North Sea trends could cause drift of semisubmersible rigs to other regions

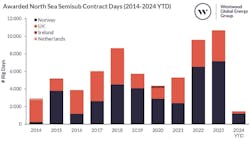

So far in 2024, the awarded days for the North Sea semisub fleet has totaled 1,468 days, with Norway accounting for 1,195 days, and the UK 273. That represents a major slump from last year’s 7,158 days in Norway and 3,524 days in the UK.

Although there are no outstanding semisub requirements for work in the North Sea this year, RigLogix has identified three rig tenders in UK waters and one offshore Norway for work likely to start in 2025 and 2026, totaling 910 days. There is tentative demand totaling 13,803 days offshore the UK, Norway and Ireland.

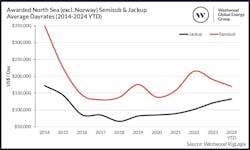

Outside Norway, semisub day rates are some of the lowest globally with the decline starting in 2022. North Sea jackup day rates have been moving in the opposite direction since 2018, currently averaging just over $132,000/d.

At the same time, Westwood has noted that several drilling contractors with rigs currently based in Norway and the UK have been bidding them for work in Southeast Asia, the Mediterranean Sea, Africa and the Falkland Islands.

While there are big P&A opportunities in the UK North Sea (more than 2,200 wells set to be plugged and abandoned between 2024 and 2033, 39% of them subsea), operators have been deferring programs, Gammack said, citing high rig day rates.