Offshore rig demand surges, yet new orders remain elusive

By Angel Gutierrez, S&P Global

Over the last three years, the offshore rig market has been experiencing intense demand signals, reminiscent of past booms; however, rig contractors are exercising caution when it comes to building new units. Despite marketed utilization rates above 90% and significantly increased day rates – up to and above $180,000 for jackups and over $500,000 for drillships – there have been no new orders. This reluctance is primarily due to limited access to capital and rising costs, with jackups priced at $250-300 million and drillships at over $850 million. Financial analysts indicate that long-term contracts with high day rates are necessary to justify newbuilds.

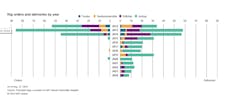

Currently, 32 rigs are under construction, compromising 14 jackups, eight drillships, six semisubmersibles, and four tenders. So far this year, three drillships and six jackups have been delivered. Six rigs are slated to be delivered this year, with 18 more on the books for next year, and the final eight penciled in for 2026. However, it should be noted that it is unlikely that many of these rigs will be delivered as planned and some will probably never be delivered.

Out of these 32 rigs, only five were ordered with contracts in hand or by operators themselves, but four of those rigs are part of Sete Brasil and those original charters were cancelled years ago and there is no sign they will ever be re-awarded. The future of the four units remains unclear, as market sources suggest that the rigs may either be converted, sold, or scrapped. Sete Brasil drillships Arpoador and Guarapari were relocated to Singapore from Brazil in 2023, while semisubmersibles Urca and Frade remain stranded in Brazil.

Chinese shipyards are currently constructing more rigs than their counterparts in other countries, with 18 rigs being built in China, specifically 10 jackups, three drillships, three tender rigs, and two semisubmersibles. In contrast, Singaporean shipyards are constructing a total of six rigs, comprising two jackups, two semisubmersibles, one tender rig, and one drillship.

In addition, Diamond Offshore also secured marketing rights for the seventh-generation Draco drillship from Eldorado Drilling earlier this year to market the rig in Latin America, West Africa, Malaysia, and Indonesia. Draco remains undelivered at SHI. However, Diamond is now working through a planned merger with Noble Corp. that is expected to close by the first quarter of 2025, which could impact the marketing of Draco.

As for semisubmersibles nearing the end of construction, Beacon Pacific remains at the CIMC Raffles Shipyard in China, where it is undergoing preparation work for potential opportunities. The rig is not yet completed but the final class certification is ongoing, and outstanding activities include the final system integration test and renewing the Certificate of Compliance. Beacon Pacific remains available for charter or purchase, and is being actively marketed.

Nearly all of the rigs currently being built were ordered speculatively, and very few have actually picked up a contract in the time since construction started. Of the 27 speculative units currently being built, only two newbuild jackups in China have been awarded contracts since construction started. Earlier this year, COSL completed the acquisition of four jackups initially ordered by Seadrill from Dalian Shipbuilding Offshore Company. These units were West Hyperion, West Rhea, West Tethys and West Umbriel. West Hyperion was scheduled to be delivered to COSL in August and is now named Hai Yang Shi You 948. Once delivered, the rig is expected to begin operations in China.

As for the second newbuild jackup that has secured a charter, China Petroleum Offshore Engineering (CPOE) jackup Zhong You Hai 21 is expected to leave a Chinese shipyard in August after finishing its re-activation program. The DSJ-design unit will be put to work in Bohai Bay for CNOOC under an initial one-year charter. The rig is a sister unit to Zhong You Hai 20, which was delivered in 2023 and also working in Bohai Bay for CNOOC. The two units were ordered speculatively in 2012 and built by China Petroleum Liaohe Equipment Company shipyard, but later fell under the auspices of parent company China National Petroleum Company and CPOE after the yard quit the offshore construction sector.

In May, Gulf Energy entered into a non-binding Letter of Intent (LOI) with Titan Drilling to utilize the newbuild jackup TS Jasper for an exploration well. Gulf Energy plans to use the rig to drill its Lion prospect offshore Australia in mid-2026, which could potentially contain up to 10 Tcf of recoverable gas resources. The KFELS N Plus design unit was initially ordered in 2014, but Keppel terminated the rig contract in 2022 due to non-payment by the owners. Currently in Singapore, the rig is expected to be delivered by the end of 2025 and will be available in the Australian market for about a year before Gulf Energy deploys it.

The average slippage in delivered rigs over the last decade has been about 2.4 years (longest 13 years, shortest 21 days), but that has gotten much longer. For the rigs delivered in 2023, the average slippage was seven years.

After being left with unfinished rigs and huge debts, the decision of several shipyards to limit their involvement in rig building going forward and instead focusing on other shipbuilding has limited the industry’s rig construction capabilities, which was exacerbated by a shortage of experienced workers and supply chain issues. High downpayment requirements – over 70% in Singapore and 30% in China – have priced out speculative investors. As a result, many contractors are shifting focus to reactivating stranded or cold-stacked units, which have become more attractive due to their lower costs and quicker market availability. The Middle East has recently absorbed over 50 jackups, illustrating this trend. However, bargains are becoming rare as the most desirable rigs have already been acquired, leaving fewer options for potential new orders.

Reactivating cold-stacked floaters costs between $70-125 million and can take up to 18 months. Jackups are generally cheaper to reactivate, costing around $5-15 million, although in some cases it can go up to $40 million. Currently, there are 62 jackups, 15 drillships, and 14 semis cold stacked, but many are older and in poor condition. Despite these challenges, rig contractors are benefiting from higher day rates and are starting to return dividends to stakeholders.

Instead of pursuing newbuilds, the industry may shift towards upgrading existing rigs to enhance efficiency and reduce emissions. Popular upgrades include offline capabilities for jackups and advanced drilling systems for floaters, such as managed pressure drilling (MPD) and backup blowout preventer (BOP) systems. The introduction of the 20,000-psi BOP stack represents the latest in drilling technology, offering new opportunities in challenging environments, albeit with a significant investment and lead time similar to newbuilds.

Looking at rig orders and deliveries since 2012, ordering of new rigs has been minimal with only eight orders made in the last nine years and none so far in 2024, while rig deliveries have averaged around 11 units per year since 2020. Any future rig orders will only take place on the back of a substantial long-term contract at an extremely attractive rate but given the number of units already in the market and that high cost, such a scenario looks unlikely in the short term.

About the Author

Angel Gutierrez

Angel Gutierrez joined Petrodata in 2014, initially focusing on the offshore supply vessel market in the Americas until 2021. He then transitioned to Petrodata’s international team, specializing in the offshore rig market. Currently, Angel oversees North America reporting and leads the team analyzing the rig market across the Americas. He actively contributes to the market intelligence tool Petrodata Rigs by S&P Global, including the World Rig Forecast: Short Term Trends. Angel holds a Bachelor of Science degree in Hospitality from the University of Houston.