Afentra negotiates entry to two offshore Angola blocks

Offshore staff

LONDON — Afentra has agreed to two transactions offshore Angola for a total consideration of up to $130 million.

They involve acquiring a 20% non-operated interest in Block 3/05 and a 40% non-operated interest in Block 23.

Block 3/05, in the Lower Congo Basin, comprises eight mature producing fields discovered by Elf Petroleum in the early 1980s and developed via platforms in 40 m to 100 m water depth, with oil production supported by waterflood.

Sonangol assumed operatorship from 2005 and has focused on workovers and maintaining asset integrity to sustain production. There have been no infill drilling campaigns over the past 15 years. Currently 40 production wells and nine active water injectors are active, drilled from 17 wellhead and support platforms and four processing platforms, with oil exported via the Palanca FSO.

Production last year averaged 17,000 bbl/d, with gross 2P reserves of about100 MMbbl at year-end.

Block 3/05's existing production sharing agreement, although set to expire in 2025, will likely be extended to 2040. To date, asset decommissioning costs have been pre-funded.

Post completion of the acquisition, the joint venture will comprise Sonangol (operator, 30%), Afentra (20%), M&P (20%), Eni (12%), Somoil (10%), NIS-Naftagas (4%) and INA (4%).

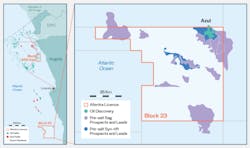

Block 23 is a 5,000-sq-km exploration and appraisal concession in the Kwanza Basin in water depths from 600 m to 1,600 m, with working petroleum system. Although much of the block is covered by modern 3D and 2D seismic datasets, it remains largely underexplored, despite containing the first presalt oi discovery in the basin’s carbonate reservoirs, with estimated oil in place of about150 MMbbl.

Post completion of the transaction, Namcor, Sequa and Petrolog would operate with 40%, with Afentra also holding 40% and Sonangol 20%.

Afentra said its team has significant knowledge and experience in Angola, where the operating environment is attractive with good fiscal terms.

05.09.2022