Report: UK set for blue/green hydrogen growth

Offshore staff

LONDON — Westwood’s Atlas New Energies solution has identified 45 low-carbon hydrogen projects in the UK. However, only a few demonstration-sized green hydrogen projects have so far reached final investment decision.

According to Joyce Grigorey, director of hydrogen at the consultant, the UK government is taking a twin-track approach, supporting blue and green hydrogen production.

Of the two, blue hydrogen can be scaled up faster relative to green because grey hydrogen production technology (SMR and ATR) is already well-established, as is carbon capture, which is required for blue hydrogen production.

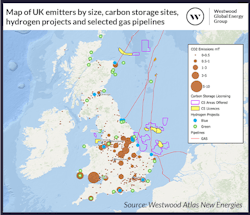

Natural gas is the feedstock for blue hydrogen production. The UK has 240 oil and gas fields in operation in the North Sea, accounting for 40% of domestic gas needs.

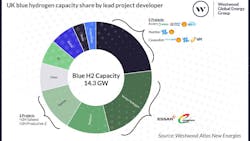

The larger established oil and gas companies are leading blue hydrogen projects, bringing access to existing hydrogen production (at refineries), natural gas supply and pipelines.

Shell is involved in three projects that will develop 3.3 GW. Vertex Hydrogen (a joint venture between Essar and Progressive Energy) is developing 3.3 GW through its Hynet project.

Equinor is participating in two projects that will provide a combined 1.8 GW of blue hydrogen capacity. All the proposed schemes are coastal, with access to the necessary natural gas supply and CO2 storage.

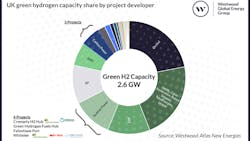

The UK currently has the largest pipeline of offshore wind projects globally, a supportive factor in green hydrogen developments, although its currently announced capacity for green hydrogen is only 2.6 GW.

Projects are typically smaller with a higher number of developers. The flagship 571-MW green hydrogen development, led by Ørsted, Phillips 66, ITM Power and Element Energy, is in South Killingholme on the coast of eastern England.

This involves planned deployment of large-scale green hydrogen production powered by renewable electricity from Hornsea Two, said to be the world’s largest offshore wind farm. Phillips 66 will offtake the hydrogen as fuel gas for its Humber refinery, while ITM Power will supply a 5-MW electrolyzer for the demonstration, which it hopes to scale up to a 100-MW system.

ITM, based in the UK, is one of the world’s largest proton exchange membrane (PEM) electrolyzer manufacturers.

The UK’s geological formations suit storage of both hydrogen and carbon, Grigorey pointed out. The UK has one of four salt caverns globally being used for hydrogen storage, with potential to convert more salt caverns currently used for natural gas to hydrogen storage.

Various planned conversion projects could go online between 2025 and 2030.

The UK will require 104 mtpa of CO2 storage by 2050, she added, and it currently has at least 70 GT of offshore CO2 storage capacity, one of the largest in Europe.

To help limit risk and costs, hydrogen projects are being built close to UK industrial clusters where demand is strongest. The government plans to establish four industrial clusters by 2030, all of which should receive the funding support needed to make low-carbon hydrogen economic.

Project Union, led by National Gas, aims to repurpose 2,000 km of pipeline (25% of the UK’s natural gas transmission pipeline system) to hydrogen. It will initially link the industrial clusters of Teesside and Humber in northeast England, but it could also connect to the natural gas transmission network and the Bacton gas terminal on the East Anglian coast, opening the prospect of hydrogen trade with Europe.

03.14.2023