Report: ‘Big 3 offshore drillers’ reporting increasing day rates, ‘robust’ outlook

By Bruce Beaubouef, Managing Editor

The “Big 3” offshore drillers – listed as Transocean, Noble Corp., and Valaris by Evercore ISI – are all reporting “strong offshore fundamentals and a robust outlook” that will likely stretch out to 2030, according to a recent report by the oilfield marketplace consulting firm.

Evercore based its analysis on information presented by the three offshore drilling contractors in back to-back earnings calls held in early August.

“Years of underinvestment and an increasing focus on energy security and reliability continue to drive multi-year growth,” Evercore wrote. “Oil prices are relatively stable at ~$80/bbl Brent and are expected to remain elevated due to increasing demand, geopolitical constraints, and OPEC’s prudent supply decisions. High oil prices and a renewed view on the longevity of the offshore upcycle, de-risking the cyclical nature of the oil and gas industry, will likely shape 2025+ to be a growth year globally.”

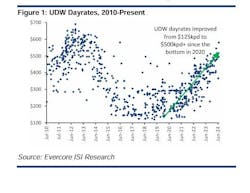

“We believe [that] the offshore drilling subsector is still in the early innings of a multi-year upcycle,” the firm wrote. The analysis noted that day rates have rebounded sharply for select rig classes, with incremental demand emerging from key geographies. Leading edge day rates are hovering around $500,000/day, with an increasing number of contracts being awarded in the low- to mid-$500,000/day range. Marketed utilization for both floaters and jackups has materially improved to the high 80s and low 90s percentage-wise, respectively.

Despite a rapid uptick in dayrates, newbuilds remain scarce and rig reactivations are slower than expected, “which makes us believe higher dayrates are highly likely, especially in late 2025 or 2026,” Evercore wrote. “We anticipate contracting activity, which was somewhat slow in 1H24, to recover as the robust FID pipeline translates to fixtures, further tightening rig supply.”

The firm noted that eleven projects have reached FID year-to-date, with nine projects being either shallow or deepwater. Another 20+ projects are expected to reach FID by the end of the year, which compares to a total of 24 sanctioned projects in 2023. Eleven projects account for $30+ billion of committed investment (three-plus billion boe of reserves) and are mostly comprised of deepwater FPSO developments. Remaining projects are likely to exceed $80 billion of investment, and the total committed capex in 2024 is likely to stay in line or slightly below the approximately $125 billion seen in 2023, with the majority expected to be allocated to offshore development.

Evercore said that contracting activity in the first half of 2024 has been somewhat slow due to 1) capital discipline and stakeholder alignment complexities, 2) supply chain constraints resulting from the sharp rise in global project backlogs over the past few years, and 3) E&P consolidations. The backlog for the deepwater rigs will likely remain flat into 2025 before recovering in 2H25.

Nevertheless, the firm also noted that offshore fundamentals are well supported by increasing demand for hydrocarbons and stable commodity prices as OPEC+ effectively manages supply. Brent spot prices are currently trading at ~$80/bbl and the five-year forward prices remain at the $70/bbl level, which continues to support the longevity of the current offshore and international upcycle.

“We anticipate contracting activity for UDW [ultra-deepwater rigs] to meaningfully improve in 2H25-plus,” the firm wrote. The Golden Triangle comprises 75%+ of the global UDW market, Evercore said, noting that there are currently 34 rigs in Brazil (up from 27 rigs last year), five rigs in Guyana, and one rig in Colombia, but none off Suriname. This region is expected to add five more rigs to 45 rigs by 2026, the report noted. The key drivers of the incremental UDW opportunities in Latin America are the Sepia and Roncador tenders, Evercore said.

As for the US Gulf of Mexico, the firm noted that “despite active upstream consolidation…this region [has] remained stable, with a current activity of 23 deepwater rigs. We anticipate [that] the US GoM and Mexico [will] remain flat in the near term.”

The report added that West Africa currently has about 18 contracted UDW rigs (a slight decrease from last year), which is currently being led by Angola with seven rigs.

Evercore also noted that “there are many offshore projects in the pipeline expected to reach FID over the next several years across Mozambique, Ghana, Nigeria, and Namibia.” Namibia could mature into a market with at least three to five rigs; it currently has one active rig, the report said. In aggregate, Africa could drive incremental UDW rig demand of five-plus units by 2026.

The Mediterranean and Black Sea regions could lose one unit over the next one to two years, while Indonesia is anticipated to add a couple more rigs in the Far East region starting in late 2025 or 2026. Harsh environment markets across Norway, the UK, and Canada are expected to remain flat.

The report also noted that Saudi Aramco plans to release five additional rigs. Earlier in March, the company announced plans to reduce capital investment by ~$40 billion between 2024 and 2028, primarily due to the Kingdom’s decision to maintain productive capacity at 12 MMbbl/d. This resulted in the deferral of the Safaniyah expansion project (+700 MMbbl per day/$26 billion) and the Manifa expansion project (+300 MMbbl per day/$6 billion), which are now forecasted to achieve FIDs in July 2026 and February 2027, respectively, according to Wood Mackenzie.

With the deferral of two oil projects and the country’s focus shifting to gas, Aramco has suspended 22 rigs to date, with at least six rigs already securing work in other regions. Although Saudi Arabia is expected to release at least five additional rigs, Evercore says that it does “not anticipate any meaningful deterioration in jackup day rates.”

Day rates for both floaters and jackups are on the rise, Evercore said. The primary drivers of higher rig day rates are tight rig supply; drillers remaining disciplined about rig reactivation; a lack of newbuilds; and natural rig attrition.

“We are seeing an increasing number of contracts above $500,000/day,” the report observed. Notably, leading edge day rates for UDW floaters are in the 500,000/day range, although “some drillers might take lower day rates for long-term contracts or short-term contracts to fill whitespace.”

Evercore said that in the near term (over the next year), there could be five to ten incremental seventh-generation drillships that could enter the market. But despite this, the firm said that “we expect day rates to further climb as operators continue to scramble for high-quality assets and development projects [continue to] materialize.”

The report also noted that day rates for harsh environment jackups are also on the rise, with leading edge day rates rising above $150,000/day.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.