OFFSHORE EUROPE

Jeremy Beckman • London

UK activity hit by rising costs

Investment across the UK continental shelf in 2007 totalled £4.9 billion ($9.97 billion), according to Oil & Gas UK’s latest survey of its oil company members’ activities. This represents a drop in real terms of around £1 billion ($2.03 billion) on the previous year’s figure, and the underlying cost inflation for services and equipment – a global phenomenon – masked the true extent of the decline.

Despite the downward shift, the shelf still offers a range of opportunities to sustain investment at current rates beyond 2010. The survey identified plans for capital investment of £29 billion ($59.07 billion) over the next 10 years, of which £12 billion ($24.43 billion) are allocated to existing projects.

The remaining £17 billion ($34.61 billion) relate to projects yet to be sanctioned, which might collectively develop 2.7 Bboe of new reserves. A year ago, the corresponding survey forecast investments of £12.5 billion ($25.45 billion) to extract 2.2 Bboe, a further indication of how the industry is paying more to deliver less.

As in most regions of the world, exploration drilling was relatively strong, with 34 new wells. Of these, 66% were near-field probes, with 13 discoveries containing a cumulative 300-400 MMboe, according to initial indications. However, development drilling dropped 15%, continuing a downward trend first noted in 2002.

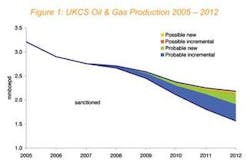

This decline is impacting production – Oil & Gas UK forecasts a continuing slide in output across the shelf to around 2.1-2.4 MMboe/d in 2010. Total finding, development and operating costs now average $35/boe, it adds, making the UK one of the world’s costliest oil and gas provinces.

Government addresses decommissioning burden

Oil & Gas UK’s report also found that cost projections to decommission existing production facilities have doubled over the past five years, and on current estimates will reach around £16 billion ($32.57 billion) by 2030, rising to £19 billion ($38.69 billion) by 2040.

The association has been in dialogue with the British government in an attempt to dilute North Sea taxes, claiming that many investment decisions remain problematic even in the current, high oil price era.

The government did take note in the Annual Budget last month. Among its new measures:

- Companies will be able to carry back losses resulting from decommissioning dating to April 2002 – the previous carry-back limit was three years

- The 100% first-year allowances regime will be prolonged to cover mid-life decommissioning and new outlay on long-life assets

- Former license holders incurring decommissioning liability due to default by a subsequent license holder will be entitled to relief on petroleum revenue tax.

Oil & Gas UK welcomed the amendments. However, economics director Mike Tholen says the tax burden should be reduced further, and that remaining discussions with the Treasury must address the issue of the 50-75% tax rate on new UKCS projects.

Far north find for StatoilHydro

Barents Sea drilling continues to hit the mark. The latest find is StatoilHydro’s Obesum, drilled by the semisubPolar Pioneer in 364 m (1,194 ft) of water, 175 km (108 mi) northwest of Hammerfest. The well – the first in production license 228 – proved oil and gas in Mid-Triassic sandstones. StatoilHydro could not issue a reserves estimate, but aims to drill another well on the license later this year.

This was the company’s first operated discovery on the Norwegian shelf in 2008. It also participated in Eni’s recent appraisal well on the Marulk field in the Norwegian Sea, in a similar water depth, which proved oil and gas 4.5 km (2.8 mi) from the discovery location. Based on the results, the Norwegian Petroleum Directorate has upgraded its reserves estimate for Marulk to 12-14 bcm of gas and 0.8-1.1 MMcm of condensate.

In the same province, StatoilHydro has commissioned a feasibility study from Foster Wheeler Engineering into the potential for carbon dioxide (CO2)/amine absorption at its Aasgard B production complex. The semisubmersibleAasgard B platform processes and exports gas and condensate from the Midgard and Smorbukk fields.

The study will assess the process options and cost estimates for the modification program. Through maximizing CO2 absorption offshore, StatoilHydro aims to expand exports of natural gas liquids and limit future needs for downstream CO2 removal.

Ireland issues more deepwater blocks

Ireland’s government has awarded ExxonMobil operatorship of two new deepwater licenses in the Porcupine basin. The package comprises 13 blocks extending over 760,000 acres (307,561 ha) in waters over 6,500 ft (1,981 m) deep. They include various identified leads, including the Drombeg prospect.

In the same basin, the company also has assumed control of the five-block 3/04 license from previous operator Providence Resources. The two companies and Sosina Exploration have conducted geological studies, including acquisition and processing of over 1,500 km (932 mi) of long-offset 2D seismic reflection data. One stand-out exploration target is the Dunquin structure, extending over several blocks.

Providence, Sosina, and Transocean subsidiary Challenger Minerals (Celtic Sea) also have picked up four blocks under Ireland’s 2007 licensing round. The blocks are adjacent to the group’s Spanish Point license, encompassing the Spanish Point gas and Burren oil accumulations.

StatoilHydro under fire for leak

Norway’s Petroleum Safety Authority (PSA) has accused StatoilHydro of serious shortcomings in its report on the oil leak from Statfjord A in the North Sea last December. A breach in the platform’s loading hose caused 77,500 bbl of crude (4,400 cu m) to be released into the sea, the second largest spill in Norway’s production history.

PSA conducted its investigation with the Norwegian Pollution Control Authority and the Norwegian Coastal Administration. Among their conclusions were:

- The spill was only discovered when there was sufficient light to observe oil build-up on the sea, suggesting inadequate systems for detecting abnormal conditions or preventing their consequences

- Barriers that could have prevented the incident had weakened over time without remedial action having been taken

- Emergency response was not mobilized, even though StatoilHydro had sufficient information to do this after reports of the spill had come through

- Inspection routines failed to detect signs of wear and tear.

UKCS production forecast. Source: Oil & Gas UK