Spinergie assesses how much steel a country requires to reach its offshore wind target

Offshore staff

PARIS — Spinergie says forecasting steel demand in offshore wind is no longer a guessing game. The data analytics provider can accurately predict the size and weight of monopile foundations, and it uses many parameters to estimate monopile metrics at the wind farm level, including its market intelligence data, dynamic loads from the wind, hydrodynamic forces from the waves, weight of the turbine and soil conditions.

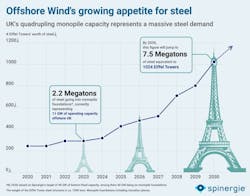

The UK already has installed 13.5 GW of offshore wind gross capacity this year, including 10.9 GW on monopile foundations. This translates into 2.2 megatons of steel for monopiles only, which Spinergie says is "an unimaginable quantity." This totals as much steel as 303 Eiffel Towers.

The energy transition relies heavily on raw materials such as steel. To meet its 2030 target capacity of 50 GW, the UK is poised to total more than 1,000 Eiffel Towers’ worth of steel in monopile foundations for offshore wind alone.

WTIV analysis

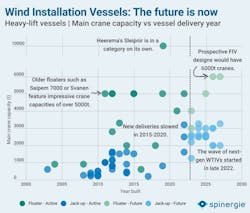

A week ago, Jan De Nul Group’s Les Alizés entered the Red Sea and headed to Europe. The vessel is ahead of the pack of next-gen WTIVs scheduled to enter the offshore wind industry in the coming years.

The global fleet of heavy-lift jackups will increase consistently by three to four units per year until 2027, according to Spinergie. In the last quarter alone, three newbuilds—Jan De Nul’s Voltaire, Shimizu’s Blue Wind and Penta Ocean’s CP-16001—set off from their shipyards for sea trials or outfitting.

The next deliveries to come include Seaway Ventus, Charybdis and Boreas, among others. Spinergie says early announcements from new entrants indicate that there is appetite in the market for still more vessels to be introduced. However, as it stands, the schedule of confirmed deliveries for these next-gen WTIVs ends in 2027, beyond which the market intelligence provider has yet to see any firm construction contracts.

02.22.2023