Further North Sea tax hikes could jeopardize investment, OEUK warns

By Jeremy Beckman, London Editor

Industry association Offshore Energies UK (OEUK) has warned of a potentially steep drop in capital investments across the UK Continental Shelf.

It has issued data that models the impact of the new Labour government’s planned intensification of the Energy Profits Levy (EPL) on the UK economy.

The government plans to raise the headline tax rate on UK offshore petroleum activity to 78% and to remove all current EPL allowances. The modeling suggests this policy could cause a loss to the UK Treasury of about £13 billion ($17.07 billion) compared to what might be generated under the current windfall tax regime.

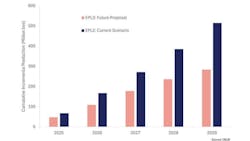

Oil and gas producers would likely respond by cutting investment in their UK projects to a forecasted £2.3 billion ($3.02 billion) over the 2025-29 period, compared to about £14 billion ($18.38 billion) under the existing regime.

That would be counteractive to the government’s goal of economic growth, even if tax receipts from UK oil and gas producers do rise in the short term (to 2026) following the new measures.

According to OEUK, continued uncertainty around the timeframe of the sunset clause for the planned arrangements, and the treatment of capital allowances, have also weakened the confidence of companies that had been looking to invest in UK oil and gas production.

The changes could put at risk close to 35,000 jobs over the next five years due to planned projects not going ahead.

While 53 UK offshore production hubs will likely reach their economic limit by 2035, there is potential for further activity to add a cumulative 50 years across 20 hubs under the right investment climate. However, that looks unlikely under the new proposal.

Moreover, 63% of additional production that might have been under the current regime would be uneconomic, making Britain more reliant on oil and gas imports from other countries to meet energy demand.

OEUK points out that the UKCS is a capital-intensive sector, so maintaining a balance between tax rates, revenue and being able to expense capital immediately through first-year allowances is vital.

In contrast to Norway, which allows E&P companies to claim a maximum £78 (£102.43) of relief for each £100 ($131) expenditure, under the new proposal for the UK, total relief would be £46.25 ($60.73). If all allowances are removed, most discretionary investment in the sector would be halted, OEUK claimed, leading eventually to the loss of critical offshore infrastructure.

The repercussions over the next few decades could cause a £49 billion ($64.34 billion) loss of economic value.

OEUK CEO David Whitehouse said, “For more than two years, UK oil and gas operators have paid three times the rate of corporation tax of any other sector in the economy. Time is running out to mitigate damage that has already been done and to avoid further escalation... The Prime Minister promised to manage the North Sea in a manner that does not jeopardize jobs. We now need an honest conversation on how we can do this and need [the] government to work with the sector at pace.”

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.