GULF OF MEXICO

David Paganie• Houston

null

Team concept

The eastern GoM region continues to maintain its healthy reputation as the “hot-play” in the deep and ultra deepwaters of the Gulf. Companies are collaborating to exploit the area’s untapped reserves. Last year, five independents and one midstream company successfully combined resources to launch the “Independence Hub” project. Recently, Anadarko and Statoil announced that they are joining forces with other operators to drill and potentially develop deepwater reserves.

Anadarko is expanding its already robust deepwater portfolio by teaming up with Chevron to drill four deepwater prospects. Under this agreement, Anadarko will pay a share of the drilling costs to earn up to a 25% working interest in two appraisal wells and two exploration wells, which are scheduled to be completed by the middle of next year. Anadarko will also gain rights in 29 deepwater Gulf blocks.

“This agreement enhances our position in the Gulf’s prolific Miocene Foldbelt trend, a key growth area where we already have three discoveries under development,” said Bob Daniels, Anadarko senior vice president of exploration and production. “These identified exploration opportunities, two of which are discovery appraisals, give us access to quality prospects that will be drilled in a short time frame,” added Bob.

The two appraisal wells, Tonga, located in Green Canyon block 727, and Sturgis, situated in Atwater Valley block 138, will evaluate the commerciality of existing discoveries, as well as additional exploration prospects identified in the vicinity.

The two planned exploration wells are Turtle Lake in Green Canyon block 847, and Caterpillar, located in Mississippi Canyon block 782. Chevron will operate all four wells using drilling rigs already under contract.

In a separate deal with another company, Anadarko acquired a 15% working interest in Chevron’s Big Foot prospect currently drilling on Walker Ridge block 29.

Statoil says that it and ExxonMobil, together with partners, plan to drill one or more exploration wells in the Alaminos Canyon area. The joint-partnership is also evaluating additional prospects in the Walker Ridge area, on trend with the Jack and St. Malo discoveries in which Statoil already holds equity interests. Statoil says that the established relationship represents a further strengthening of the company’s presence in the deepwater Gulf, and is in line with its growth strategy for this new core area.

BHP focuses on Neptune

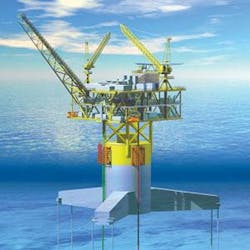

BHP Billiton and partners have awarded Atlantia offshore a contract to supply a SeaStar-designed TLP for installation on its Neptune field, just a few weeks following announcement of the $850-million project’s sanctioning.

BHP’s Neptune partners include Marathon Oil Co., Woodside Energy US Inc., and Maxus US Exploration. The SeaStar TLP, Atlantia’s fifth in the GoM, will be installed in 4,300 ft of water and will be equipped with capacity to handle 50,000 b/d, 50 MMcf/d and 30,000 b/d of water.

Atlantia is responsible for supply of the complete TLP, including topsides facilities, and installation and commissioning assistance. Atlantia’s Houston-based sister company, SBM-Imodco, will design the topsides facilities. First production from the TLP is scheduled for 2007, with tieback of an initial seven subsea wells.

The field’s associated export infrastructure is also taking shape. Enbridge Inc. plans to extend its existing pipeline network out to the Neptune field. The company will construct and operate both natural gas and oil lateral lines that will connect to the field.

The natural gas lateral will consist of 23 mi of 13-in pipeline, and the oil line will include 23 mi of 20-in pipeline. The company says that the $100 million pipeline project will offer capacity to deliver more than 200 MMcf/d and 50,000 b/d.

BHP is also in the early stages of planning for supply of a second TLP. The operator is planning to install a TLP on its Shenzi field, located in Green Canyon block 653, pending results from additional appraisal drilling. So far, five appraisal wells have been drilled on location. The field is situated in about 4,400 ft of water, approximately 15 mi east of Neptune. ABS’ recent announcement confirms the likelihood that a TLP will be deployed on the field. The classification society says that it received a preliminary planning and advice contract for initial work related to the proposed facility.

Lease sale

The Western GoM Lease Sale 196, held in New Orleans on Aug. 17, drew a total of $335,628,130 from 422 bids on 346 tracts. A total of 56 companies participated in the lease sale, which offered 3,762 tracts.

“We continue to see strong bidding activity in the deepwater Gulf particularly in the Alaminos Canyon and Keathley Canyon areas,” said Chris Oynes, MMS GoM regional director. “It was also noteworthy that there was strong bidding interest in the shallow-water area for potential deep gas prospects,” added Oynes.

Of the 244 deepwater tracts bid on, approximately 25% of them are located in ultra deepwater (more than 1,600 m). The deepest tract bid on was Sigsbee Escarpment block 288 in 3,278 m of water. The highest bid received on a block was $26,500,000, submitted by LLOG Exploration Offshore, Inc. for High Island block 156.

Oceaneering secures $13-million contract

Oceaneering Multiflex picked up a contract from Newfield to supply steel tube umbilicals for installation on the Wrigley field, located in Mississippi Canyon block 506. The $13-million contract calls for supply of a 28-mi umbilical for installation in 3,700 ft of water.

Deliveries from the Multiflex plant in Panama City, Florida are scheduled to begin in the 2Q 2006.•