Report: Jackup market remains resilient, despite Saudi Aramco’s rig releases

By Bruce Beaubouef, Managing Editor

The international jackup market remains resilient, despite Saudi Aramco’s rig releases, according to Evercore ISI’s latest Offshore Oracle report.

The report concedes that Saudi Aramco’s decision to release jackup rigs continues to raise questions about the future prospects of the Middle East jackup market, which has been a region that has absorbed assets globally over the past few years.

The Kingdom’s decision to maintain the government’s maximum sustainable capacity (MSC) directive, issued in January 2024, at 12 MMBbl/d and the shift in priorities toward natural gas have resulted in the deferral of two oil expansion projects and decreased infill drilling in oil fields, leading to the release of ~22 jackups year-to-date.

The Kingdom expects to release an additional five jackups, bringing the total number of jackup rigs to 27.

However, jackup rigs from the initial releases have been picked up in other high-spec markets, including Southeast Asia, West Africa, and the Middle East/East Mediterranean. Following the first wave of releases, five jackup rigs have been recontracted at higher dayrates (double in some cases):

- ADES Admarine 694 was awarded a contract (1 year + 18 month option) in Qatar with TotalEnergies;

- ADES Admarine 502 was awarded an 18-month (+9-month option) contract with PTTEP in Thailand;

- ADES Admarine 262 was awarded a 21-month contract with SUCO in Egypt;

- COSL Zhenhai 6 was awarded a long-term contract with CNOOC in China; and

- Borr Drilling Arabia I was awarded a 1,460-day (+options) contract with Petrobras in Brazil.

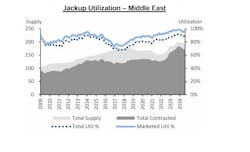

The report did state that rig demand is expected to further decline in the Middle East before recovering in 2026 and beyond. Demand in the Middle East dropped from the peak of 173 rigs to 157 rigs under contract in August (from 183 to 172 contracted rigs). Under contract demand is anticipated to remain suppressed in 2025 (average of ~150 rigs) before recovering in 2026 to ~175 rigs. The pickup in demand will be driven by a combination of at least 10–15 rigs of the 27 suspended rigs expected to return to Saudi Aramco and incremental demand in Qatar, the UAE, Kuwait, and the neutral zone.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.