Prospects improving for gas mega-projects offshore Mozambique and Tanzania, report finds

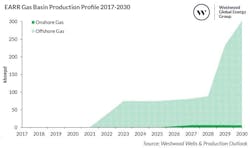

Mozambique looks set for a steep ramp-up in offshore gas production, according to a report by Westwood Global Energy Group.

Coral South, the inaugural project onstream in the East African Ruvuma-Rufiji gas basin, should continue producing about 75,000 boe/d through 2027.

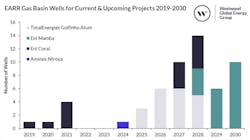

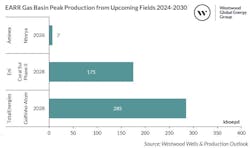

Thereafter, Mozambique’s gas output could soar, driven by TotalEnergies’ offshore Golfinho-Atum field development and Eni’s Coral Phase II.

Due to conflict locally in Cabo Delgado province, TotalEnergies’ enforced force majeure on the 13MMt/year Mozambique LNG project, delaying the originally planned production start from Golfinho-Atum field to 2028, nine years post-sanction.

There was a knock-on effect at Exxon Mobil’s Rovuma LNG project, as the plan was to share certain facilities in the Mozambique LNG project. But Exxon Mobil has since moved to reduce costs, according to Westwood analyst Michela Francisco, by revamping the design plan from the initial two-train 15.2 MMt/year proposal to an 18 MMt/year complex that is now being built using a modular approach.

Exxon Mobil has since invited tenders for a FEED contract and an EPCI option for the subsea-to-shore gas gathering facilities.