rystad Energy's base case for the next three years, approximately 12% of all awards—representing roughly 40% of medium- to high-risk awards—may not materialize. Several subsea projects face elevated risks of deferral or cancellation, primarily due to high breakeven prices that can render some developments uncommercial. These projects are particularly vulnerable to delays if oil prices decline or if supply chain costs increase.

Additionally, portfolio prioritization may lead companies to defer smaller or higher-risk projects in favor of focusing on flagship developments. Impacted developments mainly include projects in Angola, Nigeria, Indonesia, Malaysia, the US and Brazil. A significant number of these awards are linked to large floating production, storage and offloading (FPSO) vessel projects and fixed-platform developments.

By contrast, tiebacks dominate the base-case pipeline: 65% of low- to medium-risk awards between 2026 and 2028 are subsea tieback projects. Norway accounts for approximately 15% of these projects, with major subsea tiebacks on the Norwegian Continental Shelf (NCS) driven by the Equinor-operated Troll, Johan Castberg and Grosbeak projects, as well as Var Energi’s Balder-Ringhorne and Gjoa schemes. Other notable upcoming tieback projects include Area 4 LNG Phase 1 in Mozambique, the Turbot and Tripletail projects in Guyana, both of which are tied back to the ExxonMobil-operated Longtail FPSO, and the Preowei project in Nigeria, tied back to the TotalEnergies-operated Egina FPSO (Figure 2).

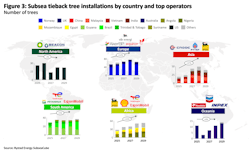

Major oil companies and national oil companies with international operations are expected to lead the majority of upcoming tieback projects. Subsea tieback tree installations are projected to experience significant growth toward the end of the decade, with a CAGR of 14% globally from 2025 to 2028.

Norway is expected to account for 26% of the global market share during this period, driven by a CAGR of 12% in the number of tieback trees installed from 2025 to 2028. As demand for these installations’ surges, certain operators are likely to take the lead. Norwegian operators are increasingly focused on utilizing existing infrastructure at mature fields on the NCS, as large standalone discoveries are becoming less common.

Equinor, with its extensive field base in Norway, is expected to account for 14% of global tieback installations over the next three years. ExxonMobil follows closely, with a 10% share, due to its extensive tieback projects in Guyana, but the US major is also expected to extend its regional exposure over the next years, particularly in Angola and Mozambique. TotalEnergies rounds out the top three, contributing 7% of the global share through upcoming installations, with the French major also set for regional expansion into key countries Nigeria, Angola, Mozambique and Suriname.

These operators are increasingly focused on maximizing the value of existing offshore infrastructure and expanding regionally, driving higher demand for subsea tieback solutions in key regions.

Despite an extensive base of operators driving the upcoming demand for subsea tieback trees, the number of tree suppliers is limited, with only four key providers: TechnipFMC, OneSubsea, Baker Hughes and newcomer Trendsetter Engineering, which in 2025 acquired the subsea tree product line from Innovex International.

The SURF market has a wider range of players, but only a few dominate, with TechnipFMC, Saipem and Subsea7 together holding 60% of the market share. The growing demand will put significant pressure on these suppliers to meet the required volumes driven by subsea tieback developments.

For operators, building strong relationships with market leaders through long-term partnerships, integrated contracts and framework agreements will be crucial to securing reliable supplies.

In recent years, only TechnipFMC and the Subsea Integration Alliance between Subsea7 and OneSubsea have been awarded integrated contracts, primarily due to their ability to deliver complete end-to-end subsea packages, covering both subsea trees and SURF scopes. During recent years, these two suppliers have supplied mainly the major players Petrobras, Equinor, ExxonMobil, bp and TotalEnergies—a scenario that is set to continue.

In contrast, Baker Hughes, with expertise in both subsea production systems and SURF through its alliance with Ocean Installer, has managed to maintain a strong position in the subsea market by serving a broader range of mid-market operators, including Var Energi, Azule Energy, India’s Oil & Natural Gas Corp., China National Offshore Oil Corp. and Eni.

As demand increases, secondary suppliers may find new opportunities to provide integrated subsea equipment and infrastructure to both major and smaller operators. With supply capacity becoming increasingly critical, smaller suppliers could gain a competitive edge as operators face longer lead times and potential delays in securing key subsea equipment.

Consolidation strategies, such as alliances or partnerships, could strengthen these suppliers’ subsea portfolios by combining capabilities, enhancing delivery capacity in a supply-constrained market and aligning more closely with operator strategies and market trends.

Alternatively, rising demand could force operators to adapt their strategies to better align with the portfolios and business models of suppliers. This could lead to a shift away from integrated contracts and long-term partnerships, with greater focus on maximizing the potential by utilizing a broader set of suppliers.

About the Author

Marit Lenes

Marit Lenes is a supply chain analyst with Rystad Energy, specializing in the subsea market with a focus on the supply and demand of subsea equipment, SURF and subsea services. She holds a master's degree in engineering and ICT, with a specialization in petroleum geosciences and engineering, from the Norwegian University of Science and Technology.