GULF OF MEXICO

David Paganie • Houston

Non-OPEC oil supply to lead growth

At print, oil had the reached the $100/bbl level during a trading session for the second time in 2008. Many analysts believe the modest growth in oil supply from non-OPEC producing countries is one of the primary drivers applying upward pressure on oil prices.

However, this non-OPEC growth trend is expected to change course this year with a large number of projects scheduled to come onstream over the next two years.

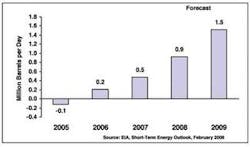

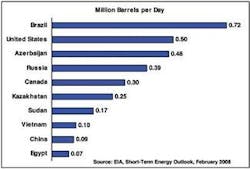

According to the Energy Information Administration’sShort-Term Energy Outlook, non-OPEC oil supply is expected to grow by 900,000 b/d in 2008 and 1.5 MMb/d in 2009. The US and Brazil will account for about half of this production increase, with the GoM estimated to be a leading source of the new supply.

Total oil production, including crude oil, natural gas liquids, other liquids, and refinery gain, in the US is expected to increase by 120,000 b/d in 2008 and by 380,000 b/d in 2009. New production in the Federal Gulf of Mexico is forecast to represent the largest portion of the increase. Oil production in the GoM is expected to increase by 50,000 b/d in 2008 and by 350,000 b/d in 2009. Three major projects are expected to be the primary sources of this increase:Atlantis semisubmersible, equipped with capacity to process 200,000 b/d of oil, is schedule to reach production capacity by the end of 2008; Thunder Horse semisubmersible, fitted with capacity to process 250,000 b/d of oil, is expected to deliver first production by the end of 2008; and Tahiti spar, with capacity to process 125,000 b/d of oil, is scheduled for first production in 3Q 2009.

Contingent on unexpected delays, which have plaguedThunder Horse and Tahiti, these three projects along with a number of smaller developments in the deepwater Gulf, could considerably change the economic landscape of the oil industry.

First Subsea to supply Thunder Hawk connectors

First Subsea is supplying 12 Ballgrab subsea mooring connectors to SBM Atlantia for theThunder Hawk floating production unit. The semisubmersible will be anchored by a polyester rope/chain spread mooring system connected to 12 driven piles by Ballgrab SMCs. The Ballgrab connectors will link the driven piles and ground chain segment, interfacing directly with long-term mooring shackles. The receptacle part of the connectors will be delivered first, to be installed subsea with the piles, mounted on the docking porch. The mooring line male connectors will follow later.

McMoran, Rowan to re-enter Blackbeard

McMoran and Rowan have teamed to re-enter the Blackbeard deep gas prospect in South Timbalier block 168. The jackupRowan Gorilla IV has been nominated to deepen Blackbeard No. 1 in 70 ft (21 m) of water. Rowan’s jackup Scooter Yeargain drilled the well to a depth of just over 30,000 ft (9,144 m) during 2005-2006. The hole was temporarily abandoned prior to reaching the primary targets. McMoran holds 26.8% working interest in Blackbeard.

Meanwhile, Rowan’s jackupBob Palmer was undergoing final preparations for its assignment on BP’s Eldorado prospect. The rig is contracted to drill one or more wells on the prospect targeting a depth of at least 28,000 ft (8,534 ft).

McMoran also continues to delineate the Flatrock discovery on OCS 310 at South Marsh Island block 212 in 10 ft (3 m) of water. The company was drilling a second appraisal well, Flatrock No. 3, to 18,800 ft (5,730 m) proposed depth to test additional targets in the Rob-L and Operc sands.

Keppel lands FPSO conversion

BW Pioneer Ltd. has awarded Keppel Shipyard a contract to convert the FPSO for the Petrobras-operated Cascade and Chinook developments. The vessel will be moored in about 8,530 ft (2,600 m) of water by a disconnectable turret.

To be namedBW Pioneer and leased by Petrobras America Ltd., the FPSO will have capacity to store about 600,000 bbl of oil, process 80,000 b/d of oil, and export 16 MMcf/d of gas. The FPSO conversion is expected to be completed by 3Q 2009, with first production in 1Q 2010.

Majors find, confirm reserves

Shell has discovered oil at the Vicksburg prospect in 7,500 ft (2,286 m) of water. The field crosses sections of DeSoto Canyon blocks 353 and 397 and Mississippi Canyon block 393. Shell operates Vicksburg with 57.5% interest; Nexen has 25%; and Plains Exploration & Production Co. holds 17.5%. Transocean’s semisubmersibleDeepwater Nautilus drilled the discovery well to 25,400 ft (7,742 m), encountering a hydrocarbon column of approximately 300 ft (91 m), according to Shell.

Meanwhile, Chevron confirmed the results of its Big Foot discovery in 5,000 ft (1,524 m) of water on Walker Ridge block 29. The appraisal well, Big Foot No. 3, sidetrack No. 2, was drilled to 25,113 ft (7,654 m) MD. It confirmed the pay intervals of the discovery and sidetrack wells, and found the main pay sand full of oil to the base, according to Chevron.

Chevron operates Big Foot with 60% working interest; StatoilHydro has 27.5%; and Shell Gulf of Mexico Inc. has 12.5 %.

Bass Lite on tap

Mariner Energy has turned on the taps on the two-well development Bass Lite on Atwater Valley block 426 in 6,750 ft (2,057 m) of water. The subsea wells are tied back 56 mi (90 km) to theDevil’s Tower spar. Gas throughput was 60 MMcf/d with maximum production capacity expected in late 2008.

According to Mariner, Bass Lite uses the second longest flowline for a subsea tieback and the longest umbilical with fiber optics for primary control ever deployed in the GoM. Additionally, the steel catenary riser used to tie-in to theDevil’s Tower production facility is the first designed and approved in accordance with the new MMS storm criteria for the Gulf, the company says.

Meanwhile, Mariner has budgeted $506 million for exploration and development in the GoM in 2008.

Anadarko extends drillship contract

Anadarko has extended its contact with Transocean’s drillshipDeepwater Millennium for three yeas beginning in June 2010. The extension is worth an estimated $586 million.

Meanwhile, Anadarko says its plans to focus its deepwater GoM activities in 2008 on development drilling. The company has allocated 25% of its approved capital budget of $4.5 - $4.7 billion to the deepwater Gulf. Some of the allocation for 2008 will be used to bring onstream the Blind Faith and Power Play projects, and to drill six-eight exploration and appraisal wells targeting Miocene and Lower Tertiary objectives.

MMS issues final lease sale notices

The MMS has issued final notices for central lease sale 206 and eastern lease sale 224, scheduled to be held consecutively on March 19, 2008.

Lease sale 206 includes approximately 5,000 unleased blocks in the central planning area offshore Louisiana, Mississippi, and Alabama. The acreage is 3 to 230 mi (5 to 370 km) offshore in water depths of about 10 ft (3 m) to more than 11,200 ft (3,400 m). Lease sale 224, mandated by the Gulf of Mexico Energy Security Act of 2006, includes 118 whole or partial unleased blocks covering approximately 547,000 acres in the eastern planning area. The acreage is south of the Florida panhandle and west of the Military Mission Line in water depths ranging from 2,657 to 10,213 ft (810 to 3,113 m).

The MMS estimates the sale 224 area contains from 100 to 140 MMbbl of oil and 0.16 to 0.34 tcf of natural gas. Sale 206 area contains approximately 0.877 to 1.457 Bbbl of oil and 3.653 to 5.892 tcf of natural gas.

K2 EOR planning continues

A decision on the optimum enhanced oil recovery technique for the Anadarko-operated K2 field is expected by year-end 2008. A project team was formed in 2007 to evaluate proposed solutions for the Green Canyon area complex. Lab testing, reservoir simulation, and facilities pre-FEED work continues on nitrogen and waterflood scenarios. Evaluation of both EOR methods will continue until one is found to be clearly more effective than the other, Anadarko says.

null