Steel demand adds to supply chain complexities

Editor's note: This story first appeared in the 2023 Offshore Wind Special Report, which published within the September/October 2023 issue of Offshore magazine.

By Sarah McLean, Spinergie

As the energy transition progresses and offshore wind energy production rises, there will be increased reliance on raw materials, especially steel. Vast quantities of steel are required for many components of an offshore wind installation but mainly for the foundations. To further compound this, foundations, which are already very large, heavy structures, are increasing in size with the newer XXL monopiles reaching more than 2,000 tons.

Spinergie currently forecasts that 149 GW of fixed bottom offshore wind capacity will be added to the global tally (excluding China) by 2030. This goes hand in hand with an anticipated significant uptick in steel demand. For context, the Global Wind Energy Council (GWEC) has stated that 90% of wind turbine components are made with steel (the remaining 10% comprises other raw materials including copper, lead, concrete, electronic scrap, etc.). This includes the tower, nacelle and generators as well as the increasing-in-size foundations.

Therefore, accurate forecasting methods are becoming increasingly important to help market players assess demand and stay a step ahead when navigating the complexities of a tightened global supply chain.

Monopile foundations are prime examples in forecasting steel demand for offshore wind. To date, monopile foundations (essentially large, hollow steel cylinders) are the dominant type of foundations used in offshore wind. Current estimates indicate that monopiles are expected to be the choice for between 70% and 80% of bottom fixed wind farm projects, especially in shallow-water depths. By examining the four main features of a monopile foundation—its length, the embedded length, the outside diameter and the wall thickness—alongside demand analysis, turbine specifications and environmental parameters, it is possible to predict how much steel will be required either by project, regional or global scales.

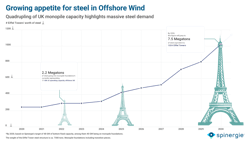

To give a key example, Spinergie analysis has determined that the UK has installed 13.5 GW of offshore wind gross capacity so far in 2023, which includes 10.9 GW on monopile foundations. This translates into 2.2 megatons of steel required only for monopiles—a huge quantity that totals as much steel as 303 Eiffel Towers. Therefore, it can be deduced that to meet its 2030 target capacity of 50 GW, the UK is poised to require more than 1,000 Eiffel Towers’ worth of steel in monopile foundations for offshore wind alone.

This all comes alongside an overall tightening of the global supply chain with numerous threads, which must be navigated and tied together to bring an offshore wind project to completion. A main thread in the global supply chain is manufacturing with the industry already expressing concern around the potential for bottlenecks. While there is not yet any suggestion of a global steel shortage in the run up to 2030, it is still uncertain whether the pace of manufacturing will be able to meet this increased demand. This will be especially true for regions that currently lack domestic manufacturing and infrastructure. Following on from that thread, a lack of ports and vessels must also be considered.

Along with this rising demand, it is important to note that steel prices have seen some volatility in recent years. The GWEC reported that prices increased by 50% from the start of 2020 to the end of 2021, with further impact due to Russia’s invasion of Ukraine. While prices have fallen again in 2023 to date, forecasted rising demand may cause further spikes.

It is imperative that developers look toward accurate forecasting to remain ahead of the curve and ensure each step of a development is carefully considered. The tightened supply chain, including steel and other raw materials required in installation components, presents numerous logistical challenges for developers and other stakeholders as they race to meet those ambitious global 2030 wind capacity targets.