De-risking decommissioning: predicting performance in aging offshore assets

Andy Aston

Yvonne Roberts

Turner & Townsend

As an unrecoverable cost, identifying the right time, method and model for decommissioning aging offshore assets is essential to minimizing financial exposure for operators. By harnessing the growing body of precedential data alongside consideration of market conditions, the industry can de-risk programs and optimize performance.

Aging assets require oil and gas operators to make informed investment decisions: financially commit to late-life asset management, or start to decommission in a safe, environmentally sound and cost-effective way.

As decommissioning services and technical discipline has grown, huge strides have been taken toward greater cost predictability – learning through experience, but also by basing the decision-making process on an increasingly robust data regime.

With activity continuing in mature markets to close down and remove offshore infrastructure, the industry needs to adopt an intelligent and flexible approach to future decommissioning, where decisions are informed by data together with an acute understanding of the impact of market conditions.

(All images courtesy Turner & Townsend)

Data platform

Compared to other commodity and infrastructure sectors, offshore oil and gas has the advantage of having recognized early the need for a global approach to data aggregation as a means to shaping programs across the asset lifecycle. Through the Performance Forum, which has been run by Turner & Townsend on behalf of major players across the sector since the mid-1990s, it has been possible to establish a series of industry metrics for costs across the upstream oil and gas industry which can be used to inform critical decisions.

One of the best examples of the centrality of data in informing decommissioning decisions is the heavily regulated and mature market in the North Sea and Norway. Over the next decade, 183 projects in the field are forecast for decommissioning, with 100 platforms set for either partial or total removal, 1,800 wells scheduled to be plugged and abandoned, and 7,500 kilometers of pipelines to be taken offline.

External factors

This data platform provides a substantive base from which to make decommissioning decisions, but real-world experience is essential to ensuring it is used effectively. While decommissioning projects have been successfully delivered for many years and cost data has been collected, a number of external market factors mean that it remains challenging to define and benchmark good performance in this evolving sector.

Price

First, an essential factor is commodity pricing. The low oil price has contributed to significant decreases in supply chain costs, with the cost of labor and vessels now much lower than when oil was priced at $100/bbl.

In the UK there is a concerted drive to reduce costs further. The Oil & Gas Authority’s Decommissioning Strategy for platforms on the UK continental shelf is focused on delivering a 35% cost reduction by 2020 in a technically competent, safe, and environmentally responsible manner.

It estimates an overall decommissioning price tag of £59.7 billion ($77.5 billion) based on 2016 prices, but if a minimum 35% cost reduction can be applied, the total cost of decommissioning could come down to £38.8 billion ($50.6 billion). This strategy is also seeking to boost supply chain expertise and capability to unlock further efficiencies, as well as providing British companies with a competitive and exportable skill set to unlock work in other parts of the world.

However, recent cost analysis by the Performance Forum has indicated that the bottom of market depreciation was reached around 3Q 2016, which accords with the general industry perception that costs are back on the rise. Operators are now examining newbuild projects, which may compete with decommissioning programs, thus impacting the supply and demand for both people and vessels – and shifting the economic balance once again.

Such fluctuations in price and cost reflect the need for long-term planning and a clear understanding of the timeframes involved in the decommissioning process, so that operators can accurately plan across a program that could last for over a decade.

Market support

A second group of factors which impact costs includes the regulatory framework and any political and economic measures that support industry.

In the UK, Norway and the US, policymakers have set out clear guidelines under which operators should deliver decommissioning projects, but in many other markets such as India and China there is likely to be a less prescriptive direction. The lack of a consistent global approach to decommissioning also makes it hard to use expertise gained in one region to inform decisions in another.

In the UK market, pressure to maintain investment and extend the life of programs has a major bearing on decommissioning decisions. Oil & Gas UK, the trade association, has argued against premature decommissioning when estimates point to 20 Bboe that are yet to be recovered. Initiatives including the UK Oil & Gas Authority’s maximizing economic recovery program is actively promoting the improvement of life extension techniques as a means to keeping platforms live.

Politically, there is stimulus from the UK government in particular to maintain activity – and therefore the generation of tax receipts – in a market where there have been few new production facilities coming forward. The decision last year to offer tax breaks on the transfer of aging platforms to smaller firms looking to extend their life reflects the financial imperative for the UK Treasury to encourage ongoing production.

New technology

A greater understanding of cost and program pressures is also informing investment in new technology. The launch last year of Allseas’Pioneering Spirit is acknowledged as a potential game-changer. The largest construction vessel in the world, it is capable of transporting the entire topsides of a platform or the steel jackets underneath, before taking them to shore for dismantling, reuse and recycling of materials.

The super vessel – which is the length of five jumbo jets – was used to cut and lift Shell’s Delta platform topsides (24,000 metric tons) in the North Sea Brent oilfield and undoubtedly reduced the time to decommission. There is not yet sufficient industry data available to assess its cost performance in a wider decommissioning context and it should also be recognized thatPioneering Spirit may not be the best solution for all projects. However, if decommissioning rates accelerate across the global industry, then further innovation of this type is anticipated.

A key objective on Fairfield Energy’s Dunlin decommissioning project in the North Sea has been to embrace a culture of sharing with other companies involved in decommissioning.

Data regime

These three primary areas of flux remind us that decisions around decommissioning need to follow an adaptive and flexible methodology that responds to changing conditions. However, these decisions can still be strongly backed by data to de-risk the process. In the North Sea, Performance Forum data has indicated a series of industry trends which now shape decommissioning strategies to provide greater certainty of cost and program.

Using the metrics established by the Performance Forum the key stages in the decommissioning process that most significantly affect cost performance have been identified. As a result, both the number of stages, as well as the number in which the operator itself is involved have been reduced

A key area of change, for example, has been in the timing for the plug and abandonment (P&A) of platform wells. A greater understanding of cost and program has seen operators shift to a staged process whereby the P&A starts before a platform becomes designated as a normally unmanned installation. This reduces servicing costs, including those for utilities and safety systems – removing the inefficiency of ceasing production on an operational platform only to maintain it as a base for well decommissioning.

Another area where experience and cost data is shaping programs is around investment in platforms to deliver decommissioning. Put simply, the risks involved with using aging platform infrastructure, which may have been dormant for a long time, are now better understood, which is leading to better assessment of the need to provide new equipment.

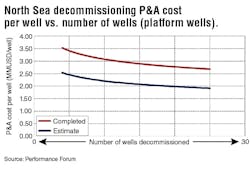

The data is showing that these insights are anticipated to drive better cost performance in future P&A for platform wells. Based on estimate data recently provided to the Performance Forum, operators in the North Sea anticipate a reduction in future P&A cost per well values of around 40% relative to historical data for completed projects.

Establishing the benchmark

There are now moves to build on this progress by establishing a North Sea benchmarking mechanism. Spearheaded by BP with other major industry players, the Decommissioning Cost Reduction Opportunity Tool seeks to establish cost sensitivities on a portfolio or field-wide basis to drive greater understanding and better performance.

Through the experience of the Performance Forum, Turner & Townsend has been involved in stress testing the assumptions and basic settings – for example, over the proportion of platform wells that may have already undergone P&A prior to the cessation of production.

Critically, this tool relies on much greater collaboration between operators and the supply chain, as it requires contractor base lines such as vessel rates, crane lift limits and average program timescales to be fed in at an early stage. Ultimately, this will lead to better working practices and partnerships at an industry level, to reflect lessons learned on individual projects.

On Fairfield Energy’s Dunlin decommissioning project in the North Sea, a key objective has been to embrace a culture of sharing with other companies involved in decommissioning. Based on this experience, Turner & Townsend has been able to facilitate knowledge transfer initiatives and the adoption of industry recognized work breakdown structures – which will support future benchmarking.

Although the nature of regional markets means that a global approach to decommissioning is unlikely to be established, the use of these data-backed tools has the potential to shape regulatory regimes.

Future projects

A better assessment of cost data on decommissioning projects can be used to inform not only the design and engineering of newbuild oil and gas assets, but also operators’ business models and execution strategies.

A traditional project approach may not be appropriate for decommissioning and many operators have a lack of experience in this field, which increases risk and uncertainty. Developing fit-for-purpose planning and cost estimating processes will be required to improve predictability of costs and set the right strategy for success.

A new focus on allocating risk and reward is required, which means operators must work closely with the supply chain. When performed effectively, risk transfer allocates parties according to their ability to control and insure against it. However, transferring risk from owner to contractor is not always the most effective option. Incorrect risk allocation in a contract can result in delivery failure and bring new risk of a contractual claim.

Maintaining the data regime

The growing body of decommissioning data is already shaping better decision-making around aging offshore assets, leading to greater cost predictability and confidence for operators.

As an industry, we need to continue to increase our efforts to collect more data as well as share expertise that informs engagement between operators, regulators, stakeholders, peers and the supply chain.