UK MPs vote against oil and gas windfall tax

Offshore staff

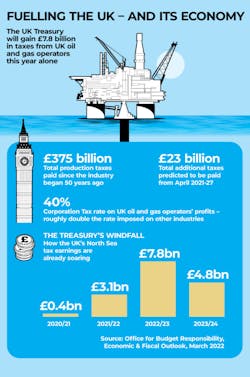

LONDON — Politicians in the U.K. are stepping up calls for a windfall tax on offshore oil and gas companies benefiting from rising oil and gas prices.

Reportedly, some polls indicate eight out of 10 people in the U.K. would favor such a measure to help alleviate soaring inflation and higher energy bills.

The opposition Labour Party had tabled an amendment to the Queen’s speech, calling for the tax to be imposed. However, the motion was rejected in a vote by the majority of members of the U.K. parliament.

Commenting on the vote, Offshore Energies UK external relations director Jenny Stanning said, "It is essential we are able to attract investment into North Sea projects to support the U.K.'s energy security and the energy transition. That has been challenging even with a stable fiscal regime, so it is incredibly important that we maintain investor confidence now.

"The Treasury is predicted to take £5 billion [$6.2 billion] more from oil and gas companies than it expected last October, due to the high global price and high tax rate—offshore oil and gas companies are already taxed at 40%, double that of the U.K.'s other industries.

"A windfall tax risks harming investment, which would lead to less home-produced energy, a drop in investment into green energies and a big hit to jobs.”

05.18.2022