Subsea spending on upward track for next four years

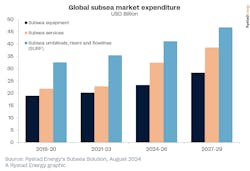

Global expenditure on subsea facilities is set for a 10% compound annual growth rate (CAGR) from 2024 to 2027, according to research by Rystad Energy.

The consultants project a total capex spend for the period of more than $42 billion.

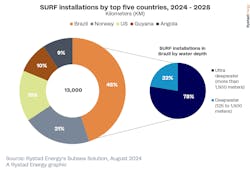

Some of the biggest investments are taking place in South America and Europe. In Brazil, spending on subsea equipment and the SURF segment is set to increase 18% this year to $6 billion, much of this on presalt projects.